Fisker is an electric vehicle SPAC that was co-founded by Henrik Fisker, CEO, and Dr. Geeta Fisker, CFO & COO. Fisker just began production of the Fisker Ocean with their contract manufacturer, Magna. Fisker has pitched themselves as “asset-light” automotive manufacturer and highlights their large cash balance as proof that they have created a better business model than other automakers.

When we spoke to formers employees of Fisker, Magna, and “Old Fisker” they told us a very different story.

- “The cash is tied up.”

- We discovered Fisker has large undisclosed bank guarantees that sets a minimum cash balance.

- The bank guarantees are for Magna and estimated at ~$790-825 million.

- This is Fisker’s entire current cash balance!

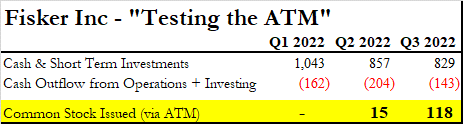

- We believe these guarantees are preventing Fisker from funding operating losses with the cash on their balance sheet and instead forces them to utilize their ATM facility to raise cash to pay expenses.

- Fisker used the ATM to raise $118 million in Q3

- They likely need to raise significantly more cash via the ATM in coming quarters to fund increasing losses.

- Fisker has been cutting costs internally.

- Fisker’s guarantees to Magna include:

- Fisker paying for Magna’s tooling costs.

- Magna’s manufacturing margins and direct manufacturing costs.

- Commits to set volume production levels.

- Fisker pays Magna for the volume commitments regardless of 3rd party supplier execution issues or low consumer demand for the ocean.

- Fisker’s has attempted to hide that the EV platform they are licensing was built for a Chinese EV.

- This reminds us of ELMS, another EV SPAC that tried to hide their vehicles Chinese origins. ELMS recently declared for bankruptcy.

- ESG – Should a culture where management’s berating of causing them to cry count as ESG?

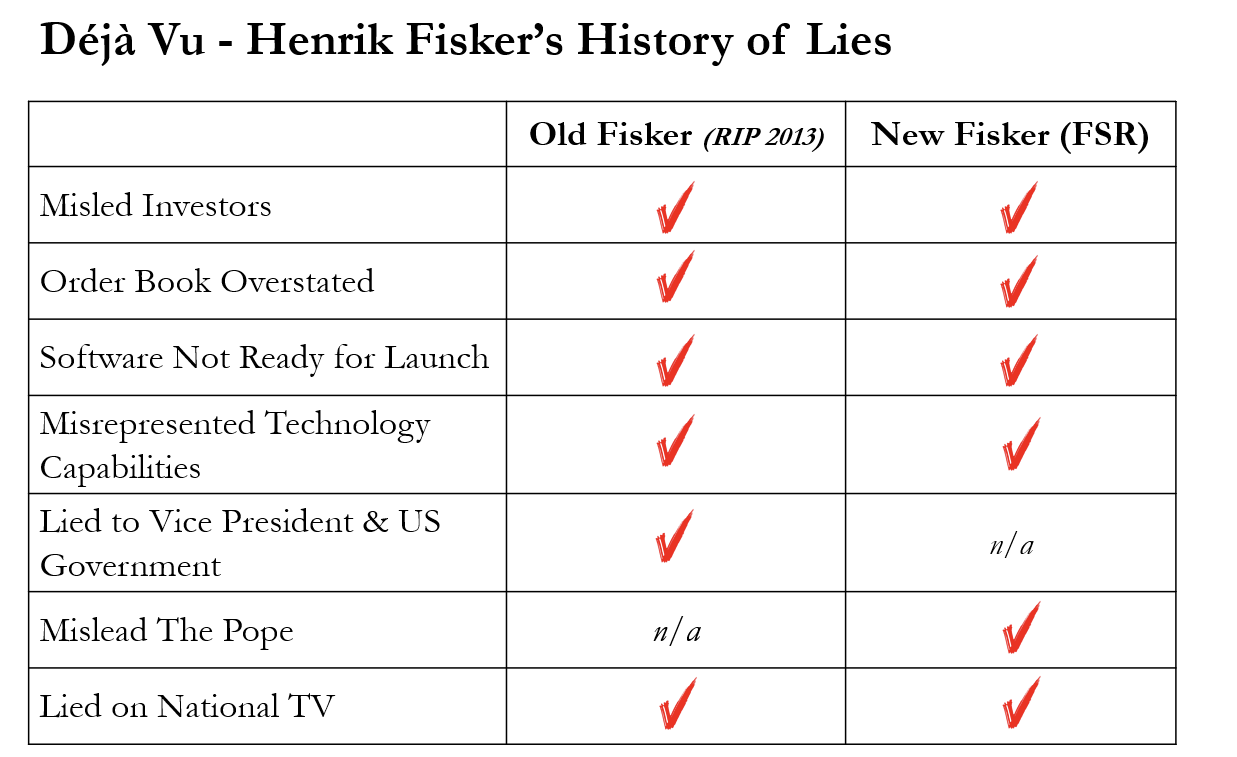

- Formers described “Henrik Fisker is a Pathological Liar.” Examples include:

- Lying to the US Department of Energy.

- Getting employees to illegally smuggle auto parts across international borders.

- Misrepresenting technology and it’s capabilities.

- “Old Fisker” (bankrupt 2013) was a complete operational disaster. We highlight previously unknown operational failures, supplier issues, broken promises and general incompetence. Notably:

- Lying about the size of the Order Book

- We have concerns about the Ocean’s too

- Major software issues

- The Ocean’s Software isn’t ready and will lack essential safety features.

- Lying about the size of the Order Book

Henrik Fisker reminds us of Trevor Milton from Nikola and SBF from FTX. All three are charismatic leaders that have shown they are willing to lie and obscure the truth to get what they want.

We thought Henrik’s story was too good to be true. And it turns out it is. We learned the truth of what happened to lead to the Henrik’s first bankruptcy. We don’t think he learned from those mistakes and is actually repeating many of the same ones.

We think Fisker’s “asset-light” business model could be better described as “liability-heavy.”

We are short Fisker Inc (FSR)

Please see additional disclosures at end of report and our terms of service.

Notes:

“New Fisker” refers Fisker Inc – founded in 2016 by Henrik Fisker and currently publicly traded as FSR

“Old Fisker” refers to Fisker Automotive – founded in 2007 by Henrik Fisker and filed for bankruptcy in 2013

Anonymous Former Employees – We decided to keep all former Fisker Inc, Fisker Automotive, and Magna employees anonymous for this report. We did this due to many sources being afraid of retribution from the Fiskers. We are happy and willing to release more information to regulators and journalists.

Submit a Tip – Individuals with knowledge of Fisker’s misstatements, former employees, etc should contact us at [email protected] with tips or information. We will protect your identity and anonymity.

Background and The Bull Case:

Henrik Fisker is a good automotive designer and a great salesman. The bull case for Fisker revolves around believing in his dream of a re-imaged automotive company. An automotive company that is asset-light and has best in class profit margins in one of the most capital intensive and competitive industries in the word. Fisker has contracted for Magna Steyr to be the manufacturer of Fisker’s first vehicle the Ocean, and contracted for Foxconn to manufacture the Pear. Henrik tells investors that the production and volume risk will fall on Fisker’s contract manufacturers.

Henrik Fisker wants investors to think of Fisker similarly to how “Apple is to Foxconn.”

Henrik tried to build his dream of an asset-light automotive company once before with Fisker Automotive “aka Old Fisker.” They built a hybrid vehicle called the Fisker Karma. That dream ended in Fisker filing for bankruptcy, investors losing billions, and even a US Congressional probe into them not repaying a DOE loan. But Henrik spins the story of Old Fisker failing because the company was unlucky. Their chosen battery supplier, A123, went bankrupt and they were the victim of a surprise hurricane that wiped out part of their initial inventory.

The Bull case for Fisker is a great story from a charismatic salesman.

Unfortunately for Henrik, everyone is about to discover:

- The true guarantees and financial commitments Fisker made in order to get Magna to be their contract manufacturer.

- The operational disasters that caused “Old Fisker” to fail.

- And the many lies Henrik has told to investors, partners, and the US government.

For example, Fisker fails to mention this to investors but their cash is essentially pledged to Magna Steyr via undisclosed bank guarantees. Operationally Henrik seems to be making many of the same mistakes all over again. It’s Déjà Vu.

Part I – “The Cash is All Tied Up” ~$800 Million in Undisclosed Bank Guarantees Revealed!

Henrik Fisker points to having over $800 million of “available” cash to underpin the company’s valuation and the strength of their supposedly “asset-light” business model. Through our interviews with former Fisker and Magna employees we believe we discovered the real truth about the cash.

It appears that a significant amount of Fisker’s cash is locked up via bank guarantees.

The cash is not like actual cash in the bank. It’s all tied up… [Fisker Management] would reassure people that everything was okay, saying we got a billion dollars in the bank, but that’s not real cash, that’s only paper…

The cash [for Fisker Inc] isn’t like actual cash in the bank that [Fisker] can start writing checks against…

Most people in the company don’t know this.

~Former Fisker Employee – New Fisker

Magna Steyr is Fisker’s contract manufacturer for Fisker’s first vehicle, the Ocean. When we spoke with a former Magna executive that was involved in negotiating the Fisker Partnership Agreement, we learned that the Fisker Ocean’s-Magna Steyr agreement included Fisker arranging bank guarantees for Magna.

These bank guarantees essentially pledged a rolling amount of Fisker’s cash balance as collateral for Magna.

Fisker violates one of the Magna agreement’s covenants then Magna is able to stop production. Apparently Magna can then utilize the bank guarantee on Fisker’s cash balance to ensure repayment of Magna’s Ocean specific tooling costs (robots, stamping machines, etc) and for Magna’s expected contract manufacturing margin and manufacturing costs over the committed life of the program.

Fisker arranged a bank guarantee for [Magna], because it’s a start-up and Magna wanted to have all the financial security…

Magna will not be in the absolute risk position…we need security.

With the bank guarantee it applies if [Magna] stops production before the end of the agreement.

It is a rolling agreement for the entire program…it’s a lifetime volume.

~Former Senior Magna Executive – Involved in Fisker Partnership Agreement

Magna reportedly has guaranteed minimums and guaranteed profits with the manufacturing agreement.

Based on our conversations with former Fisker and Magna executives we can estimate about how much of Fisker’s cash is tied up with bank guarantees.

Fisker is apparently required to maintain minimum cash balances to pay for:

- Magna’s Ocean specific tooling costs – €200 to €250 million total

- 30% before SOP (start of production) – already “paid” via FSR stock warrants.

- ~40% to be paid in first year of production & amortized per vehicle (42k vehicles in year 1).

- ~30% over remaining contractual volume commitment.

- Est €140-175 million of tooling costs remaining to be paid.

- Magna’s per vehicle manufacturing margin and direct manufacturing costs

- Magna’s expected manufacturing margin per vehicle is ~€1800 in EBIT + an estimated. €900 in manufacturing costs or €2700 per vehicle at peak volume.

- Magna Steyr’s manufacturing margin is guaranteed for Fisker’s committed life of the program (~42k vehicles in year 1, 50k vehicles in years 2-5).

- Est ~€650 million of guaranteed contract manufacturing margin and direct manufacturing costs.

Our total estimate for the bank guarantee on Fisker’s cash is ~$790 to $825 million.

“Magna would still recover the total Fixed Component and Magna Margin.”

“We need security, and as I said, we decided to have at least 70% of cost reimbursed in the first year…30% until start of production, and at least another, Around 40%, will be paid in the first year of production. And to secure this, ensure it’s … You need a guarantee from the bank,”

~Former Senior Magna Executive – Involved in Fisker Partnership Agreement

Fisker’s actions imply that they are close to violating the bank guarantees.

ATM Usage to Cover Cash Outflow – Fisker put in place a $2 billion stock offering of which $350 million was an ATM security offering put in place in May 2022. In Q2 the CFO explained using the ATM as “test.”

“We tested the plumbing on the ATM and we brought in ~$14 million”

~Dr Geeta Fisker (CFO & COO) Q2-2022 Conference Call

Within just 6 months they have already sold over $130 million of stock, an unusually high amount if Fisker was actually “asset light” and truly had access to the 800 million of cash on their balance sheet.

- Q2-2022 – $14.6 million

- Q3-2022 – $118 million

Curiously Fisker has made sure to access their ATM enough to ensure that their cash stays above the estimated ~$800 million bank guarantee line.

CFO Concerned with Cutting Costs! – A focus on cost cuts evidently began in the “Spring of 2022.” This is the same time that Fisker started using their ATM stock offering program. Former employees told us that the CFO began demanding internally that senior employees present ideas to cut costs across the board. Cost cutting showed up with Fisker:

- Renegotiating & Not Paying Suppliers – Former employees informed us that Fisker’s CFO kept pushing staff to renegotiate payments due with all their suppliers. This includes absurd items like not wanting to pay the housekeepers in full.

- Software supplier suing Fisker – Stemmons brought a lawsuit against Fisker in April 2022 for not paying software invoices.

- Delaying Building Facilities – Formers told us that Fisker delayed plans for new powertrain & battery facilities.

- Downgrading Employee Lunches – The employee free lunches program was downgraded from high-end salads to mostly pizza.

It is surprising for a company with access to >$800 million of cash on hand to be sell stock hand over fist to cover their quarterly operating costs. Unless of course the company has bank guarantees that actually impose restrictions on their cash.

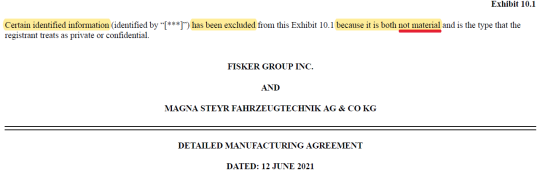

We do not understand how Fisker has deemed important terms like as “not material” and have avoided disclosing them to investors.

We must acknowledge there is an ever so slight possibility that Fisker was able to later renegotiate and remove the bank guarantee and other important guarantees from the Magna contract after the former employee we spoke with left. That said in automotive contract manufacturing we have heard that terms only get worse agreement for the customer, never better. This is because the contract manufacturer has all the leverage.

We believe these bank guarantee should be disclosed. Fisker Management should be the one’s disclosing it, not a short-seller.

Part II: Henrik Fisker’s A “Pathological Liar”

Henrik Fisker (CEO) was described as a “pathological liar” by former senior “Old Fisker” executives. We’ve also been told that “Henrik is willing to say whatever to try to get what he wants.”

“Henrik Fisker is a pathological liar. He actually lies so much that I’m pretty sure he doesn’t even know whether he’s lying or not.”

~ Former Senior Executive – Old Fisker

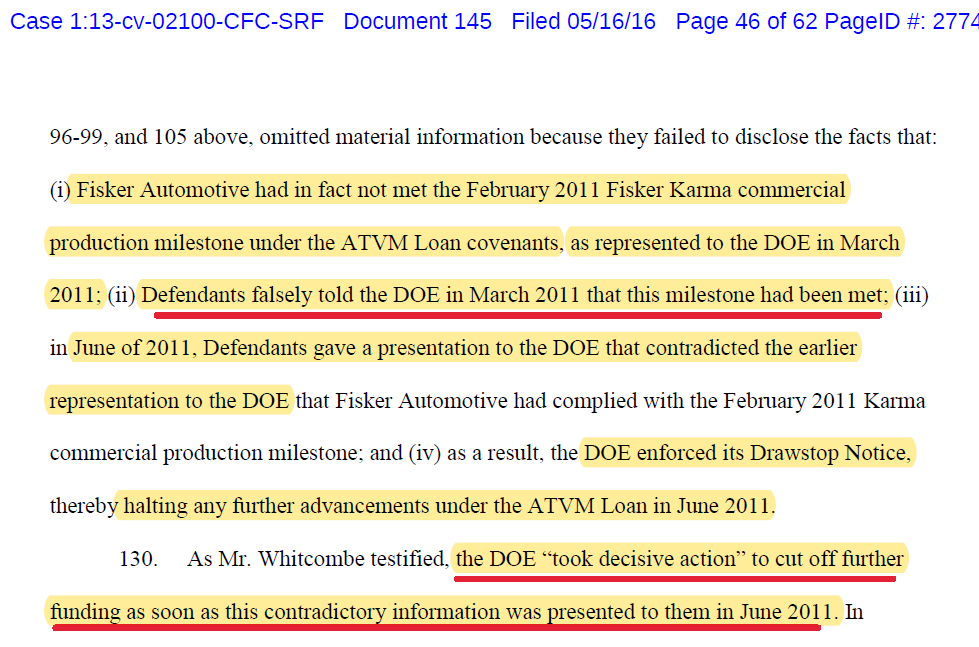

Caught Lying to the US government – We Are NOT Ready for Production

“NOT Ready For Production” and “Ready For Production” are very different statements. In 2011 Fisker’s co-founders got caught removing the word “NOT” when presenting to the US Government.

Background – In March 2011 Old Fisker had to give a presentation to the Department of Energy about whether Fisker had hit their February 2011 commercial “ready for production” milestones. This DOE loan and presentation were crucial for Fisker getting funding from private markets and from the government. Not hitting the production milestones would violate one of the covenants of the $529 million ATVM loan they had been awarded by the Department of Energy.

According to multiple former senior “Old Fisker” employees, the operational leaders in purchasing, engineering, and manufacturing were all in agreement that Fisker was NOT ready for production.

A draft presentation for their DOE originally said “Fisker is “NOT” ready for production.”

For the final presentation to the DOE, Henrik and his co-founder DELETED the word NOT!

Then they gave a presentation to the DOE saying “Fisker is ready for production” and also claimed to have hit their “saleable production milestone” for the Karma based on a pre-production build that lacked certifications to be sold in any markets.

The DOE discovered the deception in a later June 2011 meeting. The DOE immediately pulled the loan.

Source – Fisker Automotive Holdings Shareholder Litigation – Case 1:13-cv-02100-CFC-SRF – Document 145

Lies to the Vice President, a Governor, and UAW Unions

Henrik’s a skunk. He lies. He had to tell a lot of misinformation to the state [of Delaware] and federal government to get what he got out of them.

~Former Senior Leader – Old Fisker

In Old Fisker, Henrik was desperate to acquire GM’s Delaware “Boxwood Road” factory. According to former employees, Henrik and his co-founder made promises to UAW union, the Vice President, and the Governor of Delaware that the factory would be UAW-represented. These promises resulted in Fisker receiving $21.5 million of loans and grants from Delaware, and allowed them to purchase the plant completely with Delaware state funds for $18 million.

Henrik promised at least 2,500 factory jobs and to rehire laid off union workers. Henrik even gave his factory purchase and re-opening speech in front of the former union workers.

This was a lie. Former employees informed us that Henrik had no intention of hiring 2500 union workers. In reality he actually only hired 2 union people, both were the heads of the local union.

Photo Source – Henrik Fisker Speech at Boxwood Road Factory in front of Vice President Joe Biden, Delaware Governor Jack Markell, and laid off union workers – 10-27-2009 – Wilmington, DE

Smuggling Auto Parts Across International Borders:

According to another former senior executive of “Old Fisker” Henrik had his US based engineers SMUGGLE automotive parts into Finland. This is ILLEGAL.

Late engineering changes to the design of production parts early in the production cycle led to situations where redesigned parts were not readily available at “Old Fisker’s” contract manufacturer in Finland, Valmet.

Henrik became concerned about both the time that it would take for these redesigned parts to make it to Valmet (via ocean freight) and the costs to expedite their shipment (via air freight). Attempting to circumvent this, Fisker management asked their engineers traveling to the Valmet facility from the United States to smuggle production parts in their suitcases and carry-ons. Engineers would actually pack the parts into their bags, fly to Finland for their regular job responsibilities, and drop smuggled parts in the Valmet shipping department to be brought into the factory.

Is the design and execution of Henrik’s “asset-light” approach supposed to include smuggling and import tax evasion?

Misleading Statements about a Private Audience with the Pope:

Intentionally misleading the US government is horrific but it seems like one would really need to be a “pathological liar” to make misleading statements to the Pope.

Image Source – Fisker Inc

In a May 2021 Press Release Henrik claimed to have a private audience with Pope Francis, the Holy See, in Vatican City. Henrik also promised the Pope a custom-made Fisker Ocean as the new “PopeMobile,” issued a press release saying Fisker was “set to make” it, and that delivery was planned for next year, 2022.

Unfortunately for Henrik the Vatican released video footage from the event that debunks these misleading statements as nothing more than a marketing stunt. The reality was:

- Henrik and Geeta Fisker met the Pope for ~80 seconds combined.

- Media sources discovered Henrik was not listed on the Vatican’s list of official audiences that day.

- It occurred outside the Vatican Walls at Palazzo San Callisto for an educational event.

- It’s more than 1 year later and The Pope still doesn’t have the EV PopeMobile, Henrik said he’d build.

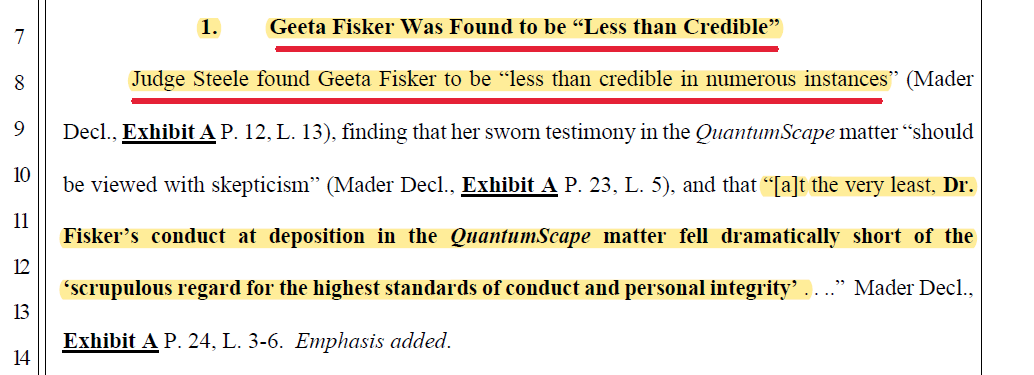

Fisker’s Current CFO & COO – Recently Declared “Less Than Credible” by a Judge

It turns out that Dr. Geeta Gupta Fisker, Fisker Inc’s current CFO and COO, appears to have a similar relationship with the truth as her husband, Henrik.

A retired superior court judge with 35 years of legal experience and that was a neutral arbitrator in the Albano v Fisker arbitration actually declared in his final arbitration decision that he found Geeta Fisker to be “less than credible” and noted that her testimony often seemed to contradicted her own sworn testimony.

We find it shocking for a judge to call out anyone for “lying.”

Source – Albano v Fisker – Case-20TRCV00731 – LA County – Doc 10-27-22 – pg 9

False Statements About the Battery Technology on TV

Henrik Fisker has a history of making exaggerated claims about his company’s technology and intellectual property.

Back in 2018 Henrik promised on national TV that “New Fisker” had developed Solid State Battery technology for a “1 minute charge” that would get >500 miles of range.

“I brought my new battery technology with me…Solid State battery charge technology allows a charge in less than 1 min and also to get 500 miles of charge.”

~Henrik Fisker – Fox Business Interview

Henrik even held up what was supposed to be a working solid-state battery in the interview.

Fisker’s key battery engineers have since called out in lawsuits that claims like this were “false statements” and that Henrik “routinely made exaggerated public claims.”

Fisker’s solid state battery program has long since failed and been scrapped.

Unlawfully Clawing Back Equity & Lying to Senior Employees

Two different “New Fisker” former employees accuse Fisker in their respective lawsuits of Fraud and unlawfully clawing back equity.

For Dr. Fabio Albano, (Albano v. Fisker Case No. 20TRCV00731) an independent arbitrator has agreed that Dr. Albano was wrongfully denied equity that Fisker should have given him. The arbitrator’s final decision awarded him $6,495,627 for equity that was unlawfully clawed back.

For Louise Bristow, (Bristow v Fisker – Case No. 21STCV11095) the case appears to have been recently settled during mediation.

Multiple “Old and New” former Fisker employees highlighted a multitude of lies that Henrik Fisker made to them.

Henrik’s lies to employees about having 10,000 firm orders for the Fisker Karma stand out as one of the worst.

Part III: Deja Vu – Another Order Book Filled With False Promises?

Old Fisker’s False Firm Orders

While at Old Fisker (Fisker Automotive), Henrik Fisker lied to his investors and senior employees about the size of the order book. Henrik claimed to have “10,000 firm orders.” But he didn’t.

In truth, Old Fisker only had <750 committed orders after years of marketing the Karma program.

Henrik tried to hide the reality from his senior leadership team. The small number of orders that did come in came after multiple rounds of going back to the dealers once production was already ready at Valmet’s factory in Finland.

“Production was as ready as possible, but dealers weren’t submitting orders. Senior management demanded that Henrik show them the 10,000 orders.

Henrik replied “I don’t have them. The dealers have them.” After years of claiming that there were solid orders for the Karma, it became clear that the 10,000 orders never existed. Personally, I buried my head in my hands.

If there was no real demand, then there was no real company.

Valmet was getting ready to build 1,000 Karma’s per month, but we only received about 750 orders after multiple rounds of working with dealers to get them to take cars…

It turned out Henrik lied about the orders the way he lied about everything. The 10,000 were either just vague promises from friends of Henrik’s or completely fabricated.”

~Former Senior Executive – Old Fisker

In Old Fisker Henrik used his relationships with friendly international dealerships to get them to place overstated refundable orders that they never planned on taking delivery of.

We believe Henrik is trying similar tricks with Fisker Inc and the Fisker Ocean launch.

Suspicious Fleet Orders – Repeating the Playbook from Old Fisker

Fisker currently has a similar pattern Fleet reservations that we feel are highly unlikely to convert to orders listed in their Fleet reservation book. Some of the reservations are from cash poor tech companies, other were just MOUs and still other reservations come from partners that seem like related parties.

Fleet Orders From Cash Poor Tech Companies:

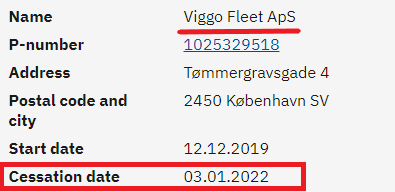

- Viggo – A Danish ride hailing business – signed order for 300 vehicles.

- Viggo HQ ApS’s Danish financials show ~$3,008 of liquid assets as of 12-31-2021.

- Viggo’s Fleet subsidiary “Viggo Fleet ApS” was DISSOLVED in early 2022.

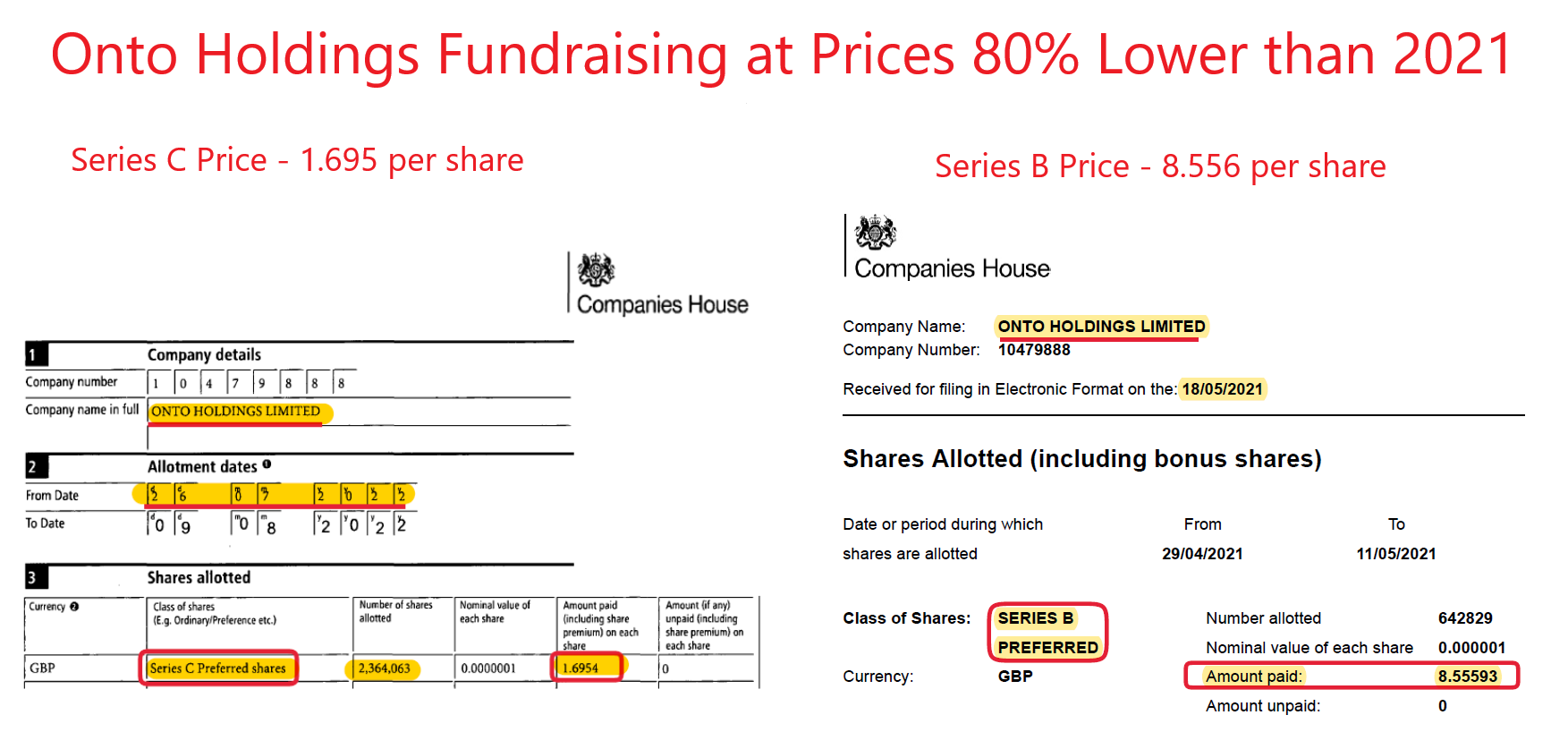

- Onto Holdings – Onto is a UK EV subscription start-up whose valuation appears to have recently declined drastically – Signed agreement for up to 700 vehicles

- Onto’s UK Company House records show that they appear to have recently raised a DOWNROUND ~80% below their peak 2021 valuation.

- Taking delivery of their Fisker Ocean reservations would equate to investing ~97% of their whole £49.9m investment round meant for expansion into Germany instead into Ocean Extremes.

An EV subscription company that seems to be doing well is Autonomy. Autonomy has successfully raised $63 million total. Autonomy recently announced an order for $1.2 billion of EVs from 17 auto manufacturers. Autonomy’s lists Fisker & Canoo (a ~$1.25 stock) at the very bottom of its planned orders list with only 100 vehicles, (Less than 0.5%) ofplanned orders from each manufacturer.

Non-Binding Memorandum of Understanding for Potential Supply

- Credit Agricole Consumer Finance’s reservation wasn’t even a reservation when announced.

- Credit Agricole refers to it as a Non-binding, Potentially Supplied, Memorandum of Understanding.

- Meanwhile, Fisker refers to Credit Agricole as a “Fleet Partner”

These Seem Like Friendly Related Party Orders!

- ServiceNow is a “Cloud Computing Company” but yet has reserved a Fleet of Fisker Ocean’s?

- We believe ServiceNow should be considered a related party since ServiceNow’s CEO on the Fisker Board of Directors

- Fisker also purchases and IT Service and Software solutions from ServiceNow

- Magna – Fisker announced their own contract manufacturer will buy the first 15 Fisker Ocean’s in Q4-2022.

- While Magna is not a related party per se, this is at the very least a strange commitment by Magna as these 15 vehicles would likely be unsellable as they likely are pre-serial number (so lack VINS) and have not passed homologation or government approvals in either North America or Europe.

- A Magna former thought they must be buying the Oceans either testing or show vehicles.

“[The announcement] was a little bit of a surprise. Maybe Magna is buying them as a “show vehicle.”

Or maybe for some technology testing, but I cannot imagine that Magna would want 15 vehicles.

~Former Senior Magna Executive – Involved in Fisker Partnership Agreement

Fleet reservations may only account for a small percentage of the total Fisker Ocean reservation book ~3%, but the Fleet reservations are the easiest ones for investors to confirm the legitimacy and likelihood of conversion. We’d expect these Fleet reservations to be from Fisker’s strongest partners with the highest likelihood of conversion.

Instead, it seems clear from our due diligence that Henrik is trying to pull the same order book tricks that he did in Old Fisker.

Ocean Sport & Ultra Misleading “Sold Out” Statements

Henrik consistently makes misleading claims about the Fisker Ocean being “Sold-Out.”

In a January 2022 interview Henrik claimed that “We are Sold Out Well into 2023.” At this point Fisker had ZERO firm orders and 24,000 refundable reservations.

In mid-August 2022 Fisker told investors that Fisker has “sold out of our U.S. allocation for Sport and Ultra”…“with two trims sold out in the United States market for 2023” (11-17-2022 Press Release)

The reality is far different. Four months later Henrik informed investors that his “Sold Out” statements actually only applied to a small production allotment of the Ocean Sport & Ocean Ultra for 2023.

Small Allotment ≠ Sold Out

“we created a small allotment for Sport and Ultra”

~Henrik Fisker Q3-2022 CC

Why hasn’t Fisker updated the market on how many of the Fisker Ocean One’s and Extreme’s have committed orders if those trims will be the majority of the 42,000 cars produced in year 1?

Part IV – Fisker’s & Magna’s Truth Revealed:

#1 – Fisker did not disclose that the Ocean is based off of a Chinese Vehicle

Fisker has never disclosed the Ocean’s Chinese JV origins to investors. This reminds us of ELMS, another EV SPAC that attempted to hide that their EVs were actually imported from China. ELMS ended up in bankruptcy!

Fisker has hidden that the Fisker Ocean has been developed off of the back bones of a Chinese SUV.

Magna-BAIC have a JV in China that developed an EV platform (chassis, shared parts, etc) and was used for the Arcfox Alpha-T.

- Former Magna employees confirmed that The Fisker Ocean was developed off of the same EV platform as the Arcfox Alpha T.

- The Alpha-T and Ocean share similar dimensions.

- It’s easy to see their similar platform in comparison photos.

- The Ocean reportedly had at least 80% of parts the same as the Chinese EV.

“Once again, Fisker is not only paying contract manufacturing and engineering, Fisker is paying all the license for the platform to our joint venture in China…in the case of Fisker, it’s tricky. Because at least 80% of the parts was carry over from China…

Former Senior Magna Executive Involved in Fisker Partnership Agreement

(Photo sources – Fisker Ocean; ArcFox Alpha T)

The Chinese SUV is produced in the Magna-BAIC factory in Zhenjiang. Since it is built in China it would have lower manufacturing costs and also has less high-end features (vegan leather seats, a base infotainment system, etc) than the Ocean. The base level Alpha-T has a lower BOM (build of materials) close to ~€20,000. The Alpha T is available for sale for <$40,000 since 2019 and will even include working software.

#2 Fisker Claims They Will License Technology That Fisker Doesn’t Own?

Not only has Fisker chosen not to disclose the Ocean’s Chinese origin to investors but they have also claimed that Fisker could license Ocean platform to OEMs.

Fisker began making statements that additional opportunities for them “could include licensing our Ocean Platform…we have been already in detailed discussions with a couple of groups, big OEMs, international carmakers about licensing our platform”

A former Magna employee laughed when we asked them about Fisker re-licensing the Magna-BAIC platform.

“(Laughter) Haha…It is really difficult to understand how it’s possible for Fisker to license it because it was already a licensed platform.”

~Former Senior Magna Executive Involved in Fisker Partnership Agreement

According to automotive licensing experts we spoke with, any attempt by Fisker to license the Ocean platform would also require licenses to the Alpha-T platform, with the vast majority of financial gain going to the Magna-BAIC JV.

#3 Fisker Assumes Most of the Volume Risk

Henrik constantly claims that all the volume risk falls on Magna. Magna formers however informed us that really Magna DOES NOT assume much of the volume risk.

Volume risk that Fisker is assuming includes:

- Demand shortfalls

- Third party supplier delays

- Late product/technology changes.

Automotive experts and former Magna employees told us “it is very rare for Magna to be the responsible party for volume shortfall.”

Magna Steyr only bears responsibility for volume shortfalls driven by lack of manufacturing readiness in their Austrian factory.

Furthermore, if Fisker’s volume is lower than expected Fisker will still pay the same total contracted amount to Magna but these same costs would be spread over a lower volume of cars for Fisker.

#4 Fisker Will Reimburse Magna for the Fixed Tooling Costs – “Asset Light” But Paying for the Assets?

Magna formers say Fisker has guaranteed to reimburse most of the fixed costs for Ocean specific tooling and equipment to Magna. Fisker’s payment schedule is as follows:

- 30% came before start of production – PAID via FSR warrants issued to Magna

- ~40% is charged to Fisker in year 1 on a per vehicle basis based on the original manufacturing schedule;

- ~30% over the rest of the program.

Our understanding of the terms of the agreement is that if Fisker committed to 3000 vehicles in Q1-2023 but was only able to have 1 produced then ALL the fixed costs that were meant to be spread over the 3000 will actually be charged to the 1 vehicle produced.

Additionally, once 100% of Magna’s total fixed tooling costs for the Ocean program are paid then ownership of the tooling assets gets transferred over from Magna to Fisker.

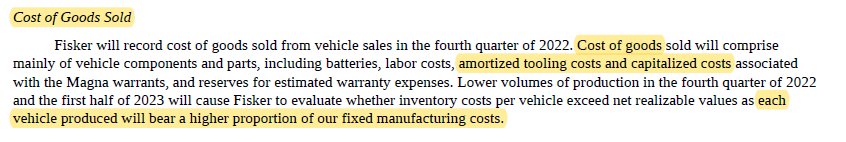

New “COGS” Disclosure Confirms Fisker is Paying Magna for Fixed Manufacturing Costs

Fisker updated their Q3 disclosure around their COGS to say that each vehicle produced in Q4-2022 and Q1-2023 will “bear a higher proportion of [Fisker’s] fixed manufacturing costs.” This further confirms that Fisker is required to start reimbursing Magna for the tooling and other fixed manufacturing costs at a set rate regardless of the number of vehicles produced.

#5 Fisker is Responsible for Supplier Performance.

Fisker is responsible for third party supplier performance. Evidently this even includes the performance of the Magna-BAIC JV as a third party supplier.

Magna have an operational responsibility…It’s Fisker’s responsibility to make Magna whole on any volume that is missed for suppliers being late.

~Former Senior Magna Employee

#6 If Fisker’s Cash Balance Falls Below the Bank Guarantee Number Then Magna Could Cease Production

We’ve been told that Magna could cease production if Fisker’s cash balance falls below the bank guarantee number or violates any other undisclosed covenants. We heard it is unlikely they would cease production for the covenant violation alone, but if Fisker got 2 months behind on paying Magna would likely stop production.

In Old Fisker the suppliers got left “holding the bag.” Valmet, Fisker’s contract manufacturer ended up with an unusable body shop for the Fisker Karma after production ceased.

Part V – The Operational Disaster at Old Fisker

Henrik likes to blame Old Fisker and Fisker Karma’s failure on their battery supplier A123 going bankrupt and a hurricane destroying his vehicle inventory. The reality is the operation was a disaster from the beginning. Self-imposed disasters at Old Fisker included:

Un-cut Carpeting for Vehicles – Fisker never sent the proper specs to the carpet supplier so instead of pre-cut carpet, a massive uncut role of carpet arrived. They needed to hire a local Finnish interior designer to cut the carpet by hand for the first production vehicles.

Wiring Harnesses with post-it notes not connectors – The electrical wiring harnesses arrived at the Valmet factory in a large box with no connectors installed and a sea of post-it notes instructing which pin to connect which connector to, and lots of the post it notes had fallen off during shipping. This failure resulted from hiring a low-cost, unsophisticated supplier from Mexico. Valmet and Fisker ultimately needed to hire several old Finish grandmothers to knit the wiring harnesses together.

Glass in the paint – Henrik demanded that the Karma have an option for “Diamond Dust” paint so the Karma would sparkle. This is essentially standard automotive paint mixed with microscopic glass flakes. The initial plan was for €300 in paint material costs per car, but this design change ended up costing >€3000.

Change Orders – Fisker kept making design change orders after the designs should’ve been finalized. An example of how many and how often change orders occurred was that Valmet ultimately had 16 different doorhandles on their inventory sheets. Each change stalled production and the scrapped doorhandle inventory just piled up in the factory.

Batteries – The battery disaster regarding supplier A123 declaring bankruptcy right after Fisker paid a $200 million order is well known. What isn’t well known is that behind the scenes senior Fisker managers tried to convince Henrik and his co-founder to not place more orders with A123 since the product was unreliable. Also, A123 wasn’t actively trying to make repairs and only had 2 engineers actually working on battery repairs in the warehouse at any one time. It was clear to other senior leadership that A123 was in deep financial trouble. Instead of listening to the automotive experts out of desperation to keep saying they have a battery supplier, Fisker decided to place one final large order of products. A123 declared bankruptcy shortly after Old Fisker paid for this order.

Software – The Karma’s software was a complete disaster and Henrik pushed Valmet to ship cars without working software because he was convinced that they could easily “Flash” the new software in the ports.

Logistic Costs – Henrik Fisker and his co-founder decided that Old Fisker should be responsible for managing inbound logistics for parts. In most lean manufacturing systems, the OEM pays the supplier based on when the parts arrive line-side. Not only did Old Fisker have to build experience in inbound shipping from hundreds of suppliers, but they also needed to arrange for the transportation of those parts.

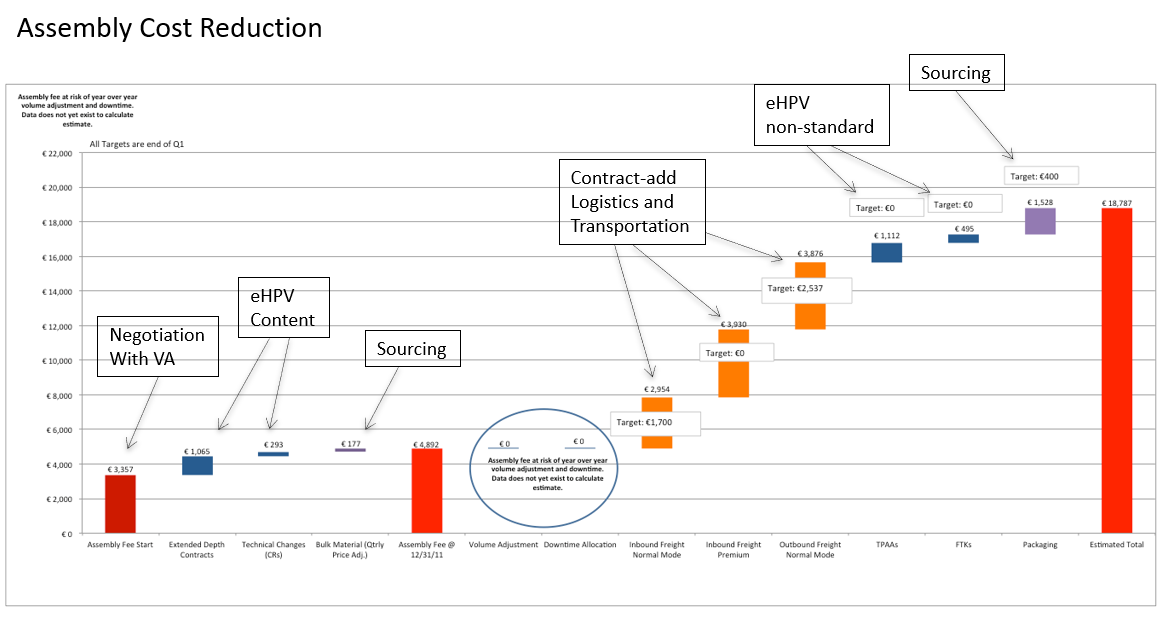

The Fisker Karma’s expected vehicle contract manufacturing costs were projected at $3,357. The estimated final costs were really $18,787 so ~560% more expensive.

The largest additional manufacturing costs came from logistics and transportation costs not being included in management’s initial projections.

It appears Henrik is making the exact same logistics mistakes again as he still hasn’t even figured out his plan to import vehicles into the US and recently claimed they might ship into 4 different US ports.

When we told automotive experts he was planning to import the Fisker Ocean into 4 different US ports they actually laughed at what a disaster it will be.

Part VI – Production Started, but Fisker Still Not Ready To Launch

Déjà vu – The Same Production Problems Occurring Again

Magna is ready for production but it seems Fisker still has not finished what they need to do.

In the automotive world entering “Start of Production” is a very specific term. It means that you have begun to mass produce certified production vehicles. To be a production vehicle it requires government certification to have already occurred.

- Government Certifications Still Missing – Fisker still has not earned government certifications required to sell any of the vehicles being produced.

- US and EU range results aren’t expected until next month.

- Fisker claims European whole vehicle type approval and U.S. homologation will occur in February.

- Lacking other government approval. [1]

- Fisker Oceans are still being built with prototype tooling

- Management said all parts won’t be built off serial tools until Q2-2023.

- The only reason that you would use prototype tooling for a pre-production build is that your program is running late. A Henrik interview confirms that they are still building cars with prototype parts.

- Suppliers Are NOT Ready For Production.

- Management notes on Q3-22 call that suppliers still need time for “ramp readiness.”

- Delivery Logistics Still NOT Figured Out.

- This was a massive problem at Old Fisker. It resulted in major cost overruns.

- Fisker hasn’t shared how Oceans will be delivered to customers.

- Has NOT even designated the proper port of entry for the USA

Fisker Ocean Lacks Essential Software

“Henrik doesn’t understand software at all…he’s a complete idiot when it comes to how automotive software works”

~Another Former Senior Executive – Old Fisker

It is clear that Henrik has not learned from his software mistakes at Old Fisker.

A November Automotive News article shows that Henrik is planning to launch the Fisker Ocean without a complete software suite. In fact, many common safety features “may not be ready until 2024.”

Old Fisker Software Mistakes

In Old Fisker the software for the Karma wasn’t ready for launch and it caused a complete disaster.

In fact, Valmet engineers were highly concerned about safety after having numerous issues with testing the Karma, including a near crash when the software locked up while traveling at highways speeds on a public road.

If you paired your cellphone with the Fisker Karma over Bluetooth and someone called you, then the whole car’s electronics would turn off. Yes, it was that bad.

~Another Former Senior Executive – Old Fisker

Valmet didn’t want the Karmas to pass their quality control inspections because the software was unreliable, so Henrik decided to have them ship the cars without production-ready software so that Fisker engineers could flash the vehicles in the ports.

It was a disaster, cars arrived in the Newark Port with different versions of software.

Did Henrik learn from the software disaster at Old Fisker?

NO!

Henrik actually said on their Q3-2022 conference call that he wants Fisker Oceans to leave the Magna factory without the correct software and then try to “flash them once they are over here” in the United States.

He is making the same mistake all over again because he thinks that updating all the vehicles software is easy. This time the vehicles won’t even be arriving in one US Port, but instead to four ports.

Will Magna Allow Fisker to Ship Vehicles with Incomplete Software?

NO!

Magna formers and automotive experts told us that Fisker CANNOT launch the Ocean without completed software. “The software should be functional…otherwise it’s illegal” to ship without complete software.

Will consumers want to pay $69,000 for a vehicle that lacks essential software?

Henrik is betting on it!

Missing safety features for the Fisker Ocean at launch due to the software not being ready include:

- Lane-keep assistance

- Blind-spot monitoring

- Traffic Jam Assistance

- Automatic cruise control

Conclusion:

Henrik Fisker claims that Fisker is an asset-light technology company, just like Apple. The reality is that Fisker has responsibility to pay for the assets and just doesn’t own them yet.

They also have minimal intellectual property, a history of operational disasters and mismanagement, and the cash is guaranteed to go to Magna.

The only things protecting Fisker’s current valuation are:

- Hope – that Henrik learned from mistakes in the first Fisker bankruptcy.

- Cash – but bank guarantees have been made on it.

Henrik Fisker has been caught:

- Lying to the US Government

- Lying about the size of his order book.

- Misleading investors, employees, and the Pope.

If you think he’s telling investors the full truth this time around…then maybe you are lying to yourself.

Now you know what really happened the first time. It’s happening all over again, and this time the cash is guaranteed to Magna.

We are short Fisker.

18 Questions Fisker Needs to Answer:

- How much of Fisker’s cash is subject to the bank guarantees given to Magna today?

- Why is it legal/ethical for Fisker to not disclose that all the cash is actually pledged? Or are the Fisker & Magna former employees lying?

- Are there other bank guarantees or capex reimbursement agreements with Foxconn or other third-party suppliers?

- Please explain what happens when you drop below the cash balance for Magna’s rolling bank guarantee?

- Which bank is providing the guarantee to Magna? Have you had to pledge anything else to the bank for the guarantee?

- Why haven’t you made it clear that the Fisker Ocean “Platform” (FM29) is built on the Magna-BAIC JV and ArcFox platform?

• Why are you hiding that the Ocean is built off of a Chinese car? - Profitability – When you state that the 1st vehicle and last vehicle off the Magna line cost the exact same are you not taking into account your capex reimbursement agreements and minimum volume commitments with Magna?

- Explain how can the Fisker Ocean Sport be profitable when you have much higher BOM costs, production costs, and logistic costs than the €20,000 BOM for the ArcFox Alpha T?

- How much would you need to pay Magna-BAIC if you were to sub-license their platform to license it to another OEM?

• Do you even currently have the right to sub-license it? - What would Fisker need to pay Magna to build the Ocean in the United States?

- What is the total cost of Magna Steyr change orders to date?

• When was the last Fisker Ocean change order made?

• Are there open change orders between Fisker and Magna Steyr that remain unresolved? - Software – Will Magna Steyr allow you to ship vehicles without complete software?

• If the software is not fully functional, how will Fisker Oceans pass Magna Steyr’s QA testing?

• Is Fisker still planning to “flash” software updates at the Port like Henrik did in Old Fisker? - How can Fisker claim to have met “Start of Production” on November 17, 2022 despite not having completed the certifications required to sell any Fisker Oceans?

- Former employees and lawsuits have said Henrik has made the following misrepresentations:

• Did Fisker Management tell the DOE that the Karma was “Not ready for production” in March 2011?

• Did Fisker Management mislead the Vice President, governor, or labor unions and promise to employee union labor in Delaware? - Why isn’t Chase releasing the cash from your firm order deposits to Fisker?

• Your financial statements indicate you have Firm Deposits for a max of 962 vehicles when Henrik claims you received nonrefundable deposits for 5000. Is your GAAP accounting incorrect or is the number of orders incorrect? - Should companies still qualify as ESG if they foster an environment of verbally abusing employees and homophobic comments?

- Why haven’t you delivered the Pope the “Popemobile” that you promised?

- What is the actual definition of the phrase “Sold Out?”

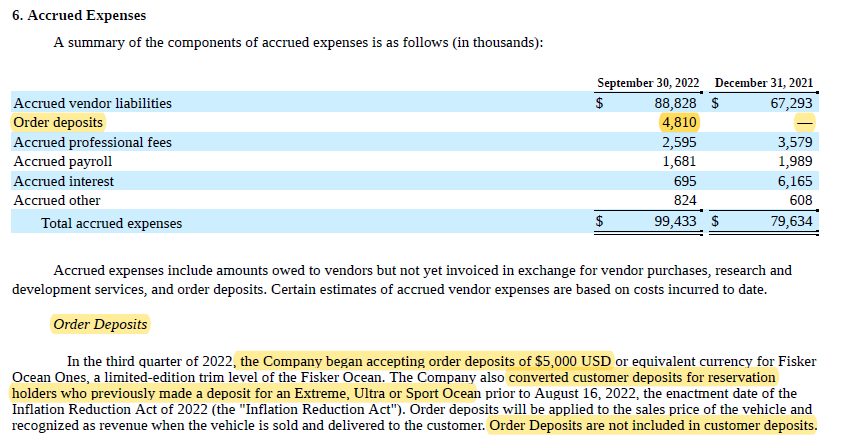

Appendix A = Bad Accounting? Another Firm Order “Misstatement”? or What?

If Fisker Has 5000 Secure Orders Then Why Does the Balance Sheet Show <1000?

Fisker’s Q3 balance sheet shows “order deposits” of only $4.81 million. If all the deposits are correctly accounted for then Fisker has “secure $5000 order deposits” for LESS THAN 1000 Ocean One Launch Edition Vehicles.

At a minimum one would expect the Q3 Balance sheet to show $25 million in order deposits as $5,000 deposits * 5,000 orders = $25 million.

Not including $250 reservations converted to orders for the Inflation Reduction Act this would indicate that Fisker actually only received $5,000 deposits for a maximum of 962 vehicles!

Fisker’s CFO did offer an odd explanation for why the deposits could legitimately be missing. Essentially saying that:

“Order deposits from credit cards were processed by JPMorgan Chase and Chase is holding onto the deposit until the vehicle is delivered to the customer.” Explanations of why deposits would be held by a financial intermediary and not Fisker show up on the Q2 conference call; Q2-Note 13; and Q3-Note 6.

This accounting is at the very least strange. Especially since Fisker has a performance liability from this deposit contract as well as a legal claim to payment. We spoke about with 2 different automotive CFOs and an accounting expert regarding non-refundable deposit accounting and all three concluded that for a non-refundable firm order they believed proper GAAP accounting would require Fisker should be booking the asset and liabilities for these deposits on their balance sheet.

It’s very confusing as to why a company would ever want to leave cash at the bank, unless they have to. Especially considering Fisker’s recent utilization of their ATM facility one would think that Fisker would want to show more cash on their balance sheet, not less.

The missing deposits has raised some questions for us:

- Why is Fisker’s Balance Sheet missing $21 million of deposits?

- Is this just an accounting misstatement?

- Did Fisker not actually receive the full 5,000 orders?

- Why wouldn’t JP Morgan Chase be releasing the cash to Fisker?

Appendix B = Bots!

Fisker Was Caught Using Fake Accounts Once – It Appears They Have Engaged Bot Farms Again!

Fisker’s CFO & COO was previously busted by journalists for using fake accounts to write favorable reviews of Fisker.

It looks like she might be up to her fake accounts tricks as it appears as Fisker gets an outsized amount of engagement from bots currently.

We conducted a study of likely bot usage for Fisker’s twitter account and discovered that ~31.5% of Fisker’s likes comes from suspicious bot farm type accounts with <25 followers and that 7.2% were from accounts whose sole purpose is to like Fisker related content. These ones had virtually no followers but yet log onto twitter daily to only liked Fisker related posts. We found >70 of these types of accounts with some obvious examples being (1, 2, 3, 4, 5).

We assume Fisker has been paying for bots again but the only person that would know for sure is…ELON!

Appendix C – The IP – A Lack of Technology & Large Empty Promises

The Technology from Old Fisker is Long Gone!

The technology from Old Fisker was sold off in their bankruptcy to Wanxiang Group and was assigned to Karma Automotive. All the technology from Old Fisker is gone.

So what IP does Fisker Inc really have?

We combed through Fisker Inc’s US and international granted patents and found Fisker’s patent portfolio to be underwhelming.

Five Solid State Battery Patents – Fisker’s battery engineering inventors have all LEFT Fisker[2].

The initial inventor of Fisker’s first solid state battery patents, Fabio Albano, even sued Fisker and an arbitrator determined he should receive $6.5 million. Dr. Albano accused Fisker of:

- Routinely making exaggerated public claims about Fisker’s development of the solid-state battery.

- Fraudulently inducing him to transfer his battery patents to Fisker.

The 5 solid state battery patents granted or assigned in the US and internationally to Fisker are: (WO2020041767A1, WO2020041775A1, US20200067128A1, US20190280330A1, WO2019160993A1). These inventions are obviously not still being utilized as all of the battery engineer inventors have left Fisker and Fisker has publicly scrapped the battery program.

Six Design Patents – Design patents are less valuable

Design Patents only protect against ornamental appearance of an article and as a result are much easier to obtain and less valuable. They are for “how it looks” rather than “how it works.” Fisker Inc has six design patents for Henrik Fisker’s automotive designs. The patents are essentially for Henrik’s basic drawings of vehicles.

Example – The Fisker Orbit Patent has 6 images like the below:

This Design “IP” ranges from drawings for scrapped vehicles (USD840874S1; USD832742S1; USD809972S1), tail-lights designs for scrapped vehicles (USD869710S1; USD861201S1); a wheel, and finally the Fisker Ocean’s drawings (USD944119S1).

Other utility patents granted that are actively being used include patents for:

- “Retractable Quarter Windows” on the Fisker Ocean WO2022109195A1; US11260729B2.

- “Rotating Infotainment System” – US11465502B1

- “Unique Front & Rear Storage” – WO2022204361A1

Henrik Fisker wants investors to think of Fisker as an asset-light IP powerhouse similar to Apple. But, Fisker’s patent portfolio mainly consists of some old design patents, scrapped battery tech, and some cute new features. Fisker’s IP is nothing like Apple’s.

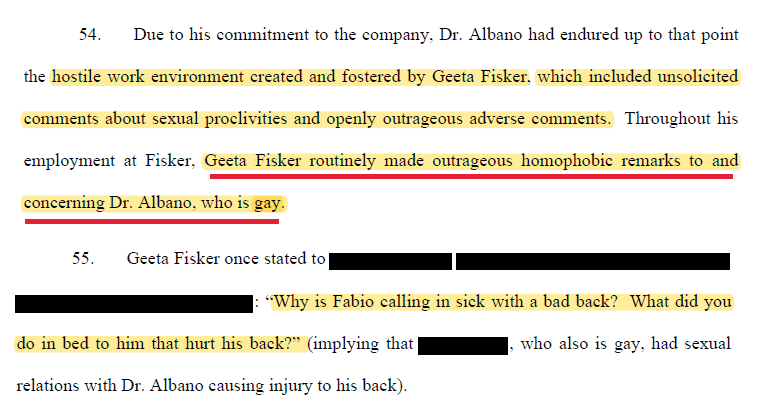

Appendix D = Does A Culture of Berating Employees and Homophobic Remarks Count as ESG?

The “S” in ESG stands for “social” factors. The “G” for ESG investors stands for “governance.”

Fisker evidentially has a culture of berating their employees. We heard many stories from different former employees of Dr. Geeta Fisker (CFO and COO) yelling at senior engineers. They even shared multiple instances of her abusive comments “making people in the office cry.”

Her verbal abuse brought senior engineers to tears.

“Other people told me how she verbally abused them. I had managers almost in tears telling me how she was so brutal…yeah, she was verbally abusive.

~Former Fisker Employee – New Fisker

Fisker employee’s glassdoor reviews also show that “management…yell about minor issues on a daily basis.”

“Dr Geeta Fisker routinely made outrageous homophobic remarks”

Source – Albano v Fisker – Case-20TRCV00731 – LA County – Doc 10-27-22 – pg 68

Submit a Tip – Individuals and former employees with knowledge of Fisker’s misstatements, other information, or tips should contact us at [email protected]. We will make sure to protect your identity and anonymity.

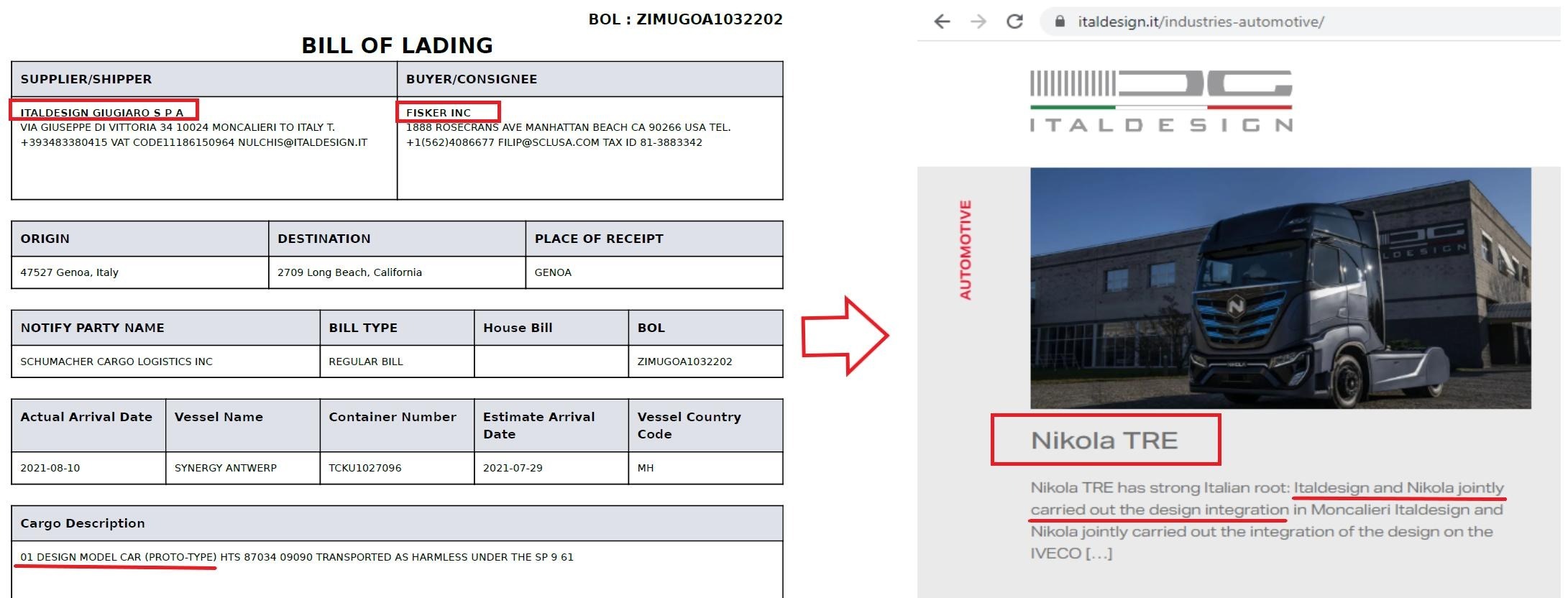

Appendix E – Henrik Following in Trevor Milton’s Footsteps:

When Fisker SPAC’ed they focused on comparing themselves directly with Nikola (NKLA) in their SPAC investor presentation. At the time Fisker was attempting to connect themselves to NKLA’s successful IPO, but now it’s even more fitting.

Fisker & Nikola – Filled Management Team with Family

Henrik Fisker seems to have followed in Trevor Milton’s footsteps by filling his management team with family members that will be loyalists.

- Trevor Milton appointed his brother to Nikola senior leadership role.

Henrik appointed:

- His wife, Dr. Geeta Gupta Fisker, as Fisker’s CFO and COO, despite her educational background in biotechnology and organic chemistry.

- His daughter, Natasha Fisker, as a Senior Marketing Manager despite her having only an associate degree from an LA fashion institute. Actually, Natasha might be the brains behind Fisker’s t-shirt revenue to date!

Both Henrik and Trevor claimed to have game-changing battery technology.

The battery claims for both turned out to include false statements and misrepresentations. They both have a flare for theatrics when making these announcements.

Fisker & Nikola – Used Same Prototype Design Firm:

From Fisker’s import records we discovered that Fisker used Italdesign Giugiaro SPA the same prototype designer that designed the Nikola TRE.

We think Henrik’s pattern of misleading statements will end with Fisker in same place that Trevor and Nikola currently find themselves in.

Large Insider Selling – Fisker’s have $20 million taken off the table so far

Just like Trevor Milton, Fisker Mangagement has been selling lots of stock.

- Henrik & Geeta Fisker have sold ~$20 million of stock via two $10 million stock sales (link, link).

- Burkhard Huhnke, Fisker’s (CTO) sold ~$250,000 of stock or 80% of his vested shares in June 2021 and then another $77,000 in stock or >50% of his vested shares in March 2022.

Disclaimer & Terms of Service:

By downloading from or viewing material on this website and/or by reading this report, you agree to the following Terms of Service. You agree that use of the research on this website or report is at your own risk. In no event will you hold Fuzzy Panda or any affiliated party, including officers, directors, employees and agents of Fuzzy Panda or any companies affiliated with them, liable for any direct or indirect losses caused by any your use of information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site or in this report. You further agree that you will not communicate the contents of reports and other materials on this site to any other person unless that person has agreed to be bound by these same terms of service. If you download or receive the contents of reports or other materials on this site as an agent for any other person, you are binding your principal to these same Terms of Service.

You should assume that as of the publication date of their reports and research, Fuzzy Panda and possibly any companies affiliated with them and their members, partners, employees, consultants, clients and/or investors (the “Fuzzy Panda Affiliates”) have a short position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds of companies covered in such reports and research. They therefore stand to realize significant gains in the event that the prices of either equity or debt securities of the subject companies decline. Fuzzy Panda and the Fuzzy Panda Affiliates intend to continue transactions in the securities of issuers covered on this site for an indefinite period after their first report on a subject company, and they may be short, neutral, or long at any time hereafter regardless of initial position and the views stated in Fuzzy Panda’ research. Fuzzy Panda will not update any report or information on this website to reflect such positions or changes in such positions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall Fuzzy Panda offer, sell or buy any security to or from any person through this site or reports on this site. Fuzzy Panda and the Fuzzy Panda Affiliates do not render investment advice to anyone unless they have an investment adviser-client relationship with that person evidenced in writing. You understand and agree that Fuzzy Panda does not have any investment advisory relationship with you or fiduciary duties to you. Giving investment advice requires knowledge of your financial situation, investment objectives, and risk tolerance, and Fuzzy Panda has no such knowledge about you.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Fuzzy Panda’s research and reports express their opinions, which are based upon generally available information, field and online research, and inferences and deductions through due diligence and the analytical process. To the best of their ability and belief, all information contained in their reports is accurate and reliable, and has been obtained from public sources believed to be accurate and reliable, and they have not obtained information from persons who are insiders or connected persons of the stock covered or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. Fuzzy Panda makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion and conclusions are subject to change without notice, and Fuzzy Panda does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the expressions of information in this report are copyrighted and owned by Fuzzy Panda Research, and you therefore agree not to distribute this report or any excerpts from it (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link: www.fuzzypandaresearch.com. If you have obtained Fuzzy Panda’s research in any manner other than by downloading from that link, you may not read such research without going to that link and agreeing to the Terms of Service. You further agree that any dispute between you and Fuzzy Panda and their affiliates arising from or related to the material on their website shall be governed by the laws of the State of California, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in California and waive your right to any other jurisdiction or applicable law. The failure of Fuzzy Panda to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to this report or the material on this website must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Other US Government Vehicle filings missing – Fisker Ocean is not listed as eligible for EV Credits w/ IRS; 2) NHTSA Crash Test – Fisker is not listed in the crash test database 3) California CARB credits – Fisker is not listed in either the 2022 list or 2023 list; Fisker is not listed in the California Dealer License Database – they stated they will sell vehicles directly as a CA dealer

Note – On 1 patent Geeta Fisker was added as an inventor, she is the only remaining Fisker employee and Fisker’s CFO & COO so obviously not a battery engineer. ↑