EVGO – A Broken “ESG” Company Connected to Jeffrey Epstein

- Charger Utilization has DECLINED since 2019

- Research Study shows 25.5% of EVGOs Chargers are Broken

- Key Patent Denied in May 2022

- SPAC Sponsor Actually EVGOs Former Failed Owner

- Hidden Connections to Jeffrey Epstein;

- July 2nd Lock-up Expiration Coming – Will it Equal Massive Selling?

Executive Summary:

EVGO is a mediocre EV charging company that we believe is substantially overvalued. Not only are a significant number of their EV chargers broken, but they also have triple digit negative operating profit margins which have gotten even worse.

- UC Berkeley study reveals 25.5% of EVGO’s chargers are broken/out of service.

- Operating margins declined from -199% in 2019 to -260% in 2021 and -381% in Q1-22

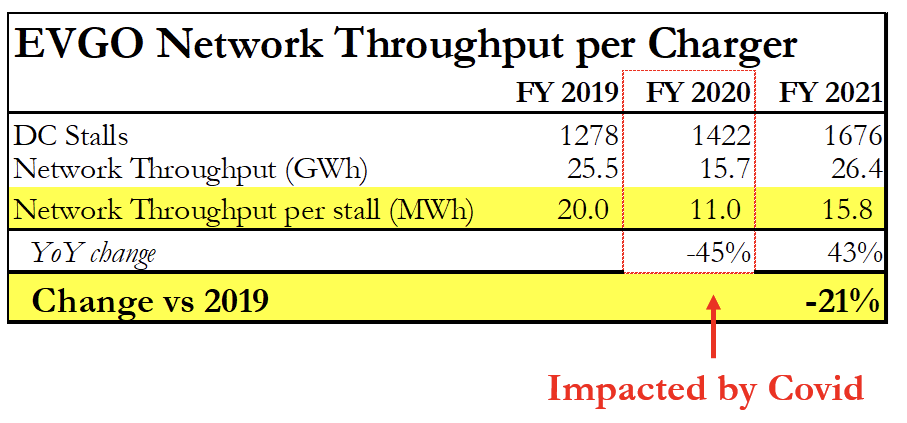

- Charger utilization has DECLINED by 21% from 2019 to 2021.

- Key patent was recently denied in May 2022.

- EVGO only spends $2m a year on R&D

- Questionable partnerships – including with ELMS who recently filed for bankruptcy.

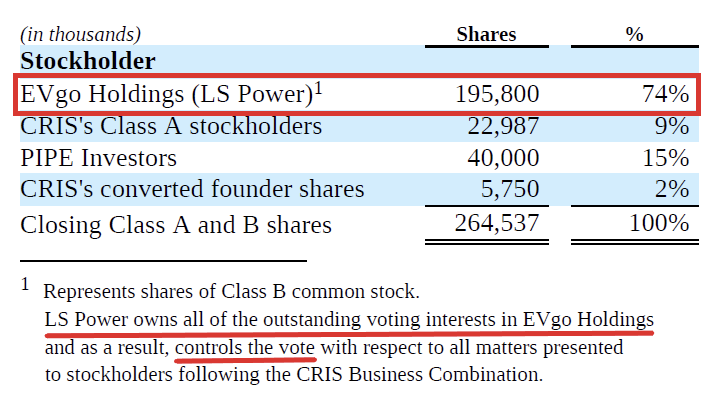

One year before IPOing via a SPAC at a $2.6 billion valuation, EVGO was purchased by LS Power in January 2020 for an estimated $134 million. LS Power is still EVGO’s controlling shareholder. Their cost basis is ~$0.70 a share.

Did LS Power turnaround the business and improve financial performance?

No! EVGO’s 2020 financial performance fell off a cliff as Covid negatively impacted auto travel:

- Revenue declined by 17%

- Utilization dropped 45%

- Net Losses doubled from -$24.8 million to -$48.2 million.

- EVGO burnt through $40 million of free cash flow.

So did LS Power take a write-down on the business?

Of course not!

Instead, LS Power was able to have:

- EVGO pay LS Power >$14 million in bonuses and other fees.

- IPO EVGO via a SPAC for a >1500% return.

Brief History of EVGO going public – SPAC Sponsor received shares for <$0.01 and was CEO of EVGO’s former parent co (who wrote EVGO’s down by 75%)

EVGO was dumped on retail investors via an IPO with a SPAC named CLII (Climate Change Crisis Real Impact I). CLII’s CEO, David Crane, is the disgraced former CEO of NRG, a Houston based energy company. NRG is actually EVGO’s original parent company. NRG created EVGO as a result of a $102.5 million settlement with California Public Utilities for price gouging California consumers. NRG not only fired David Crane but also sold EVGO after writing off 75% of their investment.

So why would David Crane want to buy EVGO again and why would the board not obtain a fairness opinion on a company in decline that was sold between private equity firms for 6% of the price he is paying just 1 year before. It might be because the SPAC founders paid just $0.0043 per share!

The founder’s lock-up expires this weekend on July 2, 2022. > 76% of shares will be available to be sold by founders & LS Power.

Could EVGO’s investment story be any worse?

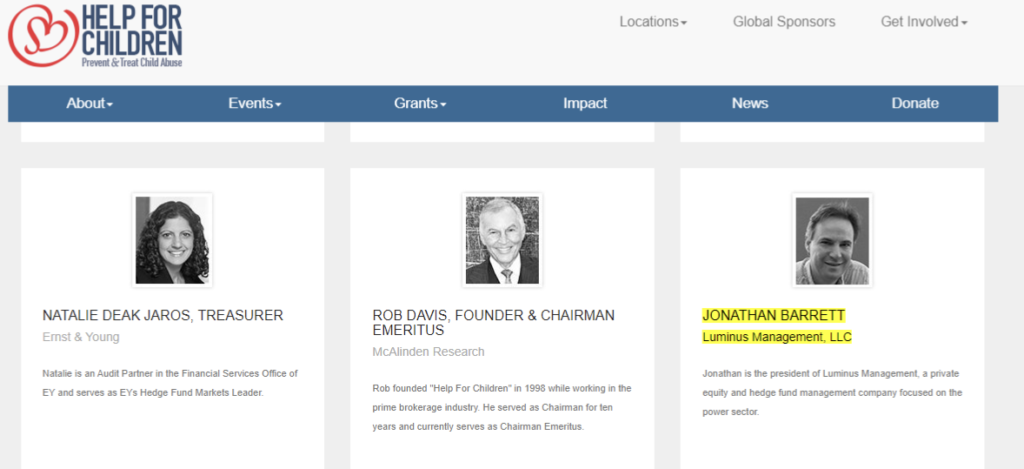

We discovered that EVGO’s controlling shareholder, LS Power, is connected to Jeffrey Epstein, the infamous and now deceased pedophile. We uncovered this connection to Jeffrey Epstein with LS Power’s “affiliate fund” Luminus Management and LS Power’s current CEO. Luminus Management is run by Jeffrey Epstein’s protégé Jonathan Barrett.

We uncovered evidence of their connections within bankruptcy proceedings; applications to join the Board of children’s schools; and fund ownership documents within the Panama Papers. Key parties even show up in both Epstein’s black book as well as the “Lolita Express” flight logs. Recent SEC filings show that Luminus and LS Power are still connected.

We are short EVGO.

EVGO’s consumers consumer complaints do a great job of explaining our short thesis.

“[EVGO]You are such a terrible company that I think you should be banned from all public places. You are preventing good companies from providing a much needed service. Please file for bankruptcy and go away”

@scott_eric_yep

Note – The “Jeffrey Epstein” information is “buried” at the end of our report. We did this so investors need to read about EVGO’s bad economics first.

Please see additional disclosures at end of report and our terms of service.

Part 1: EVGO’s Real Economics: Throughput Declining + Key Patent Denial

Throughput per charger (utilization) is the most important metric in EVGO’s business. EVGO has a business model where the company fronts the CapEx to install chargers (along with government subsidies) and is supposed to recover the cost as chargers are utilized. EVGO charges consumers a small session fee and a price per minute of utilization time while buying the energy.

Increasing throughput per charger is the key for EVGO achieving their aggressive SPAC projections of 23% future utilization.

Charger Throughput DECLINED 21% vs 2019

We believe EVGO’s management is attempting to obscure the reality of their performance by focusing on comparisons against their 2020 Covid lows vs a normalized 2019. US Department of Transportation data shows that miles driven recovered in 2021 and were only -1% vs 2019. Despite the fact that comparing 2021 vs 2019 is the proper comparison, EVGO’s 2021 10-k oddly omits the company’s 2019 performance.

What could management be hiding?

Throughput per charger DECLINED since FY 2019. EVGO’s MWh per charger is DOWN 21%!

EVGO has already lowered 2022 throughput guidance.

Within EVGO’s SPAC deck, the Company projected network throughput to grow at nearly 100% CAGR from 2021- 2027 with 2022 network throughput expected to reach 69 GWh (slide 26). In typical SPAC fashion it’s just 1 year later and EVGO has already reduced its outlook for 2022 DOWN to 50-60 GWh.

Unlike peers, EVGO does not generate any upfront revenue when it deploys infrastructure. Competitors on the other hand that have significant intellectual property are able to charge upfront revenue for their chargers.

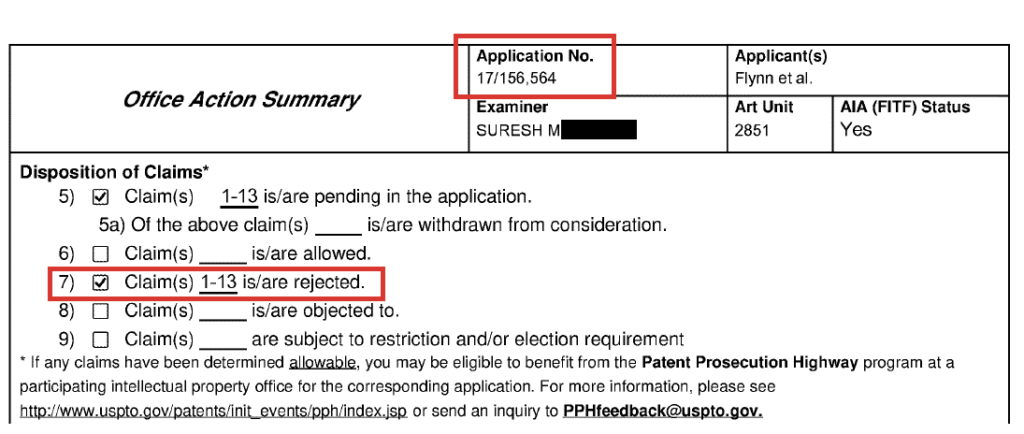

EVGO’s Key Patent Rejected in May 2022

A cornerstone of EVGO’s intellectual property was meant to be their patent US17/156,564. This patent is focused on the design of a “rapidly deployable EV charging station.” In fact, when EVGO filed their S-1 this patent was their ONLY pending patent application.

May 2022 USPTO Rejected the Patent.

On May 17, 2022 – the USPTO issued EVGO’s patent application a non-final rejection. The USPTO rejected all claims 1-13. Some claims were rejected for not being novel.

All of the patents and intellectual property that we were able to find for EVGO were actually patents granted to Recargo Inc (the plug-share app company) that EVGO recently purchased. From Google Patents it appears Recargo Inc holds 9 granted patents most of which are regarding software for an app to collect data from an EV network. Thus, it appears any of the actual patents EVGO evidently weren’t actually developed by EVGO and instead were used by the software app they bought.

Lack of R&D Spend – only $2 million in FY2021

EVGO’s 10-K confirms (pg 89) that the company does not hold spending on innovation in high regard. In FY 2020 EVGO spent only $1.2 millionon R&Dandinvested just $2.0 million in R&D during FY 2021.

This compares to their direct competitors like Chargepoint Inc that spent ~70x more on R&D over a similar 2-year period.Chargepoint spent ~$220 million on R&D in 2020 & 2021 and has ~55 patents granted.

Volta Inc (VLTA), EV competitor that spends little on R&D, has seen their stock decline by 85%.

An EV charging competitor that is similarly underspending on R&D is Volta Inc (VLTA). Volta also IPO’ed via SPAC a year ago. They have only spent $1.6 million on R&D in 2021 & 2020 and their stock’s results seem to reflect that underinvestment in technology. Yet, Volta still has a patent portfolio that includes significantly more success with the patent office than EVGO as Volta has 10 issued design patents and 2 utility patents. VLTA’s stock has already declined 85% and VLTA is currently trading for ~$1.50.

If EVGO lacks significant IP regarding building chargers then who builds them?

Third Party Vendors Produce EVGO’s Chargers!

Companies like ABB, BTC Power, Marubeni, Nationwide, etc are where the IP and expertise in designing and building EV charging stations really lies.

EVgo relies on third-party vendors for design, testing and manufacturing of charging equipment.

Pg 14 -10-k

Massively Negative Margins

Given that EVGO uses 3rd party suppliers, lacks significant IP, and is in cut throat business where their competitors give away their product for free it should not be surprising that EVGO has horrible operating margins.

EVGO’s operating margins were:

- Q1 2022 – Negative 351%

- FY 2021 – Negative 260%

- FY 2020 – Negative 331%

- FY 2019 – Negative 199%

We think EVGO is set up to fail. Their margins show they bear tremendous upfront costs and given the trends we have highlighted in throughput, they appear to be getting worse and worse at recouping them.

Part 2 – Broke Down Network – Could Non-Functioning Chargers Result in EVGO Losing Government Funding?

One positive thing is that EVGO has thus far been able to limit their cash burn by utilizing government grants and funding to cover a significant portion of EVGO’s Capex build-out costs.

Recent examples of free government funds/grants to EVGO include:

- Maryland – $950k in grants to build at 5 locations (Competitor Blink received $1.1m)

- California Energy Commission – $3.6m to EVGO (Competitor Chargepoint received $4m)

- Portland, Maine – grant size not disclosed

Much of that funding comes with government stipulations such as a 97-99% uptime. We think that EVGO could be at risk of losing some their government funding as their charging network has significantly more downtime than they are reporting to government agencies.

UC Berkeley Study Reveals 25.5% EVGO’s Chargers Were Not Functioning

A recent April 2022 study on the reliability of DC fast chargers was published out of University of California – Berkeley.

The study’s goal was to discover what the actual real-world reliability of deployed charging networks in California’s Bay Area. The study included tests of 657 chargers from multiple companies of which 216 EVGO chargers. EVGO had the 2nd highest non-functioning charger rate of the major EV charging companies.

EVGO’s chargers were non-functioning 25.5% of the time.

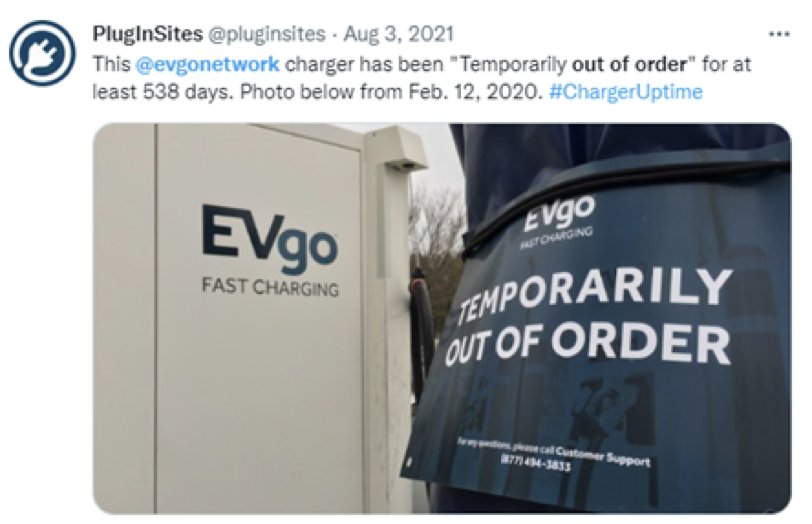

Survey of Public Data Shows ~15% of EVGO’s Chargers Broken Across the US:

We used public data to conduct our own proprietary survey and analysis of all the EVGO fast chargers with a charging speed of between 50-350kWh. Note that our survey is not as comprehensive as the UC Berkeley study in catching all the broken chargers as we weren’t able to remotely capture other charger failures like payment system errors, connection errors, etc. We wanted to see how well the government’s capex subsidies are being spent and how chargers are currently reporting being broken.

Public data allowed us to capture how many EVGO chargers were reporting their status as being off-line, broken, or unknown. The survey consisted of results from a total of 1745 EVGO fast chargers: 1253 (50-99kWh); 185 (100-150kWh) and 307 ultra-fast (>150kWh)

~15% of EVGO’s Fast Chargers were broken or offline.

- 159 – 9.1% were broken

- 11 – 0.6% were partially broken (1 outlet not functioning)

- 90 – 5.2% were offline* (returned status of unknown usually indicating the charger had been offline for weeks or more)

Below is an example of an EVGO “offline”/“unknown” status charger that was reported as being “out of order” for >538 days.

We did a similar survey of Electrify America. We surveyed 3213 fast chargers (>50kWh) and only 6.1% of Electrify America chargers showed as broken or out of order.

Another Study – EVGO – 4th place out of 7

Another recent Jan 2022 study that included 150 tests at multiple EV charging networks led an EV magazine to rank EVGO as 4th place out of the 7 networks. Primary “Cons” of the EV Go network were that many of the chargers are not high-power stations (most are 50kW) and that their charging stations were in poor condition compared to other networks.

Local governments have begun noticing

In Massachusetts members of the senate have demanded that EVGO’s broken chargers be fixed.

In California the California Energy Commission has begun requiring companies to track and report information on how often their equipment is offline.

“A 50 percent success rate in any other retail transaction would not be considered acceptable, and it shouldn’t here,”

Patty Monahan, a commissioner – California Energy Commission (link)

If EVGO’s broken chargers and broken promises aren’t enough to cause local governments to reconsider partnering with them than we wonder what will happen when they learn EVGO’s controlling shareholders is connected to Jeffrey Epstein.

Part 3 – EVGO’s History of Asset Write-downs; Some Questionable Partners

EVGO’s History… of Asset Write-downs

EVGO was not founded by a visionary clean energy entrepreneur. Instead, the company’s evolved from a $102.5 million settlement between NRG, a Houston based energy company, and California Public Utilities Commission after NRG overcharged California consumers during the 2001 power crises. As part of this settlement NRG was required to build a network of 200 public EV stations.

In 2016, NRG dumped EVGO’s money losing charging stations and recorded a $78m loss on the sale of EVGO. NRG valued its remaining 35% equity interest at just $1m. The EVGO sale by NRG to Vision Ridge Partners, an energy private equity firm, in 2016 was for $39m ($17m net of cash).

In January 2020, Vision Ridge Partners then sold EVGO to LS Power for an unreported amount. From the S-1 we see that LS Power reports having $136.3m of member’s equity in EVGO so we assume that was the price paid for the company. The $136m price would amount to EVGO valued at ~$107,000 per active DC charger.

In 2020, Covid resulted in consumers staying home and not driving which caused revenue to fall 17% and network throughput to decline 39%.

In October 2020, David Crane, was able to IPO a SPAC named Climate Change Crisis Real Impact I (CLII). David Crane happens to be NRG’s CEO from 2003 to 2015, so he was the CEO of EVGO’s parent company. David was eventually fired after overseeing a 70% decline in NRGs stock price and EVGO was sold (aka written off).

Note – The SPAC founders paid just $25,000 (pg 109) for 5,750,000 shares. This equals a cost basis of $0.0043 per share.

By the end of November 2020, EVGO had signed a non-binding LOI.

January 21, 2021, CLII and LS Power agreed to SPAC EVGO at a $2.0 billion valuation excluding cash or ~$1.4 million per active DC charger. This is a 13x 1 year mark-up of a business that declined significantly during that time-period. Not surprisingly CLII’s Board whose members were receiving shares at <$0.01 each decided NOT to obtain a fairness opinion.

In July 2021, EVGO purchased Plugshare (aka Recargo Inc), a popular EV charging app. Even the Plugshare app has been written down by previous owners. Plugshare was purchased from German energy conglomerate, Innogy SE, who bought Plugshare back in 2018. Innogy annual reports show that they had valued Plugshare at an equity value of €34.2 million, so the sale to EVGO for $25 million actually represented a ~30% write-down of Plugshare.

Plugshare is important in the EV charging infrastructure because they were meant to be an unbiased source of information about real-time available chargers, experience of past EV users, as well as help with essential route planning. They are an essential unbiased gate-keeper and traffic driver for the EV charging companies. When we spoke to members of Plugshare’s team they assured us that despite selling the company to EVGO, that nothing had changed regarding the independence of their ranking algorithms to favor EVGO.

EVGO’s Has Some Questionable Partners:

EVGO has a couple blue-chip partners like GM, Nissan ($250 of credits), Suburu (1 year free), Toyota (1 year free), Cruise (who uses EVGO for charging their fleet of Autonomous Vehicles). Beyond these partners, however, the list becomes as questionable as people claiming to just be “friends” with Epstein.

Electric Last Miles Solutions (ELMS) was proudly announced as EVGO’s newest partner in Nov 2021. ELMS named EVGO as their first charging partner and they were developing a preferred fleet charging program together.

- ELMS was exposed by Fuzzy Panda Research for having fake customers, and attempting to change Chinese EVs logo and pass them off as Made in the USA.

- ELMS has since fired their CEO & Chairman for embezzlement, announced they are under SEC investigation, and recently ELMS recently filed for bankruptcy.

Mullen Automotive – EVGO has hinted on twitter about a partnership with Mullen Automotive.

- Hindenburg Research exposed Mullen as being another EV Hustle

Meanwhile, Electrify America, one of EVGO’s main competitors has new EV drivers at most of the major OEM locked-up via free charging relationships.

Electrify America Charging Partnerships:

- Audi – 1000 kwh free over 4 years

- BMW – 2 free years at Electrify America and $100 at EVgo

- Ford – 250 kWh of free charging

- Harley-Davidson – 500 kWh of free charging

- Hyundai – 2 years of free 30 min charging sessions

- Jeep – Wranger4xe have free access to charging

- Kia – 1000 kWh of comp charging

- Lucid – 3 years of complimentary charging

- Mercedes – 2 years of unlimited 30 min comped charging sessions

- Porsche – 3 years of complimentary charging

- Volkswagen –3 years of complimentary charging

- Volvo – 240kWh of complimentary charging

Over 80% of EV charging happens at home. When a consumer happens to have free charging at Electrify America Level 3 chargers do you think they will go out of their way to charge at a slower and older EVgo station?

Part 4: EVGO’s Controlling Shareholder’s Connections to Jeffrey Epstein & Luminus Management.

LS Power is connected to Jeffrey Epstein via their “affiliate fund” Luminus Management.

LS Power controls EVGO’s Board. Currently 5 out of 9 board members at EVGO are affiliated with LS Power including EVGOs Chairman.

LS Power still owns 74% of the shares outstanding of EVGO after the de-SPAC transaction with CRIS. (pg 93). LS Power was the principal stockholder of EVGO pre-SPAC and remains in complete control of EVGO. We estimate that LS Power’s average cost basis is ~$0.70 per share (pg 9).

Who is LS Power? – EVGO’s Majority Shareholder That Controls EVGO’s Board

LS Power is an energy focused investment firm which was founded in 1990 by its current Chairman, Mike Segal. Mike’s son, Paul Segal, is the current CEO of LS Power.

LS Power purchased EVGO right before COVID-19 hit in January 2020 for an estimated $134m. Travel fell off a cliff and EVGO’s throughput per charger fell 45%. Yet less than 1 year later and EVGO’s numbers collapsing LS Power had already signed a letter of intent to take EVGO public via a SPAC.

Introducing Luminus Management – Run by Jeffrey Epstein’s Protégé – Affiliated with LS Power & An EVGO Investor

Jeffrey Epstein had multiple “investment firms.” J. Epstein & Co was one of them. Another one was named Ossa Properties and it handled Jeffrey Epstein’s real estate investments, evidently under Epstein’s brother, Mark’s Epstein’s name. Ossa Properties reportedly owned the infamous East 66th Street building that played a key role in Epstein’s sex-trafficking circle.

What is less known is that at the center of Epstein’s investment firms lay a South African family, The Barrett Brothers. This family of brothers were seemingly in charge at multiple of Epstein’s firms.

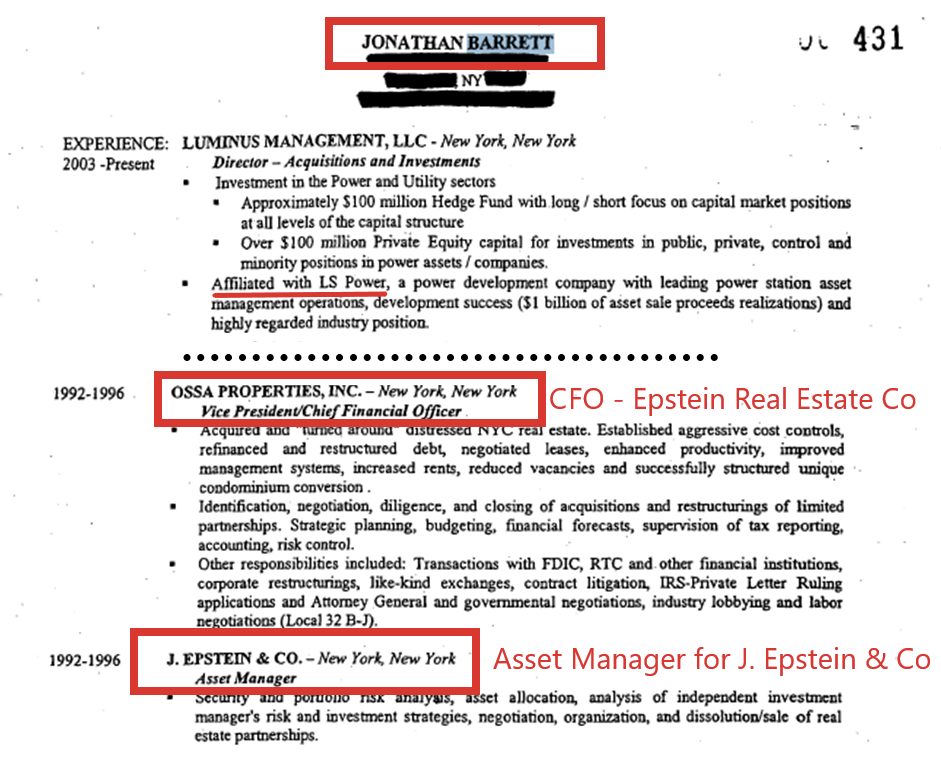

Luminus Management’s CEO – Jonathan Barrett was Jeffrey Epstein’s Protégé

Jonathan Barrett is the current CEO and manager of Luminus Management, a mysterious $2.4 billion investment manager with very few employees.

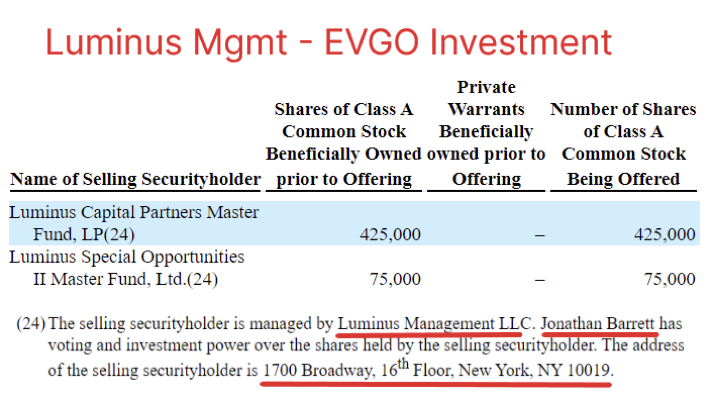

Luminus Management was a pre-SPAC IPO investor in EVGO.

Jonathan Barrett’s own resume shows his long-term connections to Jeffrey Epstein. He submitted this resume when applying to join the board of a charter school.

Jonathon’s resume clearly shows that Luminus Management was

“Affiliated with LS Power.”

Jonathan Barrett’s Brother – Anthony Barrett is Another Trusted Epstein Asset Manager

Anthony Barrett, Jonathan’s brother, is known for managing Epstein real estate portfolio Ossa Properties. An old New York Times article shows that Anthony and Jonathan were not only brothers but also partners in founding Ossa Properties.

“Anthony Barrett attests to the fact he also was J. Epstein & Co’s asset manager at one point. Why does this matter? Because Barrett ran about 500 rented apartments in four various co-ops throughout NYC almost entirely by himself, under the Ossa brand.”

~ Anthony Barrett comments on Ossa Properties (source)

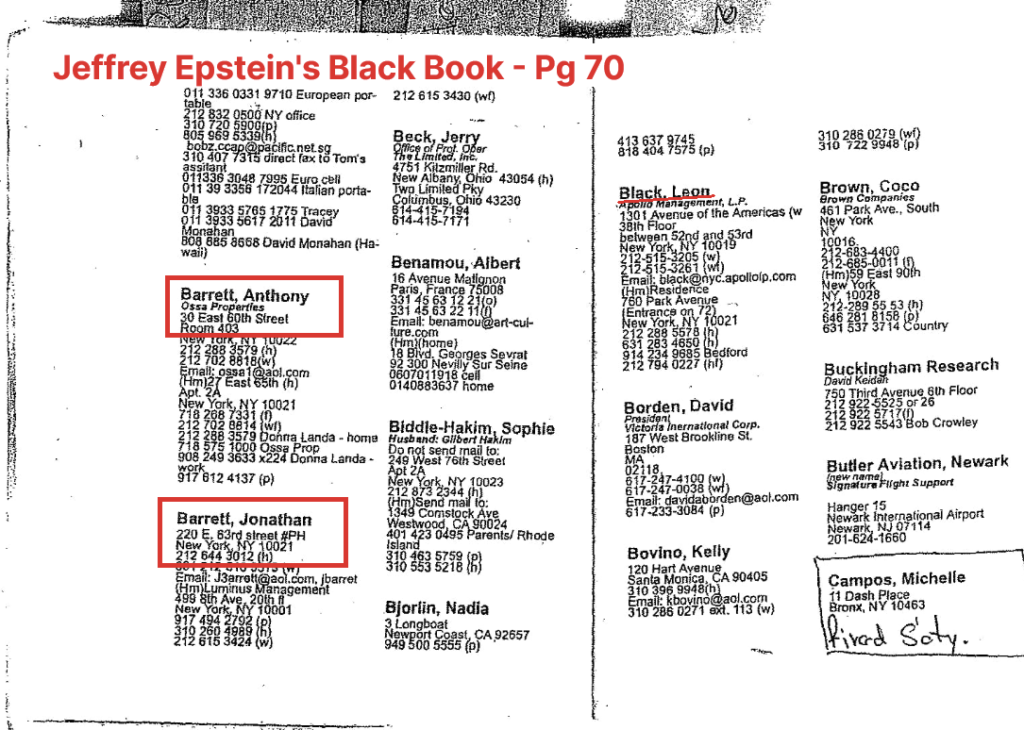

Epstein’s Black Book Features Jonathan Barrett & Anthony Barrett

Jeffrey Epstein’s “little black book” was his secret contact list that included now disgraced rich and powerful people like Prince Andrew and Leon Black.

Epstein’s Black Book also prominently features both Jonathan Barrett and his brother Anthony Barrett.

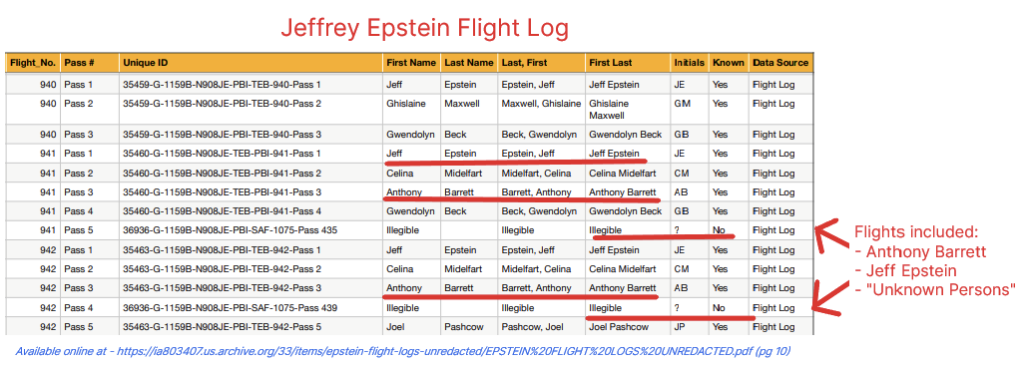

Anthony Barrett Flew the “Lolita Express” with Epstein & “Unknown Guest”

Anthony Barrett also has the appalling distinction of showing up in Epstein’s flight logs as a guest on the “Lolita Express,” the nickname given to Jeffrey Epstein’s private airplane used for sex trafficking of minors.

Barrett, Epstein and others evidently travelled to West Palm Beach along with an “unknown person” whose name was “illegible” in the flight logs. Gross.

Paul Barrett – Another Barrett Family Member Subpoenaed in Jeffrey Epstein Case:

Paul Barrett is another Barrett relative connected to Jeffrey Epstein.

According to a background check Paul Barrett appears to be Jonathan and Anthony’s younger brother. Paul Barrett is directly connected to Jeffrey Epstein, having once lived at the infamous 301 E 66th St Epstein building. That same 301 E 66th St address is listed as “Apt. for Models” in Epstein’s Black Book.

Paul Barrett was subpoenaed by the attorney general in regard to Jeffrey Epstein case. The subpoena was for all “communications with Jeffrey Epstein or any Epstein Agent, or Epstein Entity.”

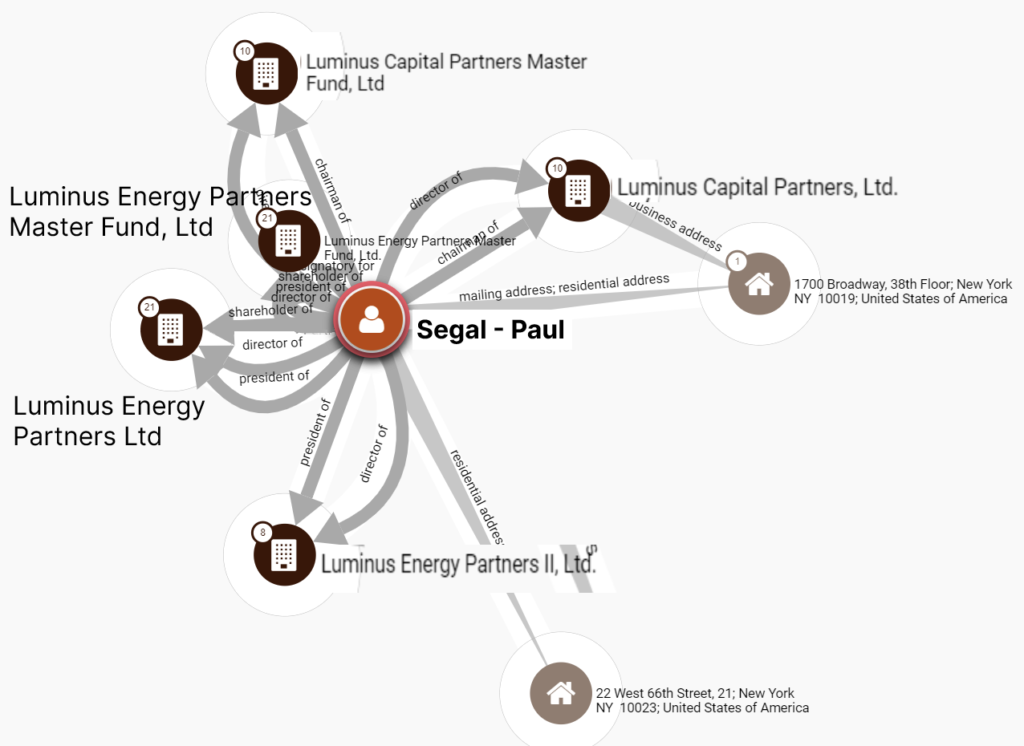

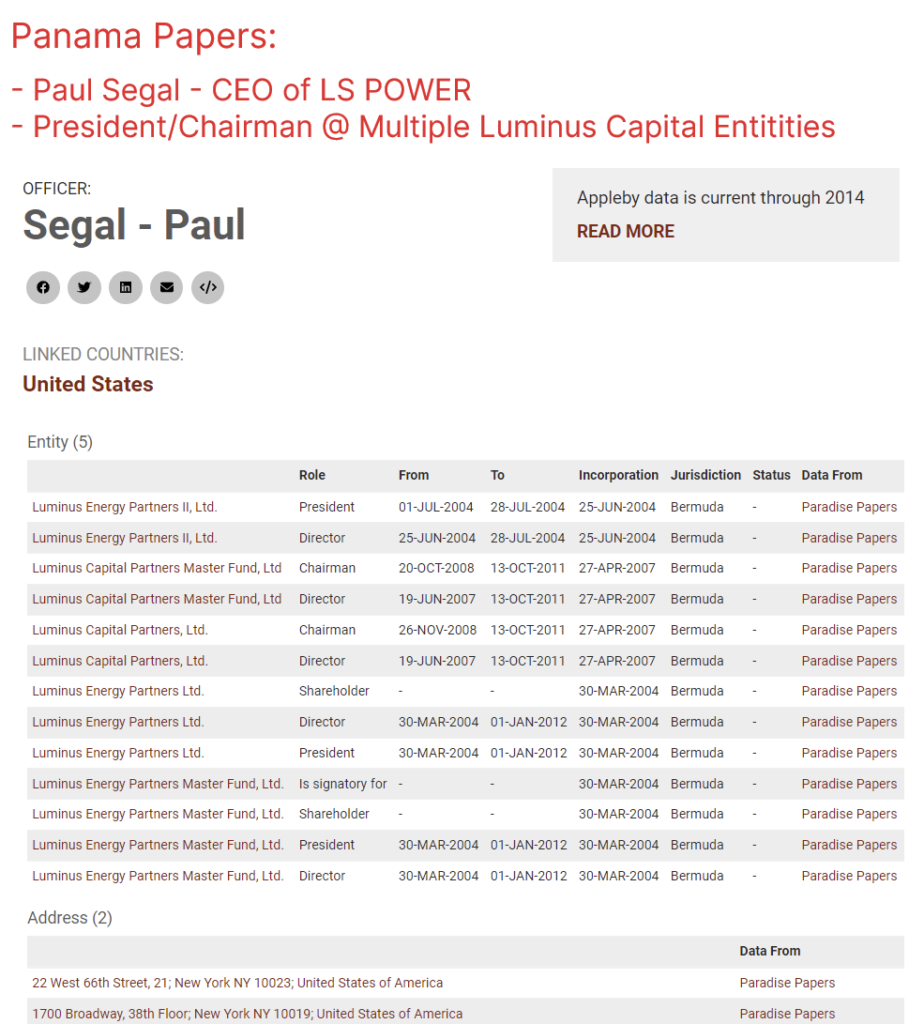

Panama Papers show LS Power’s Connection to Luminus Management

The Panama Papers were multiple massive data leaks of documents that exposed the true owners behind a vast network of Caribbean shell companies. Documents found in Panama Papers reveal how deeply connected LS Power actually is to Luminus.

Paul Segal – LS Power’s CEO – connected to at least 5 different Luminus entities as the President, Director, Chairman or Shareholder.

Other SEC Documents show Jonathan Barrett’s Connections to LS Power.

Both an old Linkedin as well as this SEC document from an LS Power & Luminus activist investment campaign describe Jonathan Barrett’s as:

- Holding a variety of senior-level positions within Luminus Management and its affiliate LS Power Group,

- Managing Director of LS Power Equity Advisors,

- Member of LS Power’s Investment Committee.

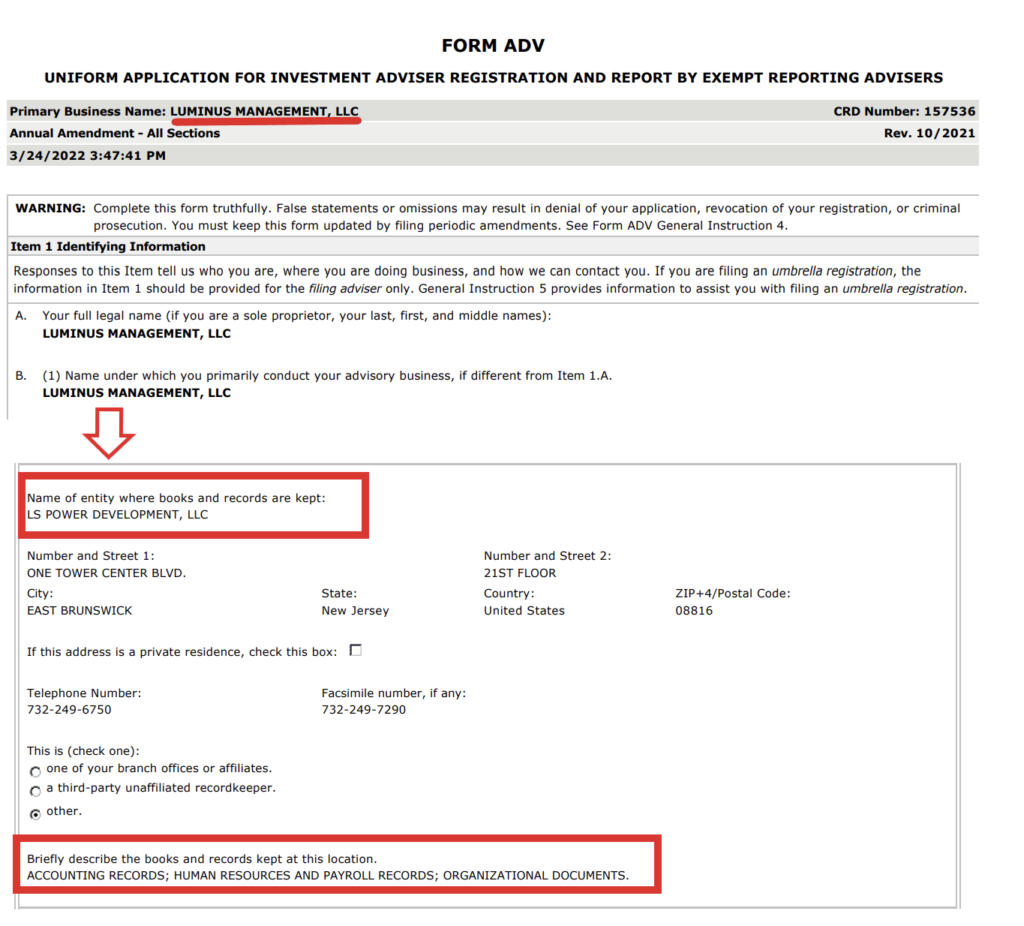

Luminus’ SEC Filings Show It Is Still Connected to LS Power.

Luminus Management’s own 2021 SEC Investment Advisor Registration filed in March 2022 show that Luminus is still connected to LS Power.

Luminus keeps books and records at LS Power.

Indeed, Luminus Management’s 2021 Form ADV shows that Luminus’ accounting, human resources, payroll and organizational records are kept at an LS Power Development address.

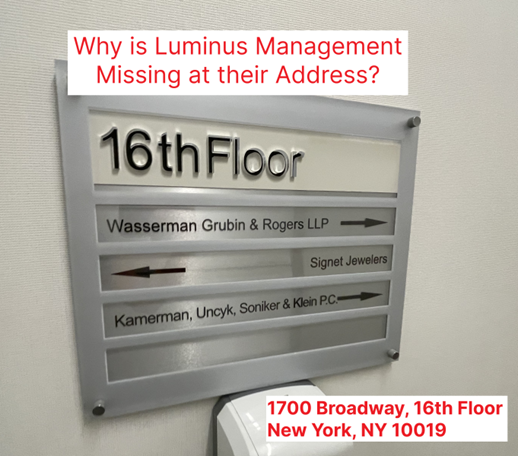

Luminus Office Visits. They Were Nowhere to be Found.

We called multiple of the available phone numbers for Luminus to ask about their affiliation with LS Power. Some of the numbers were disconnected, others forwarded to voicemails that were not returned.

Thus, we decided to visit Luminus Management in person to ask them to clear up any confusion about being affiliated with LS Power and ask why they kept their records at LS Power.

First, we visited 1700 Broadway, 16th floor, New York, NY. This is the address that Luminus Management used for their ownership stake in EVGO and disclosed in their EVGO’s S-1 (pg 124).

Luminus was nowhere to be found at the 1700 Broadway 16th floor address

Luminus’ website also shows 1700 Broadway 26th floor, New York, NY. Maybe the EVGO S-1 had a typo?

At the 1700 Broadway, 26th floor, New York, NY 10019 address we found a completely empty floor.

The real estate agent told us the 26th floor was currently listed for $79 a sq foot but we could it rent for $75 or lower. The agent also informed us that the entire floor was refurbished as it had been “empty for some time, perhaps over a year.”

(Source – Investigator Photos from Visit to 1700 Broadway 26th Floor)

LS Power’s – History of Extracting Wealth From Companies Continues at EVGO.

LS Power’s has a history of being accused of fraudulent conveyance in bankruptcy proceedings. More detail on this is available in Appendix B. LS Power’s past has even led one professional investor to recently accuse both LS Power & Luminus of being a “potential criminal enterprise” in a court filing.

LS Power extracted >$14 million from EVGO in the first 18 months.

LS Power has swiftly extracted a significant amount of money from EVGO. LS Power has paid themselves >$14 million for items ranging from consulting fees, transaction completion bonuses, and even have charged EVGO (their own investment company they control) a higher interest rate than junk bonds.

Questionable payments from EVGO to LS Power to date have included:

- $5.3 million transaction bonus paid to LS Power employees in conjunction with the closing of the SPAC acquisition of EVGO in FY 2020 (pg 62)

- $2 million for consulting and corporate development between 2020-2021 (pg 109)

- ~$6.7 million in above market interest paid on loans to EVGO by LS Power.

Does LS Power think EVGO’s credit rating is Junk?

LS Power wrote an investment note to EVGO for funding their operations with significantly above market rate loans from an LS Power controlled entity. The amount outstanding under the LS Power Note was $57.0 million and $39.2 million as of March 31, 2021 and December 31, 2020. LS power loaned EVGO money at fed funds rate + 7.0%.

This loan rate is either absurdly high or LS Power thought their own company deserved a credit rating worse than junk bonds.

Upcoming Catalyst – Lock-up Expiration on July 2, 2022; >75% Can Then Be Sold?

EVGO’s founders share (up to 5.75 million shares) have a lock-up that expires 12 months (S-1 pg 47) after the closing of the deal or possibly earlier if a 20/30 day VWAP over $12 restriction was met in April. These founders’ shares have a cost basis of $0.0043 per share so <$0.01 per share.

This lock-up expires July 2, 2022.

EVGO’s majority shareholders, LS Power, who controls 74% of the company (195.8 million shares of Class B) either can now sell due to the company completing 20 out of 30 days with the share price >$12 or we could also see their lock-up lifted on July 2, 2022. Even if LS Power liquidates 24% of their shares they still get to maintain their 5 out of 9 board seats and control the board.

LS Power has an estimated cost basis of ~$0.70

Between EVGO’s founder shares & LS Power we could potentially see 201.5 million shares now available for sale. That’s 76.2% of shares outstanding.

Conclusion – Short EVGO:

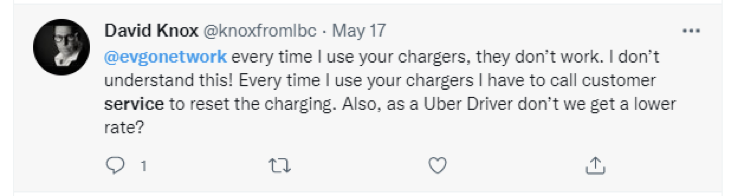

Don’t believe us though. Here is what EVGO’s customers are saying:

- Don’t use @evgonetwork, my car is stuck as the charger won’t release. Customer service isn’t even helping….(@jakay1883)

- @evgonetwork is by far THE WORST energy/EV charging company ACROSS THE BOARD!…They are a joke to say the least!!! (@Ol_Man_Winter)

- @evgonetwork every time I use your chargers, they don’t work” (Uber driver @knoxfromlbc)

- “I love having an electric car until I get to a station that is out of service. Come on @evgonetwork you can do better.”

EVGO Management, we think your consumers are sending you a clear message as to why utilization declined 21%. Management should spend less time on choregraphed dances and more on vetting the partners and investors you are “getting into bed with.”

We think EVGO has:

- Mislead SPAC investors by pitching a story of increasing utilization when it actually DECLINED.

- Mislead government officials by claiming a low down-time. Meanwhile studies show their chargers are broken >25% of the time.

- Has underspent on R&D and thus lacks any competitive advantage.

- Hidden the fact that a key patent was recently rejected.

The “E” in ESG is not supposed to stand for connected to Jeffrey “Epstein.”

We are short EVGO… you can do better.

Appendix A – More EVGO Economics 101:

EV charging is a tough business.

- High Fixed Cost – The business has high upfront fixed costs, low utilization, and long payback cycles.

- Low Consumer Demand – Greater than 80% of consumers charge their EVs at home

- Limited Upsell – No high margin add-ons like C-store products (cigarettes, snacks, etc) for gas stations.

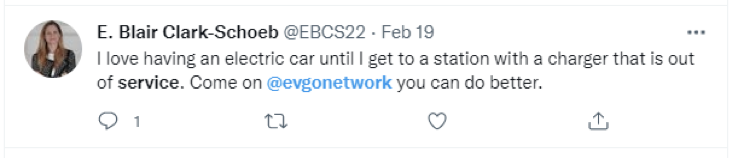

Competition – it’s impossible to compete against FREE!

The California state government has decided to give away free level 3 EV fast charging at highway patrol locations. By April 2021 CalTrans had installed at least 41 completely free level 3 fast chargers at rest stops across the state. In fact, if you use EVGO owned Plugshare to map free charging >50kwh a map of California looks like this. There are >90 free fast charging locations in California alone.

(Source – PlugShare – Map of All California Free Charging Locations for 50kw & higher)

Other competitors, specifically Electrify America, have also taken up the FREE price tag. Not only including multiple years of free charging with most EV purchases but also giving away free ultra-fast charging (150kw & 350kw) on the highest utilization holiday weekends & days like Earth Day.

Cash Burn & Lease Liabilities:

- As of Q1-2022 EVGO’s cash burn rate is running at -$43.8m quarterly. At this rate the company only hs 2.5 years of cash remaining.

- Different than other of the EV charging companies EVGO has lease liabilities where they not only pay for the capex to install the charger but they also lease the space in the parking lots from the merchant. In Q1-2022 these total lease liabilities amounted to a $22.6 million as of Q1-2022 + $34.7 million of operating leases where EVGO hasn’t taken possession yet. Thus, $57.3 million in lease liabilities in total.

Appendix B – How Did EVGO Really Win a Partnership with Tesla?

LS Power’s Has A History of Being Accused of Fraudulent Conveyance:

LS Power has been previously investigated or accused of fraudulent conveyance of assets in multiple bankruptcy cases:

- Valaris PLC in 2021 – An investor goes as far as calling Luminus a potential criminal enterprise

- GenOn Energy /NRG – 2017 (link)

- Dynegy Holdings LLC – March 2012 – Ch. 11 Case

- Mirant – 2007 – 6 power plants sold by Mirant to LS Power (link)

Did Tesla partner with EVGO because Luminus/LS Power got a bankrupt oil company to sell assets to SpaceX for 90% below scrap value?

It seems very suspicious that LS Power/Luminous might have taken a page from a previous playbook in order to land Tesla as a partner for EVGO. Just months after Valaris, a bankrupt oil company, that was owned by LS Power & Luminus sold SpaceX two oil rigs for an extremely cheap price (90% below scrap value) Tesla announced EVGO could integrate Tesla charging connectors on their platform.

Tesla-SpaceX Timeline:

- January 2020 – Luminus Management owned ~19% of Valaris Equity

- August 2020 – Valaris files bankruptcy.

- September 2020 – Valaris sells 2 oil rigs to a SpaceX subsidiary created in June 2020 that reportedly cost more than $650 million in 2008/09 for just $3.5 million each. According to an investor in the Valaris bankruptcy the scrap value alone of the rigs was estimated at between $28-36 million each.

- January 2021 – SpaceX announces the 2 rig purchase to convert the rigs to starship launchpads.

- February 2021 – Tesla & EVGO (controlled by LS Power) announces integration with Tesla and adding Tesla connectors.

We don’t have the answers to why Tesla actually decided to allow EVGO to add Tesla connectors. But the timing of their partnership as well as LS Power’s history raise a lot of interesting questions.

Appendix C is for the Children – Should Jonathan Barrett be on “Help for Children’s” Board?

NO!

Jeffrey Epstein’s close associates, and especially those whose family members have a frequent flier number on the Lolita Express should be immediately re-evaluated to see if they are fit to serve on the Boards of Children’s Charities.

Help for Children – we hope the information we uncovered is helpful in your Board evaluation process. http://www.hfc.org/our-team/

Disclaimer & Terms of Service:

By downloading from or viewing material on this website and/or by reading this report, you agree to the following Terms of Service. You agree that use of the research on this website or report is at your own risk. In no event will you hold Fuzzy Panda or any affiliated party, including officers, directors, employees and agents of Fuzzy Panda or any companies affiliated with them, liable for any direct or indirect losses caused by any your use of information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site or in this report. You further agree that you will not communicate the contents of reports and other materials on this site to any other person unless that person has agreed to be bound by these same terms of service. If you download or receive the contents of reports or other materials on this site as an agent for any other person, you are binding your principal to these same Terms of Service.

You should assume that as of the publication date of their reports and research, Fuzzy Panda and possibly any companies affiliated with them and their members, partners, employees, consultants, clients and/or investors (the “Fuzzy Panda Affiliates”) have a short position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds of companies covered in such reports and research. They therefore stand to realize significant gains in the event that the prices of either equity or debt securities of the subject companies decline. Fuzzy Panda and the Fuzzy Panda Affiliates intend to continue transactions in the securities of issuers covered on this site for an indefinite period after their first report on a subject company, and they may be short, neutral, or long at any time hereafter regardless of initial position and the views stated in Fuzzy Panda’ research. Fuzzy Panda will not update any report or information on this website to reflect such positions or changes in such positions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall Fuzzy Panda offer, sell or buy any security to or from any person through this site or reports on this site. Fuzzy Panda and the Fuzzy Panda Affiliates do not render investment advice to anyone unless they have an investment adviser-client relationship with that person evidenced in writing. You understand and agree that Fuzzy Panda does not have any investment advisory relationship with you or fiduciary duties to you. Giving investment advice requires knowledge of your financial situation, investment objectives, and risk tolerance, and Fuzzy Panda has no such knowledge about you.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Fuzzy Panda’s research and reports express their opinions, which are based upon generally available information, field and online research, and inferences and deductions through due diligence and the analytical process. To the best of their ability and belief, all information contained in their reports is accurate and reliable, and has been obtained from public sources believed to be accurate and reliable, and they have not obtained information from persons who are insiders or connected persons of the stock covered or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. Fuzzy Panda makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion and conclusions are subject to change without notice, and Fuzzy Panda does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the expressions of information in this report are copyrighted and owned by Fuzzy Panda Research, and you therefore agree not to distribute this report or any excerpts from it (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link: www.fuzzypandaresearch.com. If you have obtained Fuzzy Panda’s research in any manner other than by downloading from that link, you may not read such research without going to that link and agreeing to the Terms of Service. You further agree that any dispute between you and Fuzzy Panda and their affiliates arising from or related to the material on their website shall be governed by the laws of the State of California, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in California and waive your right to any other jurisdiction or applicable law. The failure of Fuzzy Panda to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to this report or the material on this website must be filed within one (1) year after such claim or cause of action arose or be forever barred.