- Uncovered Extensive Allegations of Insurance Fraud

- + Proof Management Knows & Has Not Stopped It

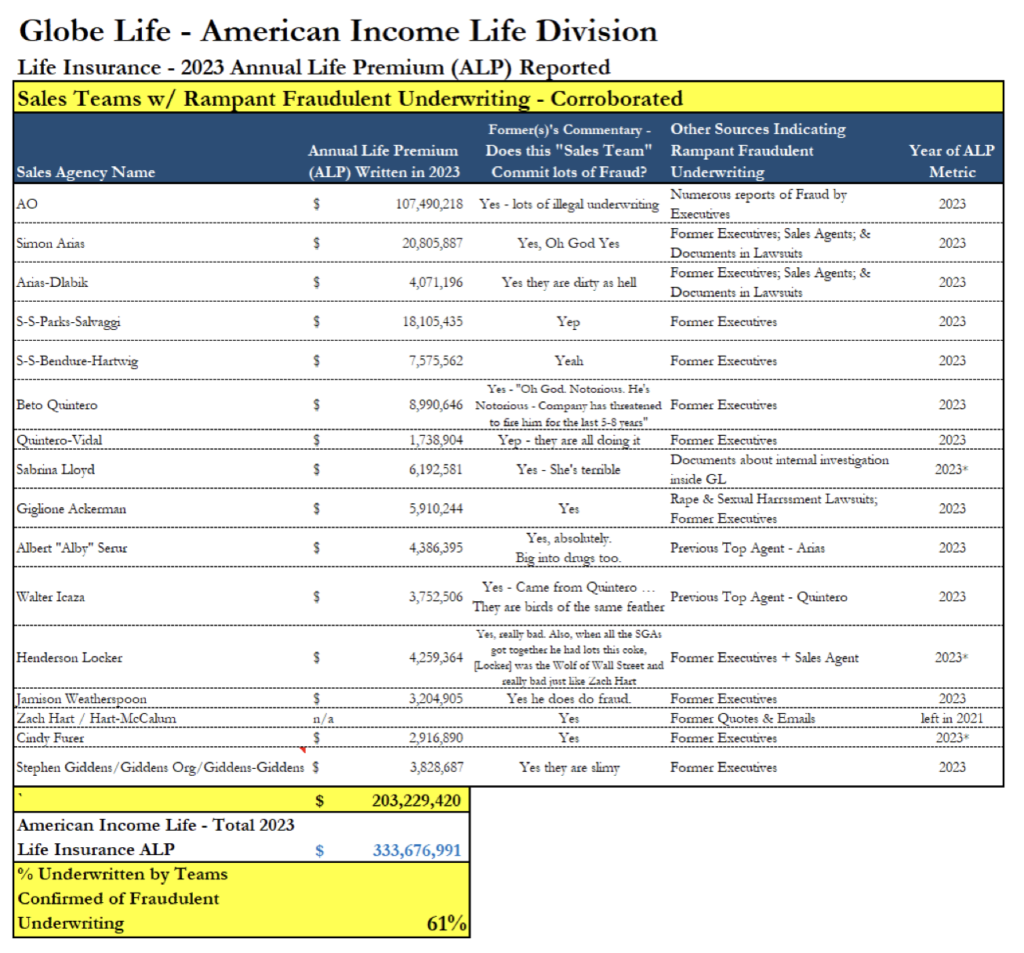

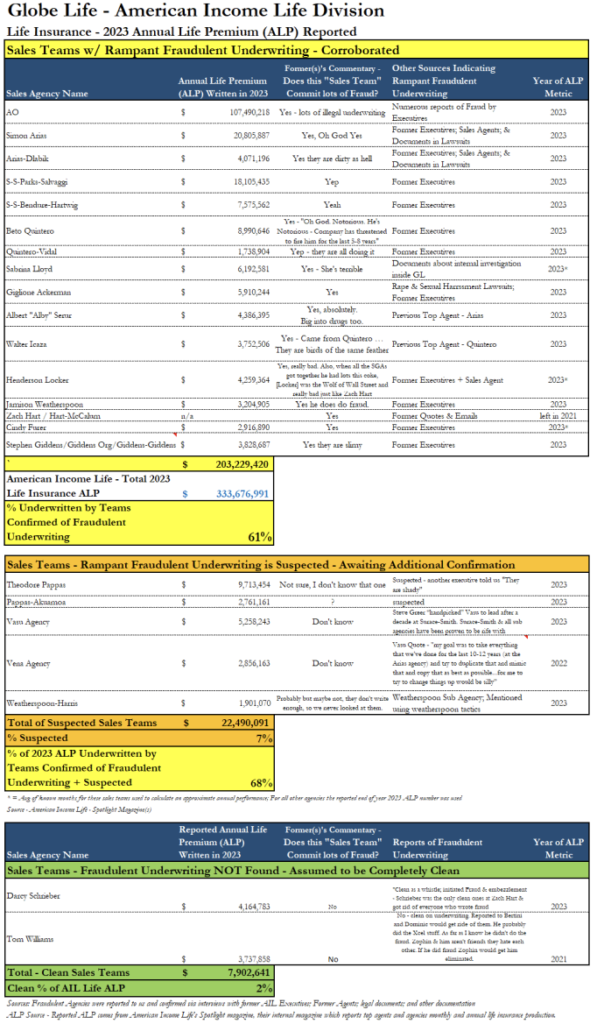

- Sales Agencies Known to Have Committed Insurance Fraud Accounted for >$200m of AIL’s ALP (>60% of AIL’s New Business)

- Wrote Policies for Dead People; Opened Policies for Fictitious People

- Forged Customer Signatures on Policies

- Withdrew Funds from Consumers Bank Accounts without Approval

- Indications of Actuarial Fraud – Faked Tests so Smokers Were Underwritten as Non-Smokers

- Growth driven by AIL sales teams with fraud

- Allegations of Illegal Kickbacks to Globe Life Executives – Sr. VP & AIL’s President of >$65 Million

Globe Life (GL) is an $10 billion Life and Health Insurance Company that sells policies through multiple subsidiaries. The biggest subsidiary is American Income Life (AIL), which accounts for 39% of total premiums; and 50% of total underwriting profits.

We uncovered extensive allegations of insurance fraud ignored by management despite being obvious and reported hundreds of times.

- Policies Written for Dead and Fictitious People;

- Forged Signatures;

- Funds Withdrawn from Consumers’ Bank Accounts without Approval

- Fictitious Bank Accounts used to Fund Numerous Fake Policies, so Agents hit their bonuses.

We reviewed hundreds of pages of court documents and interviewed dozens of former executives and agents. We uncovered a whistleblower from the executive ranks who showed us where the fraud was hidden. We even went undercover to go through the recruiting process more than 10 times.

We found that:

- The fraudulent insurance policies are NOT a one-off. It isn’t isolated to just one rogue sales team (like Arias Agency). Arias is just a small piece of this.

- We uncovered insurance fraud at many of AILs largest agencies and by AIL’s top producers.

- A former VP at AIL told us that he sent over 200 emails detailing fraud to executives, we have documents to prove it.

- “From 2017 on [the insurance fraud] became a lot more rampant and with a lot bigger numbers…you never had that before”

- Other formers and multiple lawsuits corroborated the fraudulent actions & behavior.

- Globe Life and AIL executives were involved in a bribery & kickback scheme that a lawsuit estimates netted them >$65 million.

- Kickbacks went to at least 3 senior executives who tried to obscure their ownership from regulators via shell LLCs and by listing his mother-in-law’s name.

- 60% of AIL’s 2023 new ALP came from sales teams known to be rife with bad actors.

- AIL accounts for 50% of Globe Life’s Profits

- We uncovered 16+ AIL agencies with corroborated fraudulent insurance production and we have the source for it via interviews, documents, emails, and more.

- These agencies account for >$200 million of 2023 ALP

- We unveiled an Instagram video of the 2022 top sales agent, who trailed sales figures for 51/52 weeks and AIL celebrated it. Former AIL VP told us it was obvious fraud.

- Reviewed lots of state regulator enforcement cases – to give you the sense of the tip of the iceberg – Texas sanctioned AIL agent for lying to investigators, South Carolina issued fines, Michigan sanctions and more

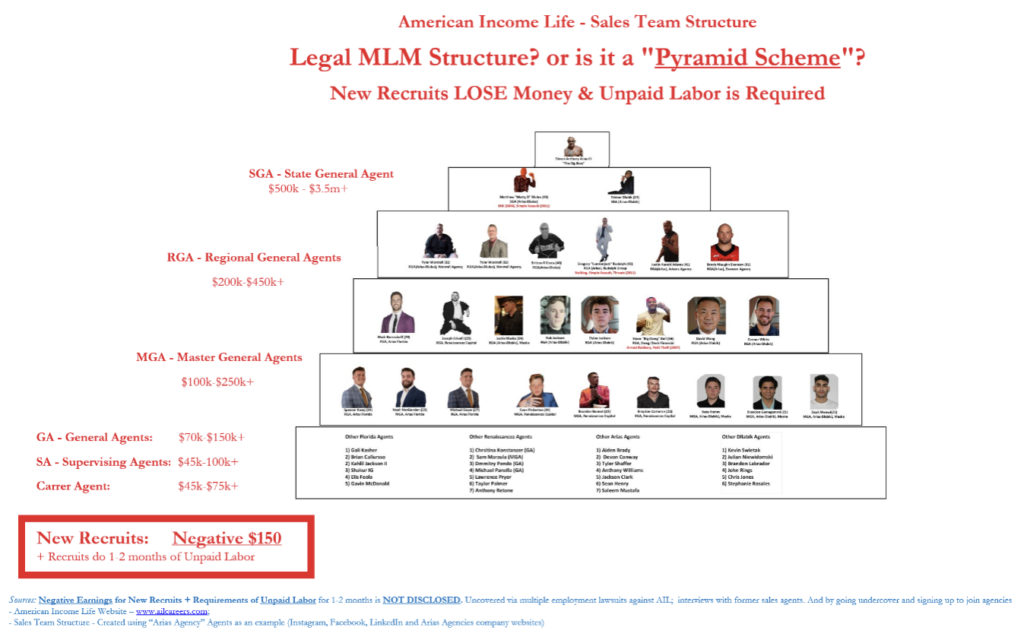

- Our Analysis indicate Globe Life and AIL’s MLM structure borders on an illegal Pyramid Scheme in Multiple States.

- Making up fake people for policies gets you paid & promoted while making fake recruits for the bottom of the MLM gets you fired according to an agent

- Discovered excessive amount of recruiting – Formers told us in 2022 >20,000 new sales agents joined AIL and the net gain at the end of the year was <200.

- We went undercover & were offered jobs to join multiple Globe Life sales agencies.

- Undercover Agents Offered Cash & Cocaine* During Verbatim Explanation of What We Believe to be an Illegal Pyramid Scheme

- Recruiters and current agents didn’t hide the MLM Structure. They explained our “Uplines” and “how recruiting new agents is more lucrative than selling policies.”

- They explained we can cheat on state insurance exams.

- Encouraged us to fake our own address and lie to regulators in an initial meeting.

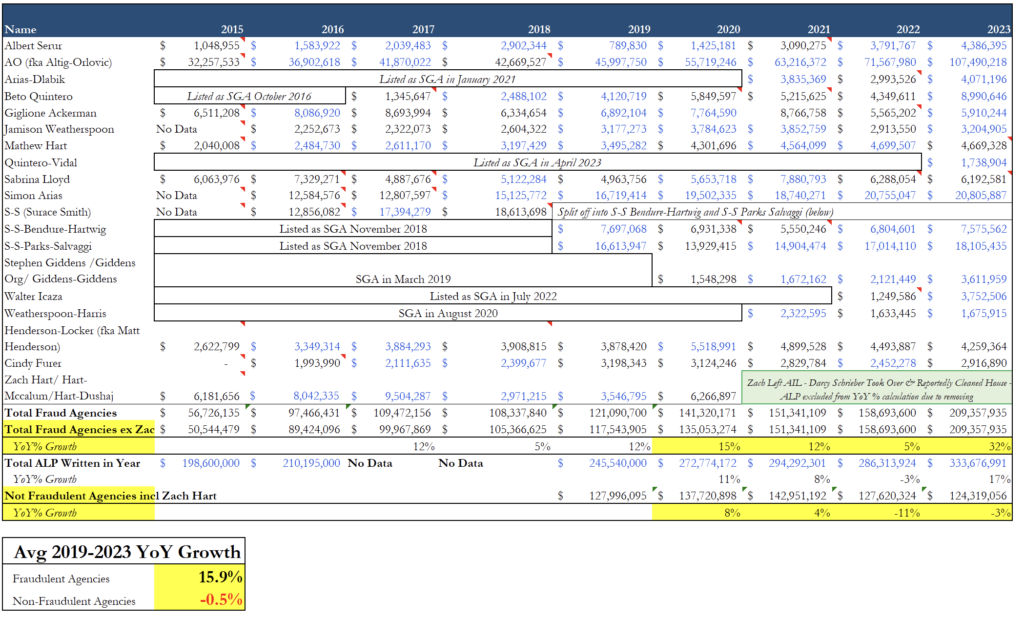

- AIL’s Growth has been a mirage. Over the last 4 years:

- Sales teams that engaged in insurance fraud grew new ALP at a ~16% per year.

- The Clean & Non-questionable teams have DECLINED at a -0.5% YoY.

- DOJ Is Investigating Illegal Sales Practices

- Sales agents portray themselves as the new “Wolves of Wall Street” – and behave accordingly

- Drug use is rampant at some agencies.

- Multiple lawsuits describe a culture of sexual harassment where bosses:

- RAPE female subordinates,

- Masturbate in front of female subordinates,

- Demand oral sex in exchange for promotions and good sales leads

- And even give the date-rape drug to those who won’t play along.

- Women that report the behavior are retaliated against and their complaints are ignored.

- Toxic Culture Has Even Spawned a website: American Income Life Victims

- Warren Buffett Dumped the Stock

- Consumer reviews show they are being harassed by non-stop calls and the FTC will care.

- Questionable union use – AIL forces 1099 employees to join a union even though they get little to no benefits. This is illegal according to legal experts we consulted.

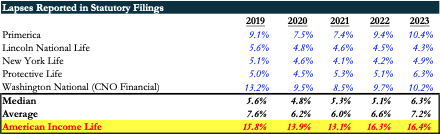

- Financials are questionable:

- Lapse rates in statutory filings are materially higher than peers and they don’t match the SEC filings. Lapse rates are running > 16% at AIL in the blue books.

- Churn in the Lapse rates reported in the blue books implies policy lives which are much shorter than those implied by GL’s DAC amortization.

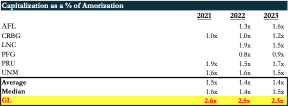

- FASB changes have enabled aggressive accounting. GL seems to be taking advantage more than other peers. This accounted for 38%, 21%, and 10% of profits over last 3 years

How has this happened at a company that’s been in the insurance business for 70 years?

We learned from the former executives, agents and documents that fraud began spreading at AIL after Steve Greer became AIL’s CEO in 2017 and Dave Zophin became its president the following year.

Our investigation revealed an exhaustive array of financial malfeasance that ramped up once Greer and Zophin took over. Members of Globe Life management know about it, too. Interviews with formers and internal emails make it clear that many executives at Globe Life and American Income Life have been complicit in allowing insurance fraud to persist.

We even have reports of them being in sales offices and watching it happen.

The organization’s structure is an MLM that mirrors a “pyramid scheme,” and former executives described the growing book of bad assets within Globe Life’s Book as a “Ponzi Scheme.” They told us that the bad agencies were forced to write more bad policies each year to keep the growth going and collect bonuses.

If you thought it could not get any worse, American Income Life has also fostered an environment permissive of sexual assault, rape, racism, and widespread illicit drug activity.

We believe multiple AIL agents and Globe Life executives will likely be going to prison for insurance fraud.

We believe Globe Life’s CEOs have 2 choices:

- Clean House – Rectify past bad underwriting by reporting it to insurance regulators; Take the appropriate large write-downs to Book Value; and end the alleged “Ponzi Scheme” that has been growing within Globe Life’s and AIL’s Life Insurance Book once and for all.

- Defend & Protect Fraudulent Underwriters – Confirm that management has known what is going on the whole time. If they choose this then we believe even more people will be going to jail.

We are Short Globe Life.

Please see additional disclosures at end of report and our terms of service.

Note on “Anonymous Sources” – Many of the former sales agents, globe life executives, employees, and other sources requested that we keep their identities “anonymous.” Some were afraid of retribution by Globe Life and others by the sales teams filled with Wolf of Wall Street style characters. We kept those sources anonymous throughout the report, but can share those source (provided they have approved us to do so) with reputable journalists, state insurance regulators, the SEC, DOJ, and other government regulators.

We will be actively reaching out and providing all this information to state insurance regulators and other government agencies.

We are reaching out and providing all this information to state insurance regulators and other oversight agencies.

Former employees or whistleblowers who wish to stay anonymous should reach out to us at [email protected].

A Note on Globe Life’s Company Structure & AIL’s Sales Force

All AIL’s sales agents are 1099 employees who technically work for independent agencies, such as AO or the Arias Organization. The structure creates a convenient fiction that allows AIL to disavow wrongdoing by simply blaming problems on purportedly independent contractors.

But our research found that these agencies are nothing but extensions of AIL. They are only permitted to sell AIL policies. The agents they employ are forced to join an AIL-wide union, and the company uses it’s “all union” workforce as a sales pitch to prospective clients (more on that later). AIL itself treats the agencies as an integral part of the company, and even refers to them as “sales teams.” That is what they are, and that is how we refer to the agencies throughout this report.

Part 1: Management Knows – We Discovered Widespread Insurance Fraud in Sales Teams Accounting for >60% of AIL’s 2023 ALP

- Fraud Flourished Following Leadership Change at 70-year-old Firm According to Formers

- Sales Team Where We Corroborated Fraud Generated > $200m of 2023 ALP

More than three dozen former executives and sales agents said fraudulent business practices began to become widespread at AIL in 2017 as Steve Greer assumed the reins as chief executive and Dave Zophin joined first as executive vice president and then president.

Selling life insurance has always attracted charlatans and grifters. AIL had their fair share over the decades, and when it found them, it fired them.

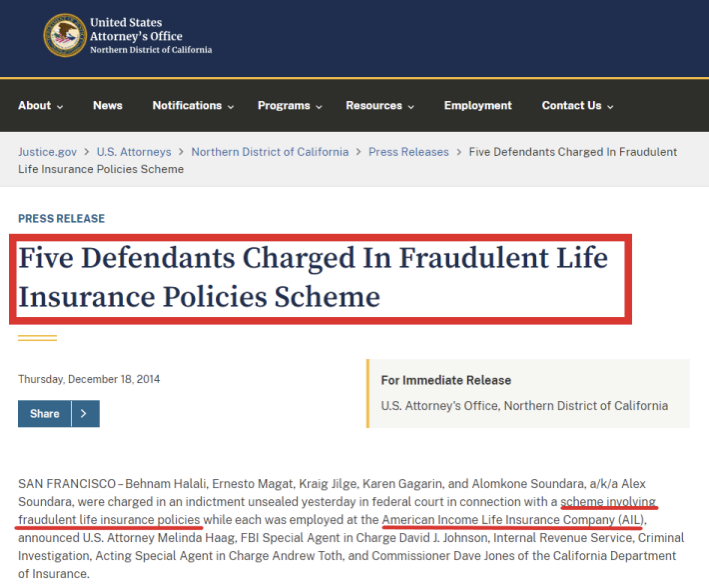

In 2014, AIL even helped authorities prosecute and convict five of the company’s agents for selling hundreds of fraudulent policies in the names of customers who didn’t know they were being signed up for life insurance.

Leadership Change Led to Insurance Fraud to Become Rampant

Multiple lawsuits describe an array of “unethical and/or fraudulent business practices” that are standard — or even encouraged — within the company. We heard the same from dozens of former executives and agents.

Scott Dehning, a former VP of Sales at AIL, told us that he sent more than 200 emails detailing cases of fraud Greer, Zophin and Globe Life’s General Counsel-Joel Scarborough.

“From 2017 on, it became a lot more rampant and a lot bigger numbers … You never had that before.”

~ Scott Dehning, Former VP of Sales at AIL

First Dehning said he was ignored, then another executive warned him that he was angering Greer and Zophin, and then they fired him.

Dehning cited examples of agencies that he oversaw where millions of dollars’ worth of fraud was uncovered and then ignored by management. Only the most egregious examples resulted in firings.

A single agency wrote “millions and millions worth the fraudulent business over the course of a year and a half,” Dehning said.

Other executives and sales agents told us they, too, reported fraud to the top leadership and were similarly ignored.

A former PR executive, speaking anonymously, said sometimes clients who had been ripped off would get an apology or, if they pressed hard enough, a refund. But most of the time nothing happened.

“Supposedly they had a process that it went through. It had to actually to go by everybody’s desk, even up to Steve Greer if it was really serious … But it seemed like they would just put band-aids on things and just handle this situation, handle that situation. But it was really, it’s a systemic situation. The problems never got fixed,” the former PR executive said.

Fraud was almost never reported to regulators, as required by law, the former agents and executives said.

More than a dozen former agents have testified to fraud they witnessed in sworn depositions as part of numerous employment lawsuits that are currently underway against AIL and Globe Life. Nearly all the depositions remain under protective orders because of arbitration clauses included in AIL’s employment contracts.

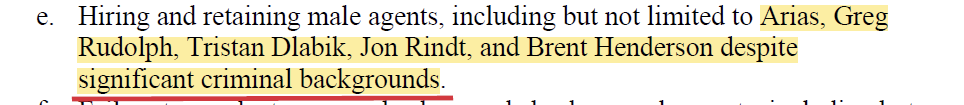

The Fraud is NOT contained to just Arias …

Investors erroneously think AIL’s problems are limited to a single sales team run by Simon Arias called the Arias Organization. Business Insider exposed Simon Arias & his organization in early 2023 for horrific acts of sexual harassment, drugging females with the date-rape drug, cocaine & steroid use, and insurance fraud.

Source – (Photo 1 – Arias Social media – Photo 2 – Simon Arias Facebook)

Anyone who thinks the issues are isolated to Arias is dead wrong. They are missing the forest for one steroid-injected tree.

The Arias Organization represents only a small portion of annual life insurance (ALP) at AIL. They generate ~$20 million ALP. If the reported insurance fraud by AIL’s producers was limited to Arias then that would represent <6% of AIL’s 2023 ALP.

But dozens of former executives and agents told us that the problems of fraudulent insurance production for Globe Life is an AIL problem, not limited to Arias.

… It’s Pervasive

Obtained Reports of Rampant Insurance Fraud at AIL Sales Teams that Write >$200 million Business. These Sales Teams Account for >60% of 2023 ALP at AIL.

Our interviews with former executives and dozens of former AIL sales agents implicate GREATER than $200 million of fraudulent annual life insurance premium (ALP) written by sales teams.

Below is a table showing evidence agencies have rampant fraud occurring in them and are writing fraud. We are still evaluating agencies and have been adding more to the list every day.

Thus far we have only been able to evaluate AIL sales teams responsible for 70% of American Income Life’s ALP. We based on determinations on interviews, lawsuit reviews, and other documents, our evaluation has found:

- No Fraud – “Clean on Underwriting” ONLY account – 2% of ALP

- Suspected Fraud – But Not Yet Confirmed by >2 sources – 7% of ALP

- Corroborated Fraud – Lots of Fraudulent Underwriting – 61% of ALP

Even if we assumed all the “suspected” sales teams were clean we still have found that <12% of sales teams are not underwriting fraudulent policies.

Former Sales Representatives Reported Egregious Examples of Fraud at AIL’s Best-Selling Sales Teams

“They had a guy on Christmas week write $270,000 worth of business. Now listen, I’ve been in [insurance] sales for 37 years. To write a policy with us takes a good hour. I don’t know how you can write~ $300,000 worth of business in three days. I mean, there’s just not enough hours in the day.”

~Scott Dehning, Former VP of Sales

The numbers produced by salespeople were at times beyond belief, Dehning said, especially at AO, the highest-grossing of AIL’s sales agencies.

“These guys write $200,000, $300,000 in a week … I’m pretty damn good. I’ve been in the business 37 years and I’m a salesperson of the year, three years in a row, so I can write with the best of ’em. There is no way in the fricking world I could have ever have written $250,000 in a week. There’s not enough time in the day.”

The average premium is $1,000 a year.

In a video put out by AO, the agency’s founder, Rick Altig, boasts about a salesman who set a single-year record in 2022. The salesman, Daniel Paravisni, broke the record in the final week of the year — that is the week between Christmas and New Year’s Eve.

Dehning said he knew of Paravisni, who “in three days, wrote almost $300,000 in a LP, which is impossible.”

The policies were either fake or multiple agents were writing policies under the name of a single salesperson, Dehning said. Both would be illegal.

Numerous State Enforcement Actions for Fraud:

We also reviewed hundreds of enforcement cases from state insurance departments across the country and found numerous instances of producer fraud at AIL.

- Texas sanctioned an AIL agent for lying to investigators, forging a bank statement and submitting applications without customer approval, resulting in unauthorized bank drafts.

- South Carolina fined an AIL agent who tried to change a client’s policy without consent.

- Michigan sanctioned an AIL agent who was caught submitting fraudulent applications for customers who had previously applied for coverage.

- An agent in New Jersey completed and submitted a life insurance application to AIL using another person’s signature.

- Louisiana fined an AIL agent who tried to enhance a life insurance policy for a dead man.

Former agents and executives we interviewed said fraud at Globe Life’s subsidiaries went far beyond what has been reported to regulators.

Allegations of Fraud Go Far Beyond What Was Reported to Regulators

Dozens of current and former executives and agents, and hundreds of pages of documents, detailed fraud that now appears commonplace at American Income Life (AIL)’s top sales agencies, enriching its salespeople and providing the appearance of growth at the corporate level. AIL represents 52% of total life insurance revenue for Globe Life.

The problem: More policies need to be sold every year to cover the ones from the prior year. As a former VP said, it is “like a Ponzi scheme.”

“They get credit for all premiums reported. So if I send in a hundred thousand dollars to you, that’s bogus money. The company still gets credit for a hundred thousand produced. Now next year they’re going to have to overwrite that a hundred thousand, but their theory is by next year they’ll have 3000 more agents that can outright that deficit,” Dehning said.

We uncovered reports of a significant amount of insurance fraud produced by unscrupulous sales agents within American Income Life (AIL). The most common ways of writing fraudulent policies we learned about were to:

- Write life insurance policies for dead people

- Forge signatures of current customers with existing policies to add additional policies without approval. The payments would be auto-drafted out of customer accounts.

- Create a fictitious bank account and then write 25 to 50 fake policies out of it.

- Sales agents often pay the first four months premium out of their own pocket because they receive a commission for all of year 1 the next week.

- Lie and say smokers were non-smokers (and then cheat on a cheek swab test) to get clients lower rates.

- Smokers die 10 years sooner than Non-smokers btw. You DO NOT want to underwrite a life insurance policy for a smoker with a non-smoker rate!

“Producer Fraud”

- Forged Signatures to Create Policies Customers Never Agreed to Buy, or to “Enhance” Existing Policies

- Created Fake Bank Accounts to Open Fake Policies

Writing bogus polices was the most common type of fraud we found at AIL’s largest sales teams, including AO, the Arias Organization, Henderson Locker and more than a dozen other agencies that collectively account for >$200 million dollars a year in ALP.

Here’s Some of the Ways We Were Told It Happens:

The agent’s bonus for each policy is calculated on its annualized value. But it is paid out in the agent’s next paycheck and only needs to be active for two- to four-months for the agent to avoid being charged back if it is canceled. So the agent collects their bonus then pays the premiums just long enough to avoid a charge back.

Sometimes the policies are created in the names of friends or family who are willing dupes. Sometimes agents use the identities of dead people or existing customers, setting up fake back accounts to cover the premiums until canceling the policy, the former executives and agents said.

In a sworn deposition in March, Brian Boehmke, a former supervising agent at AIL who is now suing the company over his employment conditions, can be heard in an audio clip saying he knew colleagues were creating policies in the names of dead people.

“It was a very high producer, so it didn’t get red-flagged immediately and the policy got issued and then there was some issue with it on the back end, like they needed an extra signature or something and that’s how it was discovered,” Boehmke said.

Agents wrote fake policies for real people.

Former agents and executives said it was standard procedure at numerous agencies to collect checking and credit card information from prospective customers and then create policies without approval. When the unwitting policyholder finds out, the agent is nowhere to be found, and it can then take months to cancel the policy – long enough for the agent to keep the bonus they earned.

“They tell them that they’re just calling to activate their coverage that’s already in place, which is a total BS, and all they need to do is verify some information from them and then they send them over a DocuSign and next thing you know, they wrote more coverage on ’em without them even knowing.

So, there’s a lot of unethical and shady practices.”

~ Anonymous Former AIL Sales Agent A

Forged Signatures & Additions to “Enhance” Policies, Banking on Unseen Fees to Go Unnoticed!

“I’ve had a handful of times people call me and be like, ‘why the f–k am I paying now $300 as opposed to a $100?”

~ Renee Zinsky, Former AIL Sales Agent

To do it, they would use bank or credit card information that was already in AIL’s customer management systems.

Renee Zinsky, a former agent who is suing AIL for sexual harassment, said that favored salespeople were given access to the customer management system, which was known as “CAS.”

“You could go in, you could pull pretty much everything from any client that you would want, and you could just write up a new application because you had all the information. No problem,” she said.

She added that colleagues would write new policies for her clients without telling her. The clients would often fail to notice new charges for months, or longer. And they would be furious when they found out.

“Actuarial Fraud”

- Agents lied and listed smokers as non-smokers

It is standard practice across numerous AIL agencies to help smokers secure lower rates by faking oral swab tests. Agents will swab a friend or colleague, or simply do it themselves (if they’re not also a smoker).

This is a huge deal for Globe Life investors because smokers die sooner than non-smokers. Studies show that on average a smoker dies 10 years sooner than a non-smoker. The “fake oral swabs” results in Globe Life investors owning life insurance policies on smoking customers who were underwritten and paying prices as though they are non-smokers.

“I mean, people swab themselves to give clients non-smoking rates,” said Pedro Lemos, a former agent at the Henderson-Locker agency who was promoted to a top job before resigning in disgust over AIL’s business practices.

“The incentives of the bonuses are so high,” Lemos explained. “When you see how much money you’re making, you don’t care that you are telling a little blue lie here and there, but you don’t really know that that little blue lie that you’re being taught is a big deal … we’re teaching them how to do these things and what to say because it’s so scripted.”

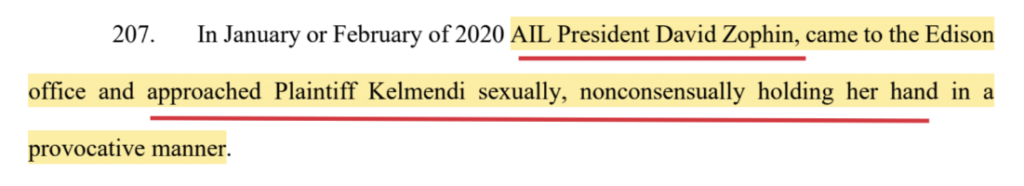

AIL executives, including Zophin, the president, witnessed the behavior and did nothing to discourage it, former executives and agents said.

“It wasn’t like something you had to do secretly. Simon [Arias] would be walking around. Dave [Zophin] often could be in town visiting, and people in the office are all just like, ‘oh, let me swab you real quick so I can put it in this bag and send it to the lab.’ And it was just normal,”

~Renee Zinsky – Globe Life (AIL) – Arias Agencies – Former Agent.

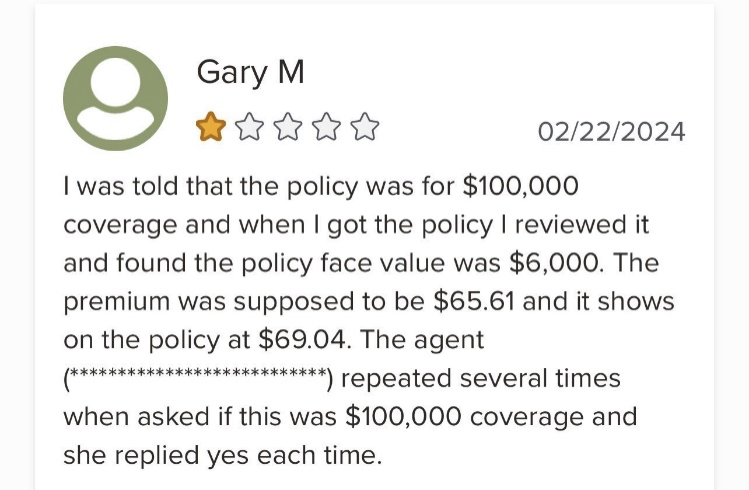

“Consumer Fraud”

- Lying to Customers About Benefits

- Bullied Customers into Buying Policies

The problems have been detailed in multiple lawsuits against AIL. One alleged that the company often targets “the elderly, uneducated and/or unsophisticated to manipulate and mislead.” All of which, the lawsuit claimed, management within AIL and Globe Life were aware of and failed to address.

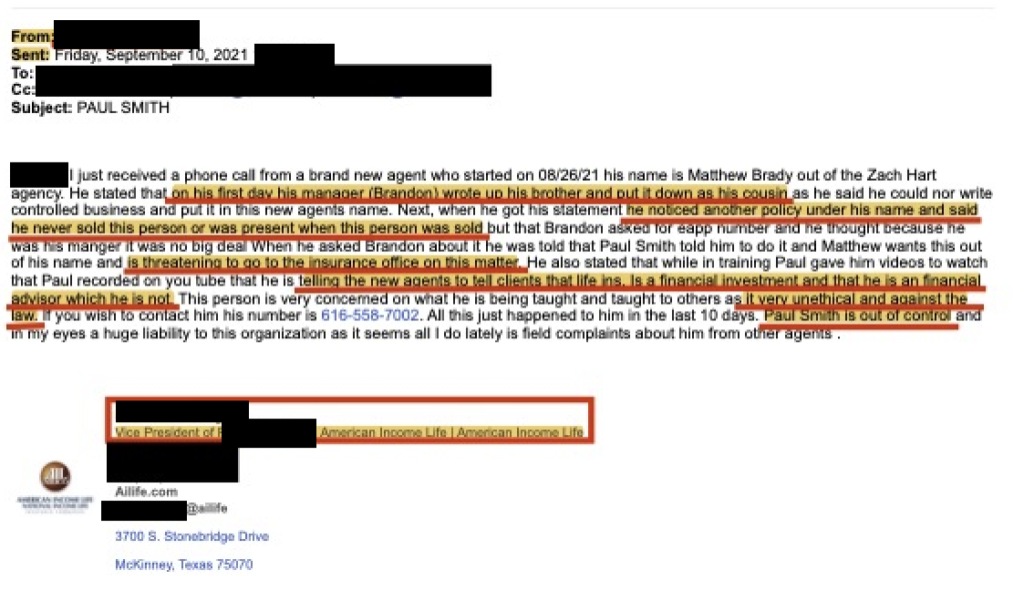

Former agents said they repeatedly told senior manager what they were seeing. We obtained an email sent to a VP that detailed illegal and unethical sales practices.

The email, written in August 2021 by Pedro Lemos, the former agent, said clients whose whole life policies included a terminal illness rider were routinely told they only had term insurance and needed a new, pricier whole life policy to ensure their coverage never lapsed.

Then the “the pitch changed and it got more and more deceitful and unethical,” Lemos wrote. Agents told clients that if they added a certain amount – the agent simply made up the number – they policy would pay out “thousands of dollars” after only a couple of years. That was a lie.

“Accidental coverage was pitched as whole life, cash value amounts were lied about, new monthly premiums added were being lied about and the complaints and bad reviews and the company’s reputation started to be dragged through the mud. Bad Google reviews and BBB reviews started to sky rocket,” Lemos wrote.

The shady sales practices are reflected in AIL’s reviews on the Better Business Bureau website. The overwhelming majority are one- or two- star reviews.

Lemos and other former agents said that if they did not lie, cheat and mislead, they could not keep up with colleagues who were willing to employ deceitful and manipulative tactics.

“I felt like I wasn’t having the success that some other people were having because I wasn’t willing to do what they did as far as the lying on sales calls or overpromising to recruits”

~ Anonymous Former Agent B

Former agents said colleagues would regularly lie about benefits such as how much a policy would pay out.

They also lied to prospective customers who belonged to unions – the core of AIL’s business – telling them that their union membership required them to buy a policy.

Getting ahead depended on lying, former agents said.

“The company gives you better leads and more leads based off of how many sales you make, so as you lie, as you get more sales, as you get more leads, then it becomes easier and easier to make the money that you want to make,” the anonymous agent said.

Management at all levels were aware of the consumer and recruiting fraud and in some cases actively encouraged it, the former agent said.

“You know the agency owner Simon doesn’t care about how many lies you tell. He just cares about how much annualized life premium you bring in,”

~Anonymous Former Agent B

Part 2 – Unseen Lawsuit Exposed Kickbacks & Bribery Scheme Ran by Globe Life & AIL Senior Management Allowing Them to Pocket >$65 million

- Globe Life Executive, AIL’s President, and Other Executives’ concealed ownership of an insurance license testing vendor and misled regulators to pocket millions via a kick-back scheme, according to legal complaint.

Almost all the sales teams at AIL and Globe Life’s other subsidiaries — Liberty National and United American– direct new recruits to a single company to prepare for their licensing exam, Xcel Testing.

The reason? According to a 2022 lawsuit, Xcel was for years owned by Bo Gentile, the SVP of recruiting at GL, and Zophin, the AIL president, and they were getting a cut of the action, along with other AIL managers who also owned a stake in the outfit.

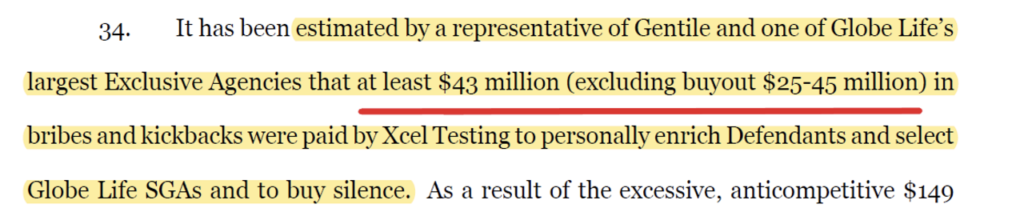

Total Amount in Alleged Bribes & Kickbacks – At Least $65 million

If the allegations prove true, recruitment at GL and its subsidiaries is a volume game. Thousands of new agents are brought in each month. Most will wash out. But not before they purchase a license test prep course. That left Gentile, Zophin and others perfectly positioned to reap rich rewards from Xcel., according to the legal complaint.

Bo Gentile – Globe Life SVP – Allegedly Received Hundreds of Thousands of Dollars a MONTH!

An anonymous industry insider claimed Gentile was getting hundreds of thousands of dollars a month in kickbacks. And the legal complaint said one of the state general agents was taking in $25,000 in kickbacks a month.

The lawsuit alleges that Gentile and Zophin coerced sales teams to require new recruits to use Xcel and charged “the exorbitant amount of $149” for a course that ordinarily cost $30. The remaining $119 allegedly was a kickback that went to Gentile, Zophin and the state general agents (SGAs) who ran sales teams, the complaint states.

The lawsuit estimates that Gentile, Zophin and the other AIL managers pocketed at least $43 million as part of the deal.

“They were forcing everybody to tell every SGA to stop using some of the other testing sites and only go with Xcel… and then we find out it’s because David and Bo owned part of the company. They were making money on it.”

~Scott Dehning, the former VP of sales at AIL

And when Xcel testing was sold in 2018, Gentile, Zophin and the others got a significant cut of the sales prices, which the lawsuit places between $25 million and $45 million.

Globe Life SVP pushed out other vendors, forced Xcel Testing on sales teams.

The lawsuit was filed by another test prep company, License Coach (BKL Holdings), that had previously provided pre-licensing training to recruits from Globe Subsidiaries. But in 2017, Gentile asked if License Coach wanted to bid to be the sole test-prep company used by all of Globe Life’s divisions. The complaint states that Gentile used the RFP to obtain License Coach’s proprietary information and client lists only in order to build out Xcel testing’s business.

Globe Life and AIL Executive’s Hidden Ownership Revealed via Zophin’s Shell Company and Gentile’s Mother-in-Law Being on the Cap Table, According to Lawsuit

Multiple People Told us that Hiding Their Ownership from Insurance Regulators Would Be Illegal!

In 2020, LeBlanc and License Coach executives realized what happened. Another company filed a separate lawsuit against Xcel over an unrelated financial dispute. And in an amended complaint submitted in Jan. 2020 it revealed that Gentile, Zophin and other AIL managers owned Xcel.

Gentile’s RFP “was part of a systematic effort … to defraud and appropriate the confidential and proprietary information and materials submitted by License Coach,” according to LeBlanc’s lawsuit.

The second lawsuit — Greenlight v. Xcel Testing Solutions — added 11 new defendants to the case, and in the process exposed the links between Xcel and GL and AIL executives. The defendants included:

- Gentile’s elderly mother-in-law, Sue Warren Forbis

- Gentile lived at the address provided in the lawsuit for his mother-in-law, Forbis– 1600 Landon Lane McKinney, TX.

- An LLC registered to the home address of AIL President Zophin

- DCBTKZ Holdings LLC is registered at the address 12594 Blitz Dr. Frisco, TX. Zophin and his wife own the property.

- The president of Xcel, Duhron Oldman, a former NY state director for National Income life, an AIL division

- Three other managers at AIL: Gregory Sinner, Tom Williams and Karl White.

Cheating to Get Licensed: Xcel’s Value Proposition

Xcel Testing repeatedly boasts how they help recruits “cheat” the pre-licensing requirements and on the licensing test as a competitive advantage.

An Xcel representative exclaimed at an AFLAC national convention, “other providers won’t tell you this, but you can cheat your way through Xcel’s course,” according to the BKL Holdings lawsuit.

Our undercover interviews confirmed this. Recruiters and agents told us:

“[Xcel] is the only one that literally has such a high success rate. A lot of different insurance companies are using Xcel now and the reason behind it is, like I said, that practice final exam is identical to the real exam.“

~Ryain Lee, Agent at Arias Agencies Beckford, WV office, in a March recruiting call

The company plainly boasts how they have practice tests are “comprised entirely of questions known or historically seen on state examinations” in a best practices guide.

Cheaters Got Caught by State Insurance Departments Sanctioned Xcel

Multiple state insurance departments had sanctioned Xcel Testing even as GL was selecting it to be its sole vendor for pre-licensing test prep.

- Washington State Office of the Insurance Commissioner fined Xcel Testing Solutions in 2015 for offering pre-licensing education courses without approval from the insurance commissioner. Then, in 2017, the department fined Xcel Testing for issuing certificates to students who had not completed the course.

- California regulators accused Xcel Testing of letting students skip training hours (investigators completed the 52-hour course in just seven hours) and filing false information. “Xcel is not of good business reputation” and “lacking in integrity,” regulators said in the accusation document.

- Florida Department of Financial Services fined Xcel Testing for offering the course with inadequate word counts and training minutes.

Globe Life management involved in the scheme allegedly “threatened to destroy vendors who participated in the Xcel Testing investigations performed by various state departments of insurance,” according to the lawsuit.

Many Globe Life Sales Teams Use Xcel as Preferred Course

Our undercover interviews for sales agent positions at American Income Life and Liberty National agencies across the county. Recruiting agents repeatedly said they use Xcel Testing Solutions for the pre-licensing training, quoting prices for the training between $150 to $400. They justified the price that’s multiples of the going rate elsewhere by pointing to the “high success rate.”

How Agencies Got Paid:

Former executives at AIL and at licensing companies said payments happen in two ways:

- Lump-sum deals – For example, one agency is paying a monthly price of $2000 a month and then Xcel pays all the new recruit fees >$2000 to the agency. the agency gets to keep all the new recruit payment giving “deals” on the course to agencies, then agencies set the price for their recruits and split the different.

- Per agent – For example, Xcel may sell the course for $49.99 and the agency will charge $200, so “the SGA has takes $150 of that on every person they hire,” formers said.

We went undercover and learned that Xcel helps AIL agents cheat on their licensing exams.

Xcel “is the only one that literally has such a high success rate … and the reason behind it is, like I said, that practice final exam is identical to the real exam.”

~Ryain Lee, Agent at Arias Agencies Beckford, WV office, in a March recruiting call

Part 3 – Going Undercover at The Sales Agencies + “Pyramid Scheme”

- We Were Told All About Our “Uplines”, Then They Offered Us Cash & Cocaine*

- We Discovered an MLM that is often described as a “Pyramid Scheme”

Globe Life & American Income Life is 100% an MLM…and we believe it might qualify as an illegal MLM, a Pyramid Scheme, in multiple states.

What we learned from our undercover “recruiting” is that within Globe Life the most profitable strategy is to recruit people rather than sell insurance.

Undercover Interviews:

- Told About Our Uplines;

- Asked to Falsify our Address on an Insurance Licensing Application;

The average person knows fraud when they see it. If you thought the Tik-Tok & Instagram evidence from our brief video was bad we suggest you spend ~45 minutes to join an AIL sales team (Arias, AO (option 1, option 2), Giglione Ackerman)*. Our undercover agents did it more than 10 times!

We were shocked by what we learned and were offered in just these recruiter calls. The first time we got off a call to be recruited we had a different feeling than any interview/undercover assignment we have ever done. The feeling was “OMG, this is the Largest Fraud we’ve ever seen in our Life, can you believe what they just said!” So, we did it again, and again and again.

- “The Upline” – An Arias Insurance Agent explained to us in detail how we would have an “Upline.”

- Upline is a common term in an MLM for someone that earns $ by recruiting other individuals rather than from their individual sales efforts.

- If we sold a $1200 a year policy (in premiums) we would earn 50% week 1; 50% in 6 months and our UPLINE would also earn 50%

- “Offer Drugs?” – In one recruitment pitch we were promised a “really big bag*” (presumably of cocaine) if we signed on and had successful sales in week one.

- Suggested Faking our Address for Licensing Exam – We told 1 recruiter that we had addresses in NY and CA two of the strictest states on MLM regulation. They responded by trying to convince us to use a relative or friend’s address in another state to sign up for an insurance license. Pretty sure using a fake address on your insurance license is fraud.

- High Pressure Sales – David Wang, a senior member in Arias-Dlabik used high pressure sales tactics on us in order to try to get us to insert our credit card information into Xcel and pay $150 for the training course on the spot. We asked to research other options, he responded that their was “no point in us interviewing further until we were willing to invest $150 in our future.”

- A licensing course with a “100% pass rate” – because the practice exam is “identical to that real exam you go and take.”

- Free leads from union partnerships – No cold calling, no need to pay for leads, the agents said. Thanks to the company’s partnerships with labor unions and associations across the countries, the agents promised an easy in to easy sales.

- $750 bonus per recruit, plus a cut of all of their sales – New hires are incentivized to recruit friends to join the business as well with $750 bonuses per person brought into the team. Those people are then “coded to you” and, in exchange for helping train them, you make a commission off of the team.

- Promises of Lifetime “Residual Income” – They promise a lifetime of future payments from every policy you sell based on residuals. Former executives and agents alleged to us that the reality is the agencies often forged signatures to amend policies and take back agents residuals.

- Passed Between Different Sales Agencies: Multiple times we began recruiting in one agency and then the day after the interview a leader or agent in a supposedly completely different agency would text us to set up an interview.We don’t know what to make of that…it’s just strange as they are supposed to be separate organizations.

- A script “that has made a lot of people a lot of money” – no need to find the words yourself, the recruiting agents promised a tried-and-true script that they say is a sure-fire way to making a lot of money, fast.

* = Cocaine* & “Really Big Bag*” – We presume the “big bag” the hiring agent was offering us was cocaine based on the specific recruiter doing a physical snorting gesture as though he was doing a line cocaine when he referenced “a big bag.” He did this multiple times. Another indicator is that this individual’s personal arrest records include an arrest for illegal drug possession. That said we can only “presume” he meant cocaine as we neglected to clarify exactly what would be inside the “big bag” that he was using to tempt us to join the Arias organization.

Agent Got Fired – Not for writing Fake Policies, But for Making up Fake Recruits

It appears tough to get fired from sales agencies. We’ve discovered allegations of:

- Agents that sexually harassed and even raped people and were not fired.

- Agents that created fake bank accounts and fake policies and were not fired.

- Agents that lost their insurance license and were not fired

But apparently one of the ways you can get fired is if you make up fake people as recruits.

A former agent told us he got fired because he was also making up fake people as recruits to hit his monthly target, but nothing happened to colleagues who were making up fake policies for real customers.

“These people still have jobs and I do something that doesn’t hurt a customer and I’m the one that gets terminated.”

~ Anonymous Former AIL Sales Agent A

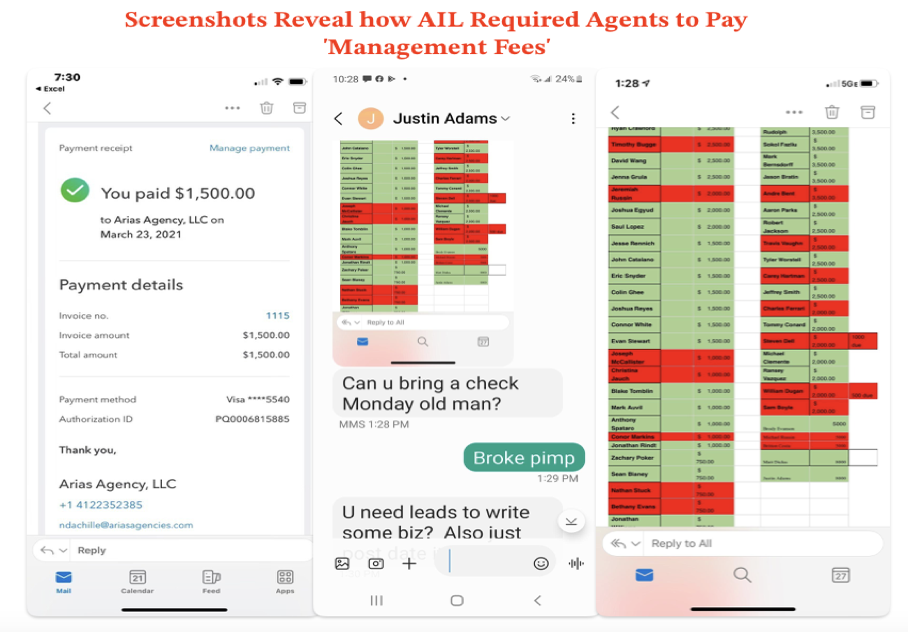

Cash App Side Payments To Managers:

In interviews recruiters say over and over again that the leads are free and that the only thing you need to pay for is your own phone and a stable internet connection.

But former agents said they were required to pay so-called management fees to their bosses to keep their jobs. The payments were typically made using Cash App or Venmo. It was not clear what the payments were for – sometimes agents were told it is for use of office space even if they never went to the office. But if they didn’t pay, they would lose their jobs, the agents said.

Former executive said the payments violated GL and AIL policy.

Tribute Payments to Uplines: Agents are required to pay “tribute” payments via Cash App or Venmo to their management lower-level members for better leads.

Are Sales Teams “A Pyramid Scheme” or Another Shady MLM?

“That’s what they always told us. We’re a recruiting company that happens to sell insurance.”

~Scott Dehning, Former VP of Sales for AIL

Former agents and recruits often say that Globe Life’s distribution structure is a Pyramid Scheme, an illegal MLM. Below is an org chart we generated for The Simon Arias organization. It exemplifies one of the many MLM structures under different State General Agents, and how the newest recruits lose money while the top of the MLM wins.

New recruits are force to PAY ~$150 out of pocket for a required licensing course. Since they are not yet able to generate commissions, they then are required to work for 1-2 months as unpaid labor.

Multi-Level Marketing 101:

What makes an MLM ILLEGAL?

MLM is a seen as a dirty word but MLM structures are not inherently illegal according to most state insurance agency regulations. In fact, Primerica, another insurance agency, is a well-known for having a legal MLM sales structure and does not hide this fact from investors. However, an MLM does becomes illegal when turns into a pyramid scheme.

Many state regulators and the FTC define an illegal MLM, a pyramid scheme, as when recruitment of people becomes more profitable than product sales.

Recruiting PEOPLE appeared to be more important than Product Sales within AIL:

Undercover investigators were explicitly told that “yes, you can make more money, recruiting people than selling insurance.” Recruiters and current agents also told us it was only important that at least someone we recruited and, in our downline, has to “at least sell some insurance to someone at some point,” but it didn’t have to be us.

High Pressure Recruiting – Undercover investigators faced high-pressure recruitment tactics to sign up immediately. According to sources the recruiter and the uplines immediately receive a payout after the new agent pays for a licensing course.

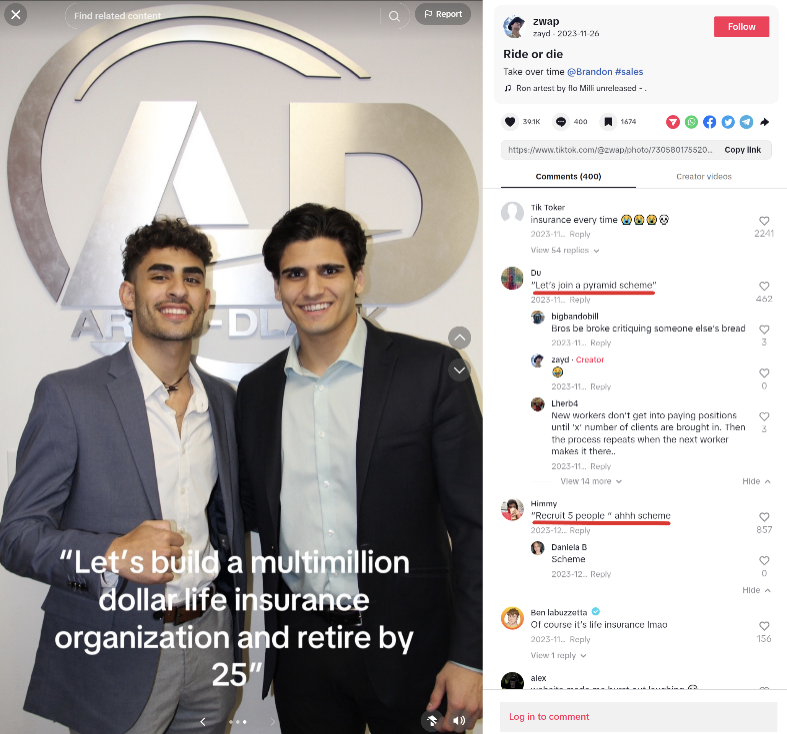

Extravagant Promises of Large Earnings – Definitely, see Appendix D for AIL agent’s Instagram and Tik-Tok accounts.

It is no wonder why consumers and former agents frequently describe American Income Life as a pyramid scheme in reviews and on social media.

AIL agencies check a lot of the boxes on the signs of a pyramid scheme that the FTC warns people about.

Agents Defrauded – Steal Back Residuals

False promises of a lifetime of ‘residuals’

Former agents and executives said, despite the company’s promises, they don’t receive their residuals, sometimes valuing thousands of dollars each month, after leaving the company.

We reviewed agent manuals from top AIL agencies and participated in recruiting calls which both promised a lifetime of “residuals,” a compensation structure that allows agents to collect a percentage of every policy they sell every month as long as the client is alive and paying. While at the company, the agent receives 100% of their residuals. Then, once they leave, they are entitled to a “vested” percentage calculated based on the number of years with the company. At 5 years you are 50% vested and at 10 years you are 100% vested.

“They had said that I broke the contract by switching careers,” one former agent said. “It was just a convenient way for them to not have to pay me even though it wasn’t explained fair, it wasn’t fair, wasn’t right. They just kind of prey on situations like that.”

Part 4 – Is This ESG? Sexual Assault, Drug Use and Greed – The Wolf of Wall Street in your Own Neighborhood

What we discovered occurring at Globe Life would make Harvey Weinstein blush.

AIL Agents across the United States cut a very specific figure. They flex five-figure Rolex watches on Instagram, and cruise in six-figure sports cars on TikTok. Their suits are flashy – wide pinstripes are a favorite – and tailored tight, better to show off the results of all the work they do at the gym (another favorite subject of social media postings).

Members of the AO sales team in Dubai on a company retreat in February (left); Simon Arias, founder of the Arias sales team and one of AIL’s top sales people (right)

They talk about how they went from dropping out of college to earning small fortunes, promising rich rewards for recruits who follow in their steps.

The messaging is always clear, and straightforward: Greed is not just good, it is great.

Some openly emulate the Wolf of Wall Street – and not just in their taste for pricey suits, watches and cars. A series of lawsuits brought by former agents against AIL and several of its largest captive sales teams detail violent workplaces where sexual harassment is the norm, drug use is at the very least tolerated by management – and at times openly encouraged – and the only way to get ahead is to join in.

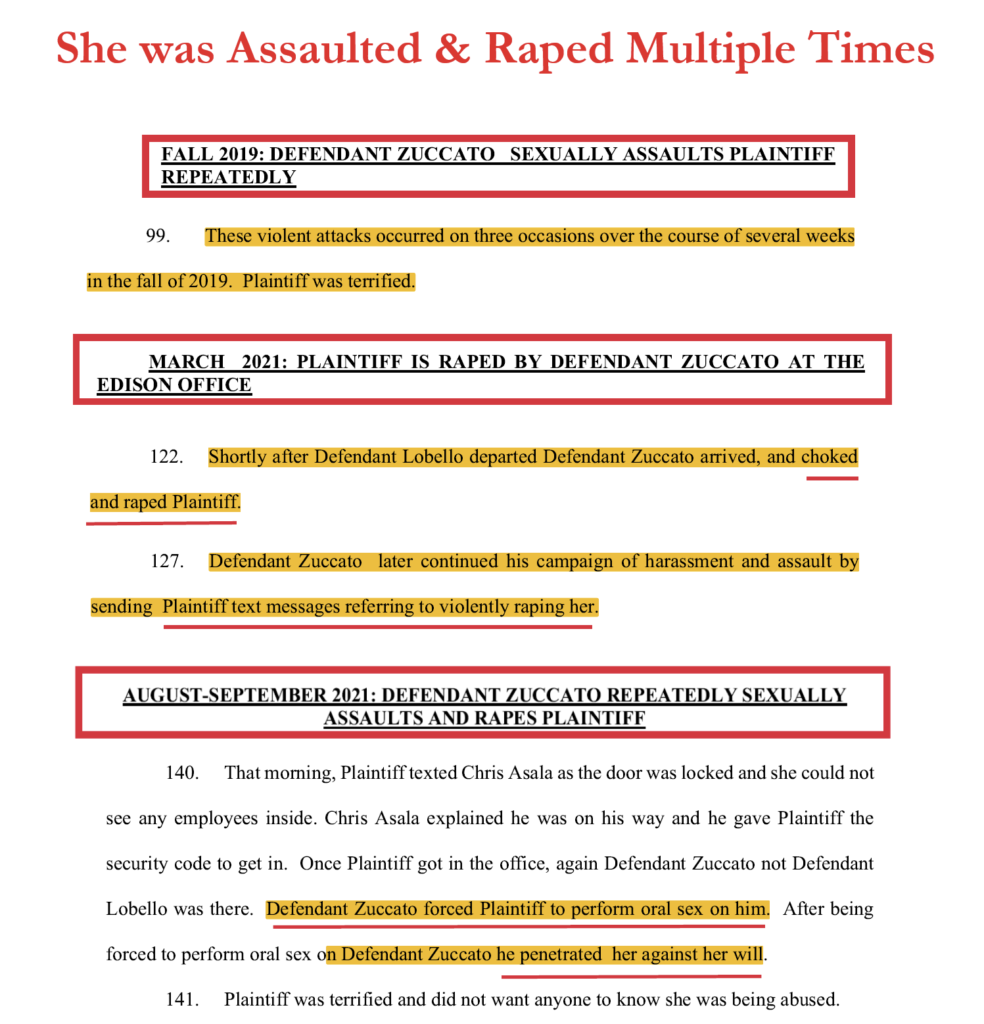

New NJ Lawsuit Reveals AIL Management Failed to Respond Violent Rape, Choking at a New Jersey AIL Agency

Yairaniz Ruiz filed a lawsuit in March against American Income Life (AIL) and its New Jersey-based agency, Giglione-Ackerman, detailing a years-long nightmare of rape, sexual assault, harassment, and retaliation.

The lawsuit lays bare a working environment where upper management protects sexual predators. One male manager even mocked a female leader who reported a potential assault, it says.

Ruiz, meanwhile, endured a relentless campaign of sexual terror, violence and threats that lasted the entire seven years she worked for the agency.

When the agent requested to be transferred away from her abusers, AIL President David Zophin allegedly intercepted her request and denied her request for transfer.

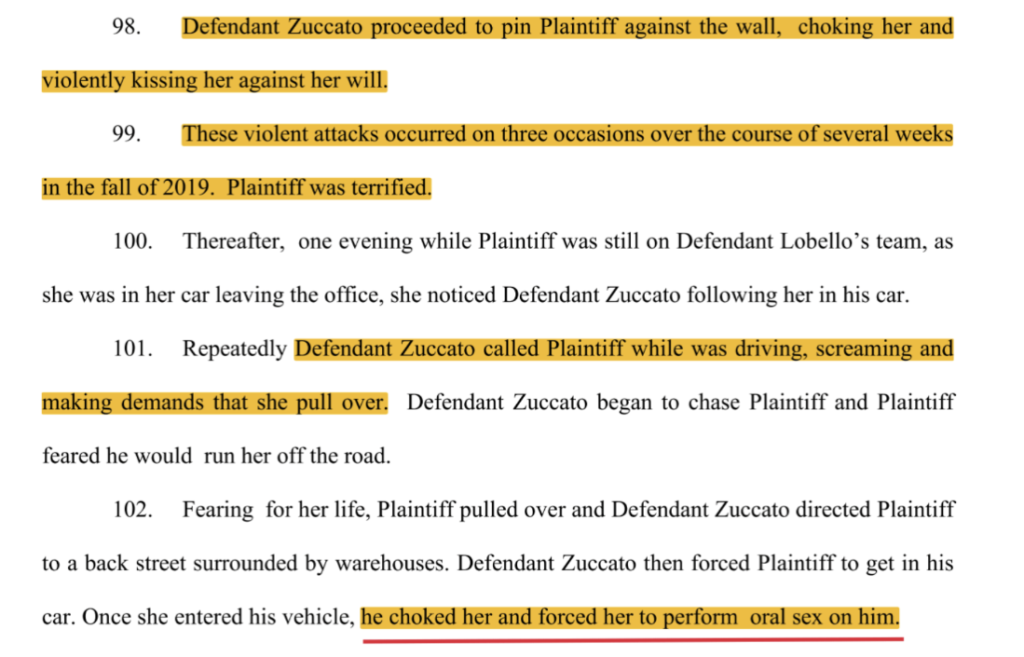

The details of the alleged abuse Ruiz suffered are horrific. She claimed that one boss, AIL Regional General Agent Morgan Lobello, subjected her to repeated unwanted sexual advances for years. Another, Managing General Agent Richard Zuccato, stalked, choked, and repeatedly raped Ruiz, the lawsuit says.

One night, he even followed Ruiz in his car as she drove away from work and called her, according to the allegations, screaming that she pull over. When she did, she said he choked her and forced her to perform oral sex.

In three instances spread across a few weeks, Zuccato pinned the agent “against the wall, choking her and violently kissing her against her will.”

~ Ruiz v. AIL Complaint

He allegedly choked her and forced her to perform oral sex on him.

Ruiz attempted to report the abuse, the lawsuit said. But AIL corporate office told her there was no HR department for her to deal with and that she would have to file her complaint to the same managers who were abusing her, according to Ruiz..

She allegedly faced another year of abuse and retaliation from Lobello and Zuccato.

The lawsuit says that AIL allegedly failed to take any meaningful steps to protect Ruiz and instead actively retaliated against her for speaking up, denying her transfers and assigning her lower-quality leads, ultimately crippling her career.

AIL management and leaders of the Giglione-Ackerman agents allegedly not only signaled reporting incidents of sexualized violence at work were “futile,” but also “condoned sexual harassment” or “directly participated in such.

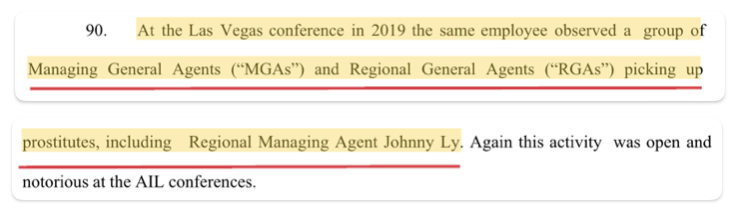

Another NJ Lawsuit Details “Debauched Sexualized Atmosphere” at AIL Conferences

A separate lawsuit filed in January by six former AIL agents from New Jersey detailed how the company’s bi-yearly conferences were “marked by an out-of-control culture of drinking, drugs, and a ‘hookup’ atmosphere.”

All of it allegedly took place around AIL management.

Greer and Zophin would watch as male agents ogled female colleagues, it says. There were even allegations that at a Las Vegas conference in 2019, top agents who led teams within their organizations openly picked up prostitutes, which was “open and notorious at the AIL conferences.”

At a conference in Cancun in May 2021, Greer and Zophin allegedly joined male colleagues in the “VIP Section” of a party where they watched female employees twerk in thongs.

“All the attendees were drinking and cheered while watching the women twerk. At all times CEO and President were aware of this atmosphere and condoned it.”

~ Little v. AIL Complaint

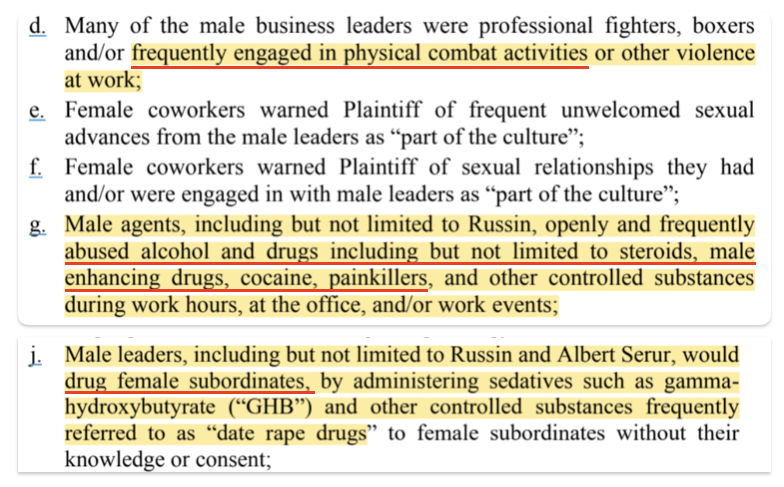

PA Lawsuit Exposes Open Drug Use, Violent Behavior and Sexual Harassment at a Top AIL Sales Team

In 2022, Renee Zinsky and 14 other women who had worked for AIL’s Arias sales team in PA sued the company, alleging that they had been sexually harassed and forced to work in a hostile workplace for years.

AIL encouraged a “highly charged misogynistic, aggressive, hostile and toxic work environment.”

~ Zinsky v. Russin Complaint

The complaint named AIL and two top sales agents, Simon Arias, who ran the “Arias Organization” team that Zinsky worked for, and Michael Russin, one of Arias’ top lieutenants. The complaint offered a litany of egregious behavior that it said was commonplace:

- Male leaders openly abusing alcohol and drugs including cocaine, pain killers and steroids.

- Male leaders giving unsuspecting female subordinates date rape drugs.

- Simon Arias encouraging aggressive and violent behavior in the office, including physical fights and wrestling matches

- Near constant sexual advances from male colleagues.

The lawsuit says that AIL CEO Greer and President Zophin “encouraged, participated in or were otherwise complicit with” the misogynistic work environment and corporate culture.

Greer and Zophin allegedly witnessed firsthand some of the disturbing conduct displayed in the office and at work events because they made frequent in person visits to the offices and work-related events attended by Arias Agencies and Russin Financial leaders.

That Zinsky was gay and married to a woman only made the harassment worse, she told us. She said that Russin would make explicit and lewd comments about what he wanted to do her, and say things like, “you just haven’t had the right dick yet.”

Zinsky also detailed a string of horrifying sexual harassment and assaults she experienced from Russin, including:

- Exposing his genitals to her and other female agents during work meetings, saying “What are you going to do about this?”

- Sending her photos of him naked.

- Taking her for a drive and then forcing her to watch him masturbate in a parking lot.

- Administering “date rape” drugs without her knowledge, during which Zinsky believes she was “forced to engage in sexualized conduct against her will.”

“Telling me that the next way I get my promotion is if my wife and I blow him at the same time.”

~ Renee Zinsky

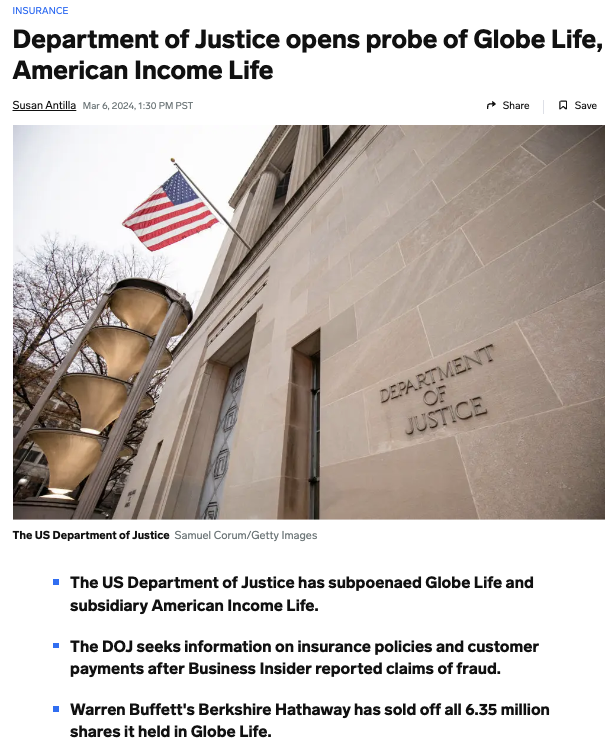

Part 5 – Actions Have Consequences; DOJ is Investigating & Buffett Sells

The Department of Justice (DOJ) is investigating Globe Life and their MLM agencies.

The DOJ subpoenaed Globe Life and American Income Life (AIL) seeking information on Arias Agencies to investigate reported fraud and customer abuses within the agency. Globe Life announced the investigation internally in January and requested its subsidiaries preserve relevant documentation to comply with DOJ orders.

Yet they have continued to hide this fact from investors. In fact, there is zero mention of a DOJ investigation in either Globe Life’s FY 2023 10-K and on their earnings call on February 8th.

Business Insider broke news on the pending DOJ investigation in March, reporting the DOJ had requested broad information about policies written and policyholders at Arias Agencies.

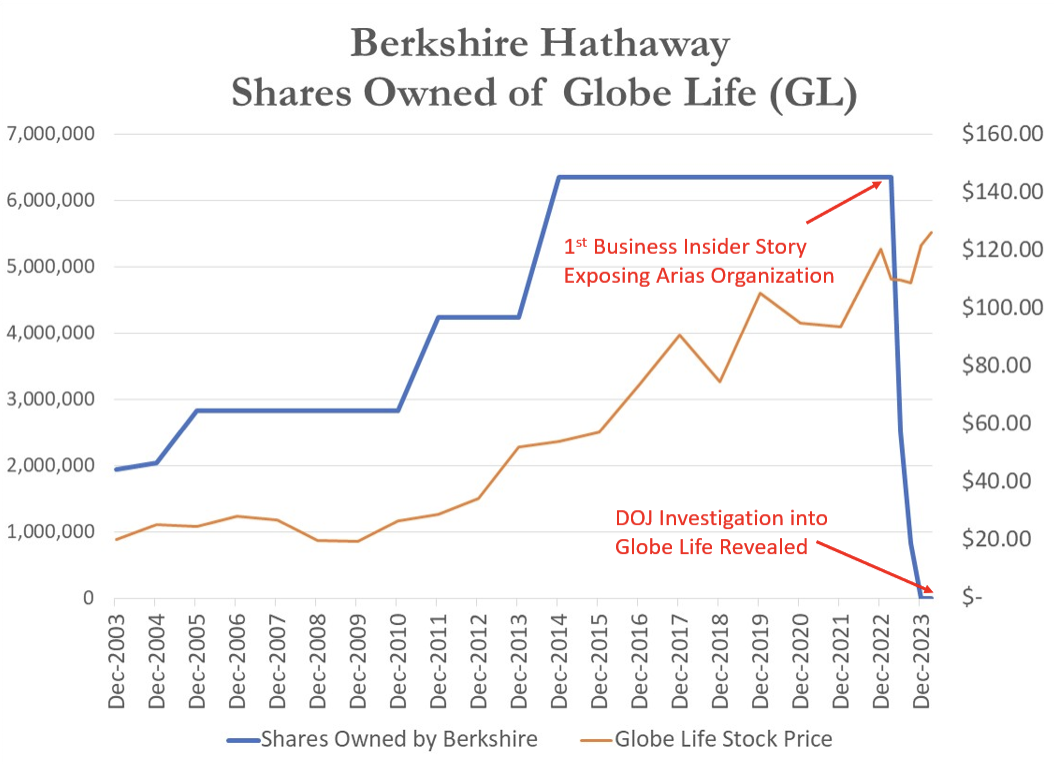

Warren Buffet Sold 100% of GL Stake – After Owning for ~20 years!

“Beyond that, we have learned – too often, painfully – a good deal about what types of insurance business and what sort of people to avoid…when charlatans are involved, detection is often both slow and costly.

~Warren Buffet – FY 2023 Shareholder Letter

Berkshire Hathaway’s investment was a rock that insurance investors could use to justify purchasing GL and giving the company a premium multiple for the last decade. Berkshire initially bought in 2003 and never sold a single share for ~20 years, not even during the 2008 global financial crises.

That all changed over the last year, Buffett dumped his entire GL position. The explanation for why was buried in the recent annual letter—Warren writes that in the insurance business he learned painfully about “what sort of people to avoid.”

Berkshire’s selling started right after a Feb 2023 Business Insider story revealing the shady business practices occurring at the Arias Organization.

We think that after the first Business Insider article Berkshire realized what they likely now owned: An insurance book filled with fraudulently underwritten policies by the likes of Simon Arias and his cocaine and steroid fueled sales force. He decided to sell quickly and quietly.

Rule No. 1 is to Never Lose Money.

Rule No. 2 is Never Forget Rule No. 1

~Warren Buffett

We think investors should add a Rule #3. When Buffett quickly dumps a stock … it’s time to short.

Part 6: Financials – How to Value a Financial Co with a Giant Asset Hole; The Hidden Signs Within Regulatory Blue Books

- Without the Fraudulent Agencies There is Negative Growth at AIL GL’s Lapse Rates in Statutory filings are HIGHER than peers and GL’s SEC supplement

- With the “Growth” Gone – GL Deserves a Below Market P/BV

An insurance business is only as good as the quality of the policies it writes.

Globe Life has been rewarded with a premium multiple as a growing life insurance company. We think this premium multiple is unwarranted.

We discovered a source for all of American Income Life’s Monthly Spotlight magazines*. The magazine within AIL that says each agent and agencies ALP production, growth rates, and targets. We used these to calculate the growth that has occurred at the Sales Teams reported as committing fraud and within the rest of the business.

From 2019 to 2023 Annual ALP at the:

- “Bad Sales Teams” grew FASTER at 15.9% per year

- Non-Fraudulent Sales Teams DECLINED at -0.5% per year

Lapse Rates Higher in Blue Books Than SEC Filings – We Hired a Professional Actuarial Consultant Who Confirmed Our Analysis

We hired a professional actuarial consultant to ensure we were analyzing GL and AIL’s regulatory blue books and other financial filings correctly. Our analysis showed that the large variation appears unique to AIL.

- AIL’s statutory filings illustrate a lapse rate of 16.4%, whereas peers tends to be mid single digits

- AIL’s blue book lapse rates are much higher than those reported in the SEC financial supplements

- Aggressive Assumptions? GL’s GAAP accounting appears to use more aggressive assumptions than those used in the figures reported to regulators.

- Insurance Peers SEC filiings matched statutory filings. We analyzed statutory & supplemental SEC filings which report lapse rates at peers and they all matched fairly closing.

- AIL was the only one with a large variance.

AIL’s statutory filings disclose a much higher lapse rate of ~16.4% in 2023!

Meanwhile AIL’s SEC filings at the end of 2023 shows a reported lapse rate for first year policies was 8.7% and ~2.5% for renewal year policies for a blended lapse rate of ~3.5%. GL reported $1.65B of ALP in force and an overall lapse rate of 3.67%.

It is possible that this difference is due to a variation between SAP and GAAP accounting, along with different definitions for base metrics (e.g., ALP vs. total premium). However, there is a unique disconnect between the lapse rates AIL reports to regulators and those reported in its financial supplement.

The expert we hired, stated it is likely GL’s GAAP Accounting likely uses more aggressive assumptions than those used in figures reported to regulators.

Using our suspected calculations for lapse rates in Primerica and Lincoln National Life’s supplemental disclosures, the implied figures are much closer to their statutory filings (i.e., there isn’t the disparity we see w/ AIL). In fact, for both companies the calculation returns numbers which are almost exactly what is disclosed in the statutory filings.

The elevated lapse rates in AIL’s statutory filings also call into question the rising DAC and low amortization (see Exhibit A)

Putting aside the variations noted above, the lapse rates as compared to peers are materially higher.

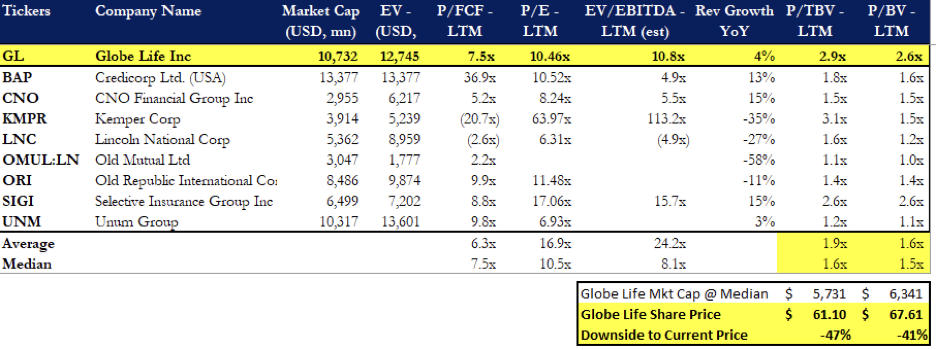

GL Stock Price at an Average Price/Book Value = $64.35 ~40% Downside & We think that is very generous

If Globe Life were trading at the median multiple to their publicly traded insurance peers then GL’s stock would trade at a 1.6x P/TBV and 1.5x P/BV.

Comparable companies imply a fair value for GL stock of $61-$67. This implies an ~40% downside from current prices.

We actually think trading at a 1.5-1.6x Book value is an overly generous valuation for GL considering:

- We discovered that a materially significant portion of Globe Life’s insurance book has been fraudulently produced

- The company is under DOJ investigation.

Normally bad underwriting + government investigation into the producers would cause an insurance company to deserve a below market multiple.

Conclusion – Short Globe Life

Globe Life stands out as an unparalleled investment opportunity to us as a short. It has low short interest and the market is just barely starting to catch-on to what is going on beneath the surface.

Our investigation revealed that senior executives of AIL and Globe Life are not only aware of the fraudulent policies that are being written, but also that management themselves had been receiving massive kickbacks. Which is likely why they turned a blind eye.

Management evidently was warned about the growing insurance fraud in over 200 emails by just one whistleblower.

The amount of fraudulent policies that former agents and executives described is absolutely shocking.

Insurance practices by AIL’s producers have been described to us as fraudulent and a growing “Ponzi scheme.”

Formers said the Book is filled with fraudulent insurance policies.

- Policies that were Written for Dead People

- Creation of Fake Bank Accounts to Open Policies Under Fake Names

- Forged Customer Signatures on Policies

- Agents that Withdrew Funds from Consumers Bank Accounts without Their Approval

- Faking Medical Tests so Smokers Were Underwritten as Non-Smokers

Somehow after doing all the above management and sales agents had the extra free time to violate pretty much all the ESG rules.

We only have 2 questions for Globe Life management:

- Did you know about all the fraudulent life insurance policies?

- Now that you for sure know, are you going to immediately clean house?

Management is damned if they do and damned if they don’t. This plays out in 1 of 2 ways for them, they either:

- Clean house – They evict the fraudsters; report them to regulators; and management is forced to tell the market the size of the large hole that the fraudulent activity left in their balance sheet.

- Protect the fraudsters – Management keeps pretending that rampant fraud isn’t occurring. Which confirms to investors and regulators that management has known all along, and results in the DOJ prosecuting senior management for the same insurance fraud crimes as their colorful agents.

Either way… We are Short Globe Life (GL)

Appendix A –Aggressive Accounting

Playing with the DAC

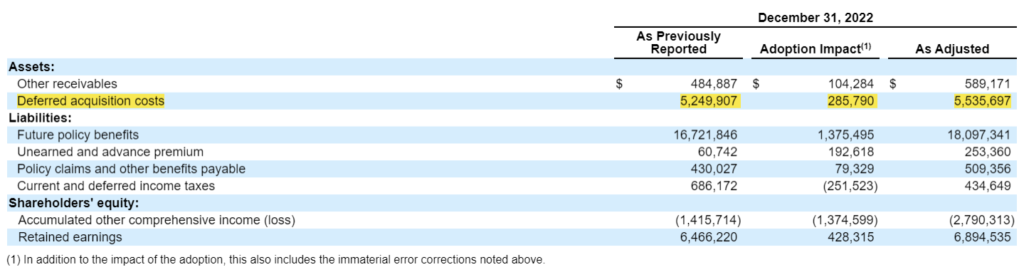

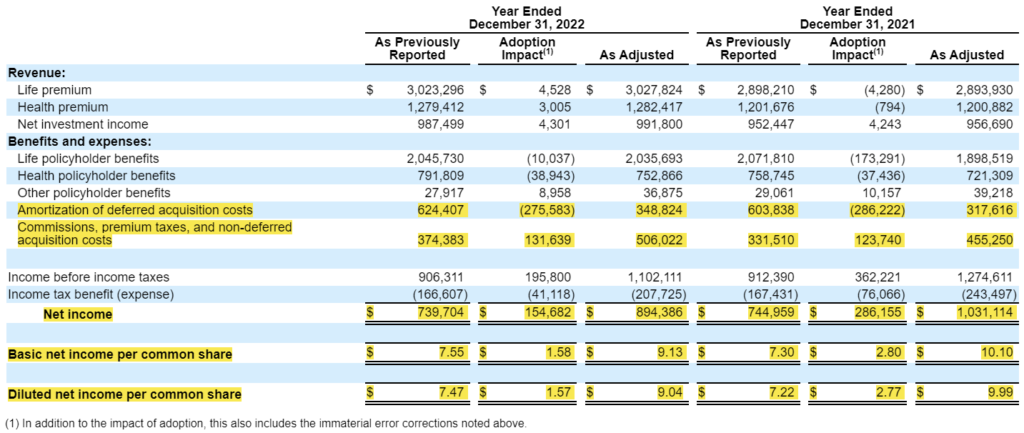

In 2018, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU) 2018-12 known as LDTI, which went effective January 1, 2023 for SEC filers. One of the objectives of LDTI is the simplified amortization of deferred acquisition costs (DAC). Think of DAC as the capex for an insurance company.

The new guidance, generally requires insurers to amortize DAC on a straight-line, constant-level basis over the expected term of the insurance contracts.

In 2023, GL expected the accounting change to driven an increase of $110-115M to its net income in 2023.As shown in the below disclosures from its 2023 10-K, GL’s diluted EPS increased from $7.22 to $9.99 and from $7.47 to $9.04 in 2021 and 2022, respectively.

Balance Sheet:

Income Statement:

As shown below, capitalized costs are now being added to DAC at a rate which far exceeds what is being amortized.

Whereas the new accounting guidance was meant to provide consistency across products, GL’s ratio of capitalized policy costs vs. amortized policy costs is now significantly higher than other insurers.

Appendix B = Bad Sales Teams – Only found 2% to Be Completely Clean

Appendix C – Unions – From Protecting the Working Class to Exploiting Them

AIL was founded in 1951 to provide low-cost insurance policies for working people. To this day, AIL’s competitive advantage is that works closely with unions. It even markets itself as a union shop.

The slogan “Be Union, Buy Union,” is splashed across AIL’s website.

But today’s AIL is hardly a champion of the working class. Its thousands of salespeople – the bulk of its workforce – are contractors, not employees, and they have no benefits or job security. Yet they are required to join the Office and Professional Employees International Union and pay union dues. Legal experts we consulted said the structure of the union at AIL does not appear legal under U.S. labor law.

The idea of AIL being a union shop — the foundation for AIL’s sale strategy — not only appears baseless, it may also be illegal.

But that has not stopped AIL from using its union roots to drum up new business. AIL gives unions free benefits to their members – mostly accidental death and dismemberment policies (AD&D) – the in return it gets access to membership rolls, which are turned into sales leads. AIL employs what it calls PR teams to build and managed its union relationships.

Agents then aggressively try to sell pricier policies to union members. A former PR executive and former sales agents said some agents would flat out lie, claiming they were part of the member’s union or had personal relationships with their union’s leadership or that they had to buy an AIL policy to stay in their union.

Bait-and-Switch Tactics and Emotional Manipulation

We reviewed dozens of pages of scripts and handbooks provided to AIL agents. They appeared to actively encourage agents to mislead clients about their union ties with deliberately crafted language that leveraged the trust workers have in their unions. The scripts instruct agents to use phrases like:

- “benefits set up for you by your union”

- “We handle your benefits through your (Union/Association)”

- “I spoke to you about your benefits through (group name).”

- “Over 20,000 local unions looked at and chose this program over any other. … Your financial guy may be a great guy, but wouldn’t it be better to take the advice of oer 20,000 unbiased financial advisors’ over one biased.”

“They are just praying on the middle to low class. People that want to protect their family. People that want to do what they are supposed to do with their union, people that want to do the right thing and they leverage that emotion to sell life insurance.”

~Anonymous Former AIL Agent B

Appendix D – Fast Cars, Watches, & Money Guns – The Social Media Accounts

The best way to truly experience the AIL recruitment machine required to bring on a new generation of suckers downlines is to view the sales agent’s social media. We have been tracking them for a while.

So investors don’t need to even leave the comfort of their own home below is a long list of many of the colorful figures within AIL, so you can experience the False Promises and Wolf of Wall Street Culture yourself.

Enjoy the fast cars, blinged out watches, and money guns!

Appendix F is for the “Felons” & Arrests:

Felons and criminals – We kept bumping into them throughout our Globe Life research, which is nuts because it is explicitly illegal in most states to be both a convicted criminal and a licensed insurance agent. We were not even really looking for criminals because a) we view that as more of an AIL sales agency problem and less of a Globe Life corporate issue, and b) we don’t really want to know what all the guys in Appendix D have done…you can’t unread or unsee those images. But criminals and arrests kept popping up.

Criminals are celebrated openly by AIL sales teams. Leaders post on social media about “wanting to be a gangster” and that a Netflix special will be made about them (presumably about their criminal conduct.) They attempt unsuccessfully to emulate “Wolf of Wall Street” (see “sell me a pencil” video).

Surprise – Our Undercover Interview Conducted by a Convicted Felon – In one undercover interview, the team leader scheduled to meet with our investigator didn’t show up. In his place arrived a person whose name we had never heard of before. They told us if we did a great job selling, he would give us a big bag* (of presumably cocaine).

Shocked by the offer of drugs in our first meeting we began to do Google searches after the interview. They revealed this “hiring manager” within Arias Agencies had multiple criminal convictions:

- 1st Felony conviction for drugs

- 2nd Conviction for Firearms related offenses (he shot a gun with a modified serial number in the middle of a living room filled with people and then fled the scene)

- Also Pennsylvania revoked his insurance license for the above criminal convictions in February 2023

Shocker – Criminals Do Not Make Great Leaders – Along the way, we have been less shocked to discover that a bunch of the senior agents running offices reportedly rife with insurance fraud and sexual harassment also have a criminal background.

- Does AIL really expect someone convicted of assault & stalking to handle sexual harassment appropriately?

- Or expect an SGA involved** in “Criminal Mischief” to not engage in criminal mischief?

The O in AO (Largest AIL Sales Agency) Arrested for Kidnapping & Assault with a Firearm:

We were trying to figure out why (the O in AO) left Globe Life in Dec 2020 right as his sales team’s insurance production was taking off. Instead, we found a December 2020 arrest record for kidnapping, false imprisonment, and assault with a firearm. Note – we have not uncovered records of him being convicted with those crimes, so he is 100% innocent until proven guilty (and not a criminal or a felon). But this was a shocking finding to have occurred right at the same time as when he “retired” from AIL.

** Note – Walter Icaza’s Criminal Mischief charge was not a conviction but an adjudication withheld judgement. Our understanding is that an adjudication withheld generally occurs when a defendant pleads “No Contest” or “Guilty” and then a judge decides to impose some other sanctions without declaring you as being convicted of the felony…aka the judge was nice.

*Appendix S – Spotlights Saved for Later

(Additional Appendix added 4-24-2024)

“If you delete we must retweet!“

Globe Life and AIL is trying to remove important information in our report from the web by removing our link and blocking access from investors.

Too Bad for Globe Life…we saved EVERYTHING!

How AIL’s Directory of Spotlight Magazine Used to Look

Originally, we published a link to all of the AIL spotlight magazines exposing the actual AIL ALP numbers and growth rates from ALL the companies agencies so investors could audit the annual growth rates and suspicious numbers put forth by agencies that we have corroborated as producing fraudulent life insurance policies. It appears AIL is trying to obscure the amount of production that comes from the likes of AO, Arias, Humberto “Beto” Quintero, the SS agencies, etc.

Below are links from Webarchive.org; Scribd.com; etc for all of the monthly AIL Spotlight magazines we have found. Enjoy!

Download all PDFs here. (3 gigabyte .zip archive of all issues).

Links to All Monthly AIL Spotlight Magazines

2023 23-Jan 23-Feb 23-Mar 23-Apr 23-May 23-Jun 23-Jul 23-Aug 23-Sep 23-Oct 23-Nov 23-Dec

2022 22-Jan 22-Feb 22-Mar 22-Apr 22-May 22-Jun 22-Jul 22-Aug 22-Sep 22-Oct 22-Nov 22-Dec

2021 21-Jan 21-Feb 21-Mar 21-Apr 21-May 21-Jun 21-Jul 21-Aug 21-Sep 21-Oct 21-Nov 21-Dec

2020 20-Jan 20-Feb 20-Mar 20-Apr 20-May 20-Jun 20-Jul 20-Aug 20-Sep 20-Oct 20-Nov 20-Dec

2019 19-Jan 19-Feb 19-Mar 19-Apr 19-May 19-Jun 19-Jul 19-Aug 19-Sep 19-Oct 19-Nov 19-Dec

2018 18-Jan 18-Feb 18-Mar 18-Apr 18-May 18-Jun 18-Jul 18-Aug 18-Sep 18-Oct 18-Nov 18-Dec

2017 17-Jan 17-Feb 17-Mar 17-Apr 17-May 17-Jun 17-Jul 17-Aug 17-Sep 17-Oct 17-Nov 17-Dec

2016 16-Jan 16-Feb 16-Mar 16-Apr 16-May 16-Jun 16-Jul 16-Aug 16-Sep 16-Oct 16-Nov 16-Dec

2015 15-Jan 15-Feb 15-Mar 15-Apr 15-May 15-Jun 15-Jul 15-Aug 15-Sep 15-Oct 15-Nov 15-Dec

2014 14-Jan 14-Feb 14-Mar 14-Apr 14-May 14-Jun 14-Jul 14-Aug 14-Sep 14-Oct 14-Nov 14-Dec

2013 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun 13-Jul 13-Aug 13-Sep 13-Oct 13-Nov 13-Dec

2012 12-Jan 12-Feb 12-Mar 12-Apr 12-May 12-Jun 12-Jul 12-Aug 12-Sep 12-Oct 12-Nov 12-Dec

2011 11-Jan 11-Feb 11-Mar 11-Apr 11-May 11-Jun 11-Jul 11-Aug 11-Sep 11-Oct 11-Nov 11-Dec

2010 10-Jan 10-Feb 10-Mar 10-Apr 10-May 10-Jun 10-Jul 10-Aug 10-Sep 10-Oct 10-Nov 10-Dec

2009 09-Jan 09-Feb 09-Mar 09-Apr 09-May 09-Jun 09-Jul 09-Aug 09-Sep 09-Oct 09-Nov 09-Dec

2008 08-Jan 08-Feb 08-Mar 08-Apr 08-May 08-Jun 08-Jul 08-Aug 08-Sep 08-Oct 08-Nov 08-Dec

2007 07-Jan 07-Feb 07-Mar 07-Apr 07-May 07-Jun 07-Jul 07-Aug 07-Sep 07-Oct 07-Nov 07-Dec

2006 06-Jan 06-Feb 06-Mar 06-Apr 06-May 06-Jun 06-Jul 06-Aug 06-Sep 06-Oct 06-Nov 06-Dec

2005 05-Jan 05-Feb 05-Mar 05-Apr 05-May 05-Jun 05-Jul 05-Aug 05-Sep 05-Oct 05-Nov 05-Dec

2004 04-Jan 04-Feb 04-Mar 04-Apr 04-May 04-Jun 04-Jul 04-Aug 04-Sep 04-Oct 04-Nov 04-Dec

2003 03-Jan 03-Feb 03-Mar 03-Apr 03-May 03-Jun 03-Jul 03-Aug 03-Sep 03-Oct 03-Nov 03-Dec

2002 02-Jan 02-Feb 02-Mar 02-Apr 02-May 02-Jun 02-Jul 02-Aug 02-Sep 02-Oct 02-Nov 02-Dec

2001 01-Jan 01-Feb 01-Mar 01-Apr 01-May 01-Jun 01-Jul 01-Aug 01-Sep 01-Oct 01-Nov 01-Dec

2000 00-Jan 00-Feb 00-Mar 00-Apr 00-May 00-Jun 00-Jul 00-Aug 00-Sep 00-Oct 00-Nov 00-Dec

Additional – 1973-May

Disclaimer & Terms of Service:

By downloading from or viewing material on this website and/or by reading this report, you agree to the following Terms of Service. You agree that use of the research on this website or report is at your own risk. In no event will you hold Fuzzy Panda or any affiliated party, including officers, directors, employees and agents of Fuzzy Panda or any companies affiliated with them, liable for any direct or indirect losses caused by any your use of information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site or in this report. You further agree that you will not communicate the contents of reports and other materials on this site to any other person unless that person has agreed to be bound by these same terms of service. If you download or receive the contents of reports or other materials on this site as an agent for any other person, you are binding your principal to these same Terms of Service.

You should assume that as of the publication date of their reports and research, Fuzzy Panda and possibly any companies affiliated with them and their members, partners, employees, consultants, clients and/or investors (the “Fuzzy Panda Affiliates”) have a short position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds of companies covered in such reports and research, specifically they have a short position in Globe Life (GL). They therefore stand to realize significant gains in the event that the prices of either equity or debt securities of the subject companies decline. Fuzzy Panda and the Fuzzy Panda Affiliates intend to continue transactions in the securities of issuers covered on this site for an indefinite period after their first report on a subject company, and they may be short, neutral, or long at any time hereafter regardless of initial position and the views stated in Fuzzy Panda’ research. Fuzzy Panda will not update any report or information on this website to reflect such positions or changes in such positions.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall Fuzzy Panda offer, sell or buy any security to or from any person through this site or reports on this site. Fuzzy Panda and the Fuzzy Panda Affiliates do not render investment advice to anyone unless they have an investment adviser-client relationship with that person evidenced in writing. You understand and agree that Fuzzy Panda does not have any investment advisory relationship with you or fiduciary duties to you. Giving investment advice requires knowledge of your financial situation, investment objectives, and risk tolerance, and Fuzzy Panda has no such knowledge about you.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Fuzzy Panda’s research and reports express their opinions, which are based upon generally available information, field and online research, and inferences and deductions through due diligence and the analytical process. To the best of their ability and belief, all information contained in their reports is accurate and reliable, and has been obtained from public sources believed to be accurate and reliable, and they have not obtained information from persons who are insiders or connected persons of the stock covered or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. Fuzzy Panda makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion and conclusions are subject to change without notice, and Fuzzy Panda does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the expressions of information in this report are copyrighted and owned by Fuzzy Panda Research, and you therefore agree not to distribute this report or any excerpts from it (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link: www.fuzzypandaresearch.com. If you have obtained Fuzzy Panda’s research in any manner other than by downloading from that link, you may not read such research without going to that link and agreeing to the Terms of Service. You further agree that any dispute between you and Fuzzy Panda and their affiliates arising from or related to the material on their website shall be governed by the laws of the State of California, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in California and waive your right to any other jurisdiction or applicable law. The failure of Fuzzy Panda to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to this report or the material on this website must be filed within one (1) year after such claim or cause of action arose or be forever barred.