ASP Isotopes (ASPI) is using old, disregarded laser enrichment technology to masquerade as a new, cutting-edge Uranium enrichment company. The truth is hiding just below the surface. Unbeknownst to investors, we discovered a crew tied to the most notorious “Microcap Fraudsters” (Honig & Stetson) behind the scenes. Nuclear energy and Uranium stocks are hot right now, so naturally Honig’s family and friends are tied to a paid stock promotion in Uranium. ASPI is that company.

We spoke with former executives from customers and competitors, and they told us ASPI is using old, mothballed technology that has been shown to be uneconomic.

We believe ASPI’s story is the same as all Honig & Stetson’s previous hype stories and it will end in shareholders portfolio’s being nuked.

- ASPI’s Headquarters was originally a Virtual Shared Space in Boca Raton and now is in a Co-Working Space in DC

- We caught ASPI using Multiple Paid Stock Promoters

- Failed Tech – Former Centrus Executives deemed ASPI’s technology virtually worthless.

- One senior executive told us Centrus had looked at acquiring ASPI’s tech in the past and Centrus decided it was NOT even worth $2 million.

- They said ASPI was “selling hope” with tech that is “impossible” to scale

- TerraPower Former Executive said the MOU with ASPI is “non-binding” and came at Zero Cost to TerraPower.

- Cameco looked at ASPI’s tech and passed on investing – A former Klydon employee told us that Cameco’s scientists were “skeptical of the technology and “did not think it would work on Uranium.”

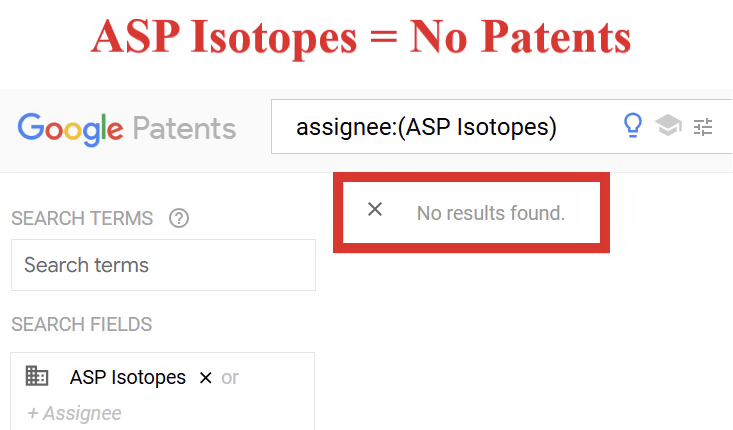

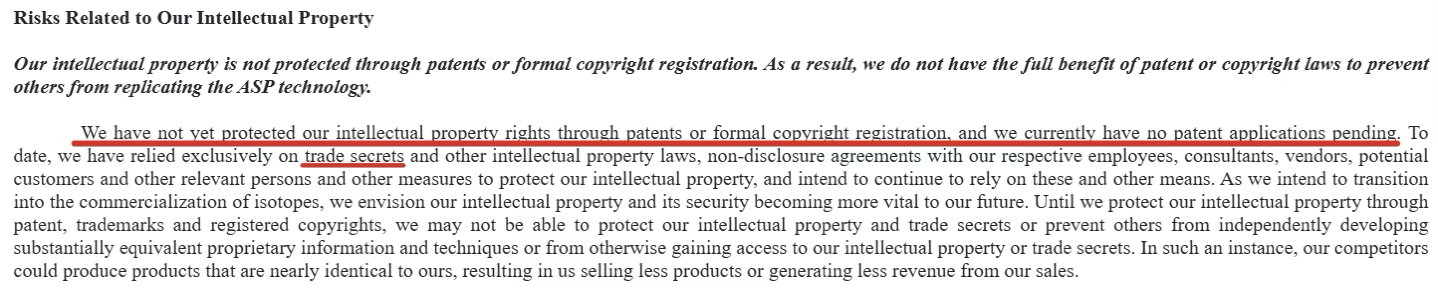

- ASPI has ZERO Patents – Mgmt claims patents would be bad & their process is a trade secret

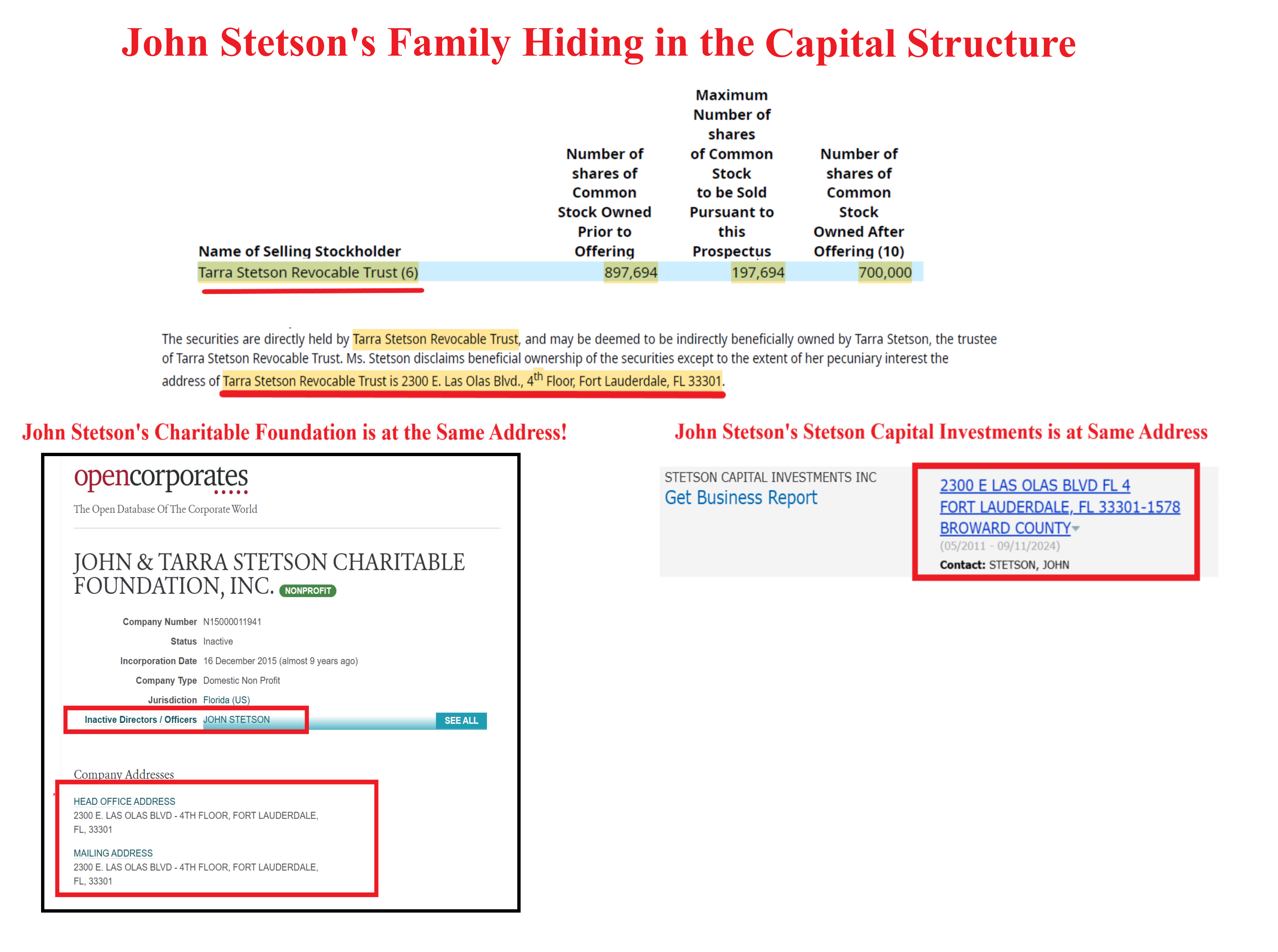

- ASPI’s Questionable History: Incorporated Sept 2021 then Funded <90 days later by Shell Company formerly controlled by Barry Honig’s Crew.

- Notorious Penny Stock Promoters— Barry Honig & John Stetson’s families are hiding in ASPI’s Capital Structure:

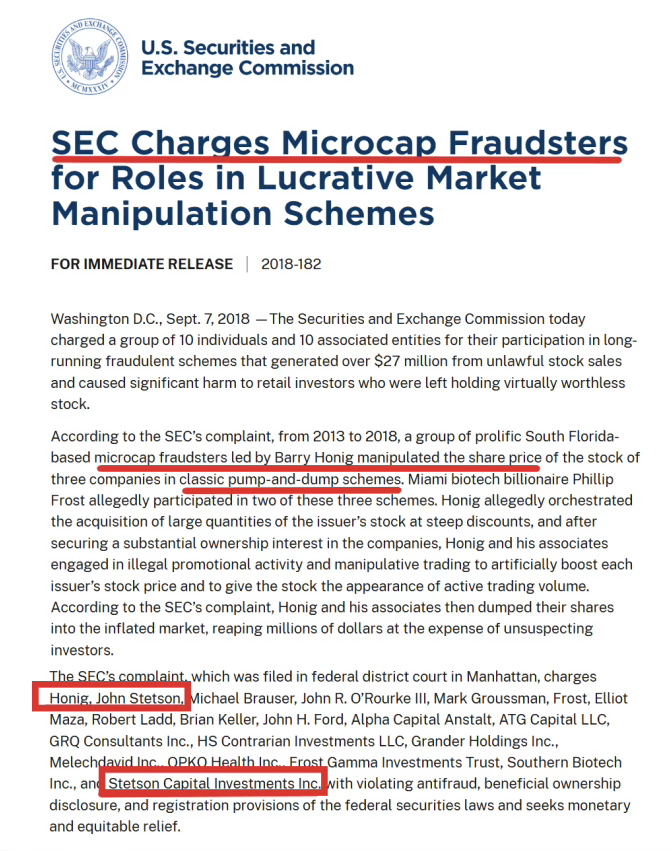

- Honig & Stetson were previously charged by the SEC for defrauding retail investors with misleading stock promotions and “pump-and-dump schemes.”

- Honig & Steston have been tied to >40 alleged stock promotions and Honig & Stetson are currently banned from penny stock offerings after the SEC charged them with fraud.

- Stetson has a 10-year ban and Honig has a lifetime ban.

- Honig & Stetson’s Hidden Ownership:

- Honig’s brother, Jonathan, owned a large stake in ASPI via “Titan Multi-Strategy Fund”

- Stetson’s family’s ownership was concealed under John’s wife “Tarra Stetson Revocable Trust”

- CEO Paul Mann hides his past involvement in a failed alleged stock promotion connected to Honig & Stetson, PolarityTE. Mann was CFO of PolarityTE, a fact not mentioned on his LinkedIn.

- We uncovered a whole cast of other colorful characters behind the scenes who have been sanctioned by the CFTC, connected to SEC probes, and are known stock promoters.

- Our Investigators Could NOT Find Multiple of ASPI’s South African Subsidiaries at their Registered Addresses:

- We pulled South African corporate records which showed multiple ASPI subsidiaries sharing the same address. When our investigator visited, we found NONE at that location.

- Instead, we found a South African crypto fund for retail investors, Jaltech.

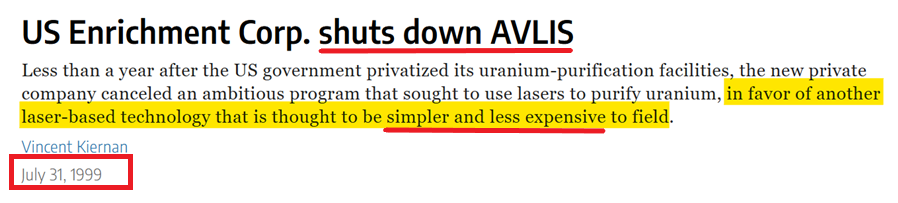

- Twenty Governments spent decades researching ASPI’s AVLIS Technology (laser enrichment of uranium) and they scrapped the programs. It was proven to be uneconomic.

- US Government spent ~$2 billion and gave the tech away for free.Japan scrapped its laser isotope enrichment program in 2001.France canceled its program in 2003.

- Even Iran & Iraq researched the tech and decided it didn’t work

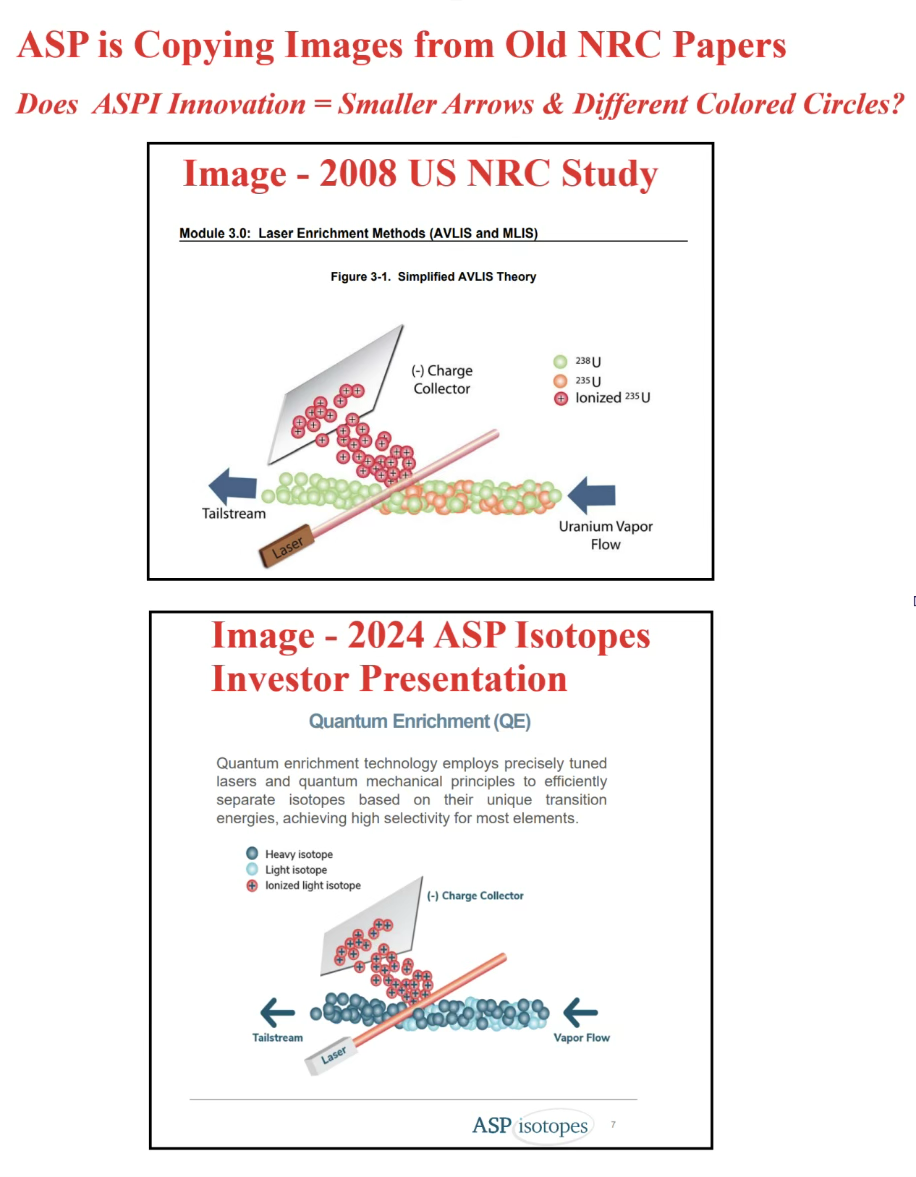

- Same Old Tech But Now with New Arrows! Images of ASPI’s “propriety” technical process appear to be the exact same images as ones from >15-year-old NRC’s Studies.

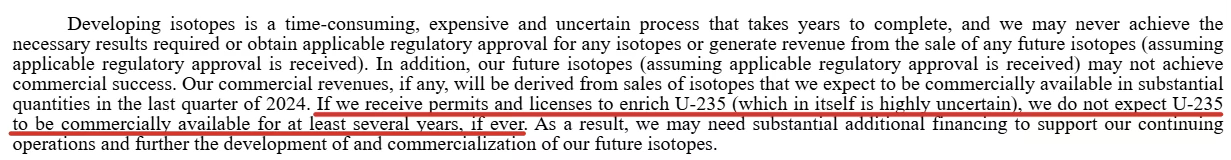

- ASPI Lacks an NRC license to enrich Uranium – Industry experts said the NRC license could take 10-15 years.

- Experts told us ASPI did NOT even bid for the DOE’s HALEU supply contract

- Delusional Cost Estimates – Mgmt claims facilities will cost <$10 million.

- TerraPower & Centrus Executives said at best it would cost >$100m would more likely run into the $ billions

- Trump Restoring Russian Trade Relations Would Destroy Hope for ASPI – Experts told us if Trump restored trade relations, it would destroy hope stories like ASPI.

- Management has issued false promises and promised milestones since the beginning.

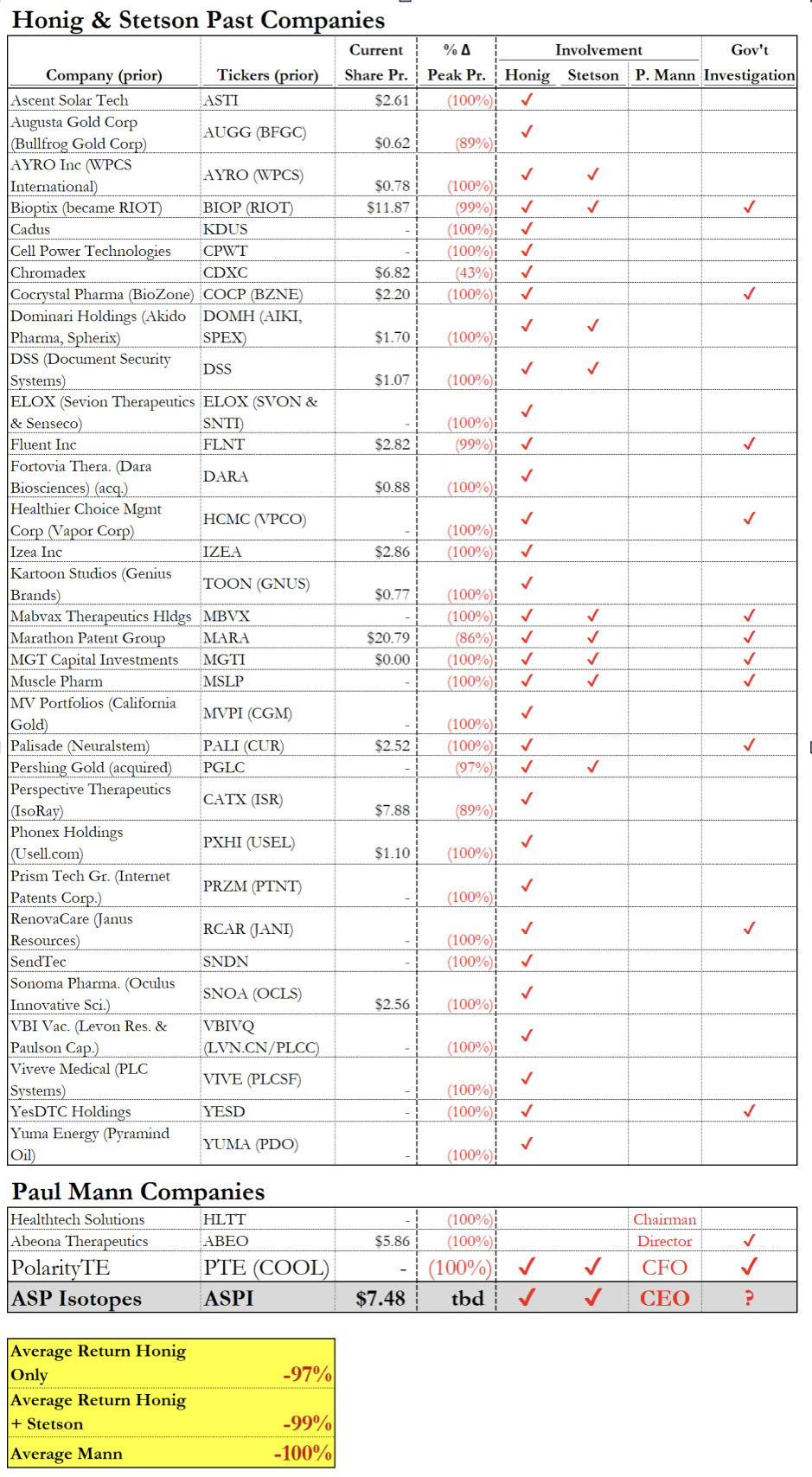

Honig & Stetson have an unparalleled record of investing in paid stock promotions that implode and go down >95%. The Honig crew of “Microcap Fraudsters” have been behind marijuana companies, biotechs, AI companies, consumer beverages, green energy, electric vehicles, gold miners, etc. These microcap hype stories almost always end the same way … with retail investors losing their money.

ASP Isotopes might be the worst one yet. This time the ASPI paid stock promotion has decades of government research studies and failed experiments showing that ASPI’s supposed cutting edge solution is actually 20-year-old technology that does NOT work commercially. It likely never will.

Fuzzy Panda Research is Short ASP Isotopes (ASPI)

Fuzzy Panda Research and Fuzzy Panda “Affiliates” are short securities of ASP Isotopes (ASPI). Please see additional disclosures at end of report and in our terms of service.

Part I – “Microcap Fraudsters” – Honig, Stetson, and Family & Friends Hidden in Plain Sight at ASPI

Barry Honig, John Stetson, and their crew have gone down as some of the most notorious Penny Stock Promoters in Small Cap History. To short sellers, the name “Barry Honig” is right up there with “Charles Ponzi.” Honig & Friends have been behind the scenes of >25 Penny Stock dumpster fires from 2000-2020.

If you haven’t heard of Barry Honig or John Stetson, imagine if Billy McFarland’s “Fyre Festival” was on its 40th failed attempt yet people kept buying tickets to eat cheese sandwiches inside FEMA tents.

Guess who we found hiding behind the ASPI IPO?

Yes – Honig & Stetson are back! And ASP Isotopes is about to implode in the same way that almost all of the other Honig & Stetson paid stock promotions have.

For the Honig Crew, decades of alleged pump-and-dumps supposedly stopped when the SEC charged Honig and his co-conspirators with Securities Fraud and illegally manipulating microcaps. Many of Honig’s family, friends, and co-investors paid fines and agreed to consent agreements (2019-2020) with securities bans that included:

- A lifetime ban from Penny Stocks for Barry Honig.

- A 10-year ban from Penny Stocks for John Stetson & others.

Honig has a track record that is great for him, but terrible for retail investors.

The average Barry Honig-led investment is -97%.

The average Barry Honig investment where John Stetson also participated is -99%.

As for Paul Mann, his average company’s stock performance prior to ASPI is -100%.

Sources for “Alleged” Honig, Stetson & Mann Connected Companies – (SEC complaint 1, 2, 3; Massachusetts Consent Order; SEC Info; Whale wisdom; Lakewood Capital 2013 Expose on Opko; TeriBuhl.com Articles 1, 2, 3, 4, $PTE; Twitter – White Diamond 1; 2; Sharesleuth.com – Pretenders & Ghosts; Hindenburg Research; J Capital; Bleecker Street Research; Paul Mann SEC.gov search)

Note – If any of the above companies listed are incorrect and were NOT connected with “Barry Honig” or “John Stetson” then we are happy to fix the above table; If there are additional companies that are missing from this list then please let us know and we will happily add them. Please email us at [email protected] for corrections or additions.

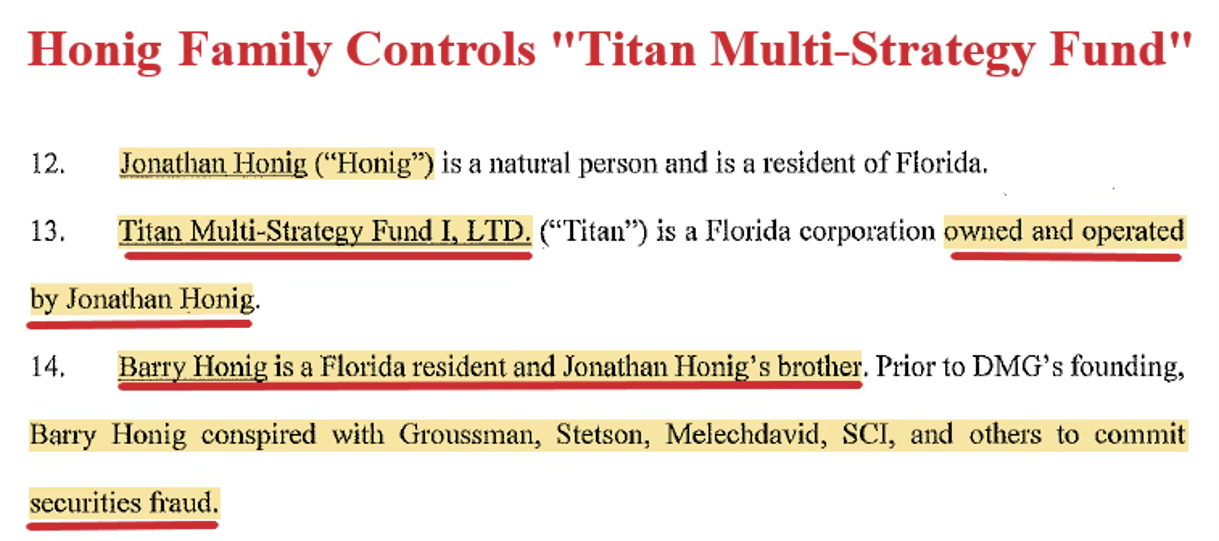

Barry Honig’s Family Hiding in ASPI Under Honig’s “Brother’s Fund”

We discovered an entity called Titan Multi-Strategy Fund that is run by Jonathan Honig (Barry Honig’s younger brother) as having owned 6.2% of ASPI.

The Massachusetts Securities division named Barry Honig, Jonathan Honig, and Titan Multi-Strategy as related parties in a “Consent Order” that charged the US Data Mining Group with “acts or practices that violated” Massachusetts securities law. The Consent Order makes it crystal clear the entire crew are related parties. The MA consent order states that in a prior case “Barry Honig conspired with…Stetson, and others to commit “Securities Fraud.” The SEC has accused Barry Honig and the Honig Crew of running “pump-and-dump” schemes.

Editorial Note Post-Publication* – The MA consent order does not specifically name Jonathan Honig & Titan Multi-Strategy as the “others” that Barry Honig previously “conspired to commit securities fraud” with. The SEC has charged Barry Honig, John Stetson, and the Honig Crew with Securities Fraud, but the SEC did NOT name Jonathan Honig and Titan Multi-Strategy in that Case.

Titan Multi-Strategy = “The Honig Family” were 6.2% owners of ASP Isotopes

*A correction was made on Nov. 27, 2024: An earlier version of the report incorrectly stated that Barry Honig, Jonathan Honig and Titan Multi-Strategy were charged in a “Consent Order” with manipulating a microcap. The consent order only charged a microcap US Data Mining Group with “acts or practices that violated” Massachusetts securities law and it named Barry Honig, Jonathan Honig and Titan Multi-Strategy as related parties. The Consent order names John Stetson as a “Bad Actor” but it does not call Jonathan Honig a “Bad Actor.” We also clarified other language regarding who specifically the SEC has charged with fraud that could have been read incorrectly. Please Note – Jonathan Honig & Titan Multi-Strategy have NOT been charged by the SEC with Securities Fraud.

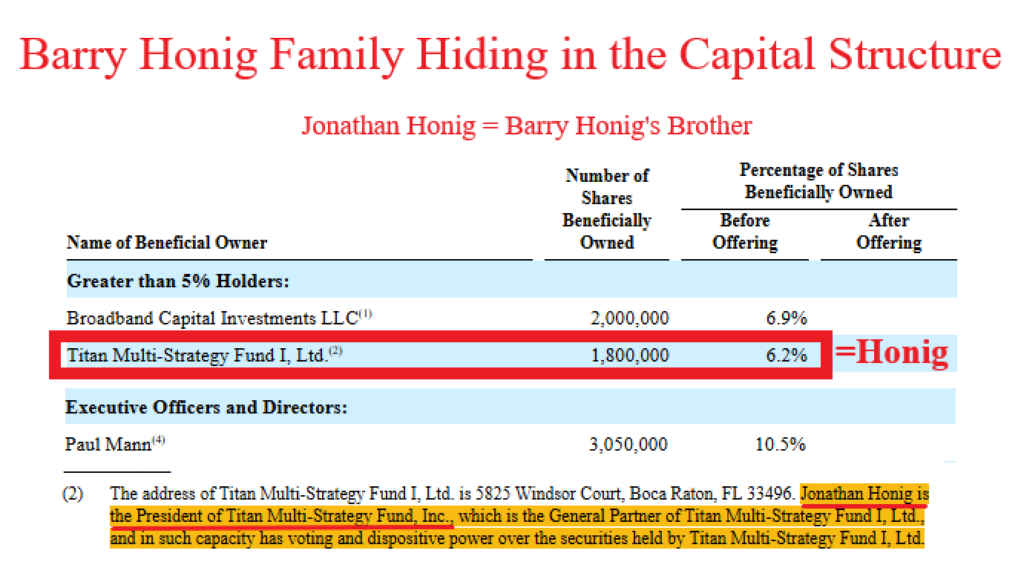

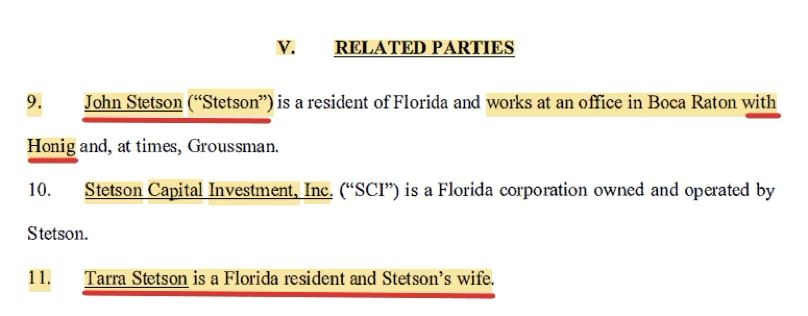

John Stetson’s Family – Hiding behind his Wife’s Ownership

John Stetson – another Honig Affiliate who was charged with fraud by SEC also shows up in ASPI’s capital structure. He appears to be using his wife’s name to try to obscure the Stetson family ownership.

John’s wife, Tarra Stetson, directly shows up in the S-1. The family’s ownership is not cleverly hidden: It shows up under the “Tarra Stetson Revocable Trust.” The 2300 E. Las Olas Blvd Fl 4 listed for Tarra shows up as a current address for John Stetson on background checks and is the same address John Stetson once used for his Charitable Trust & Stetson Capital investments.

Fun fact – Stetson’s charitable trust has not been so charitable in recent years as it evidently wrote down 100% of the assets in 2022, calling it “WOTHLESS STOCK.” Yes he even mis-spelled “Worthless”

The Massachusetts Securities division Consent Order with Honig & Stetson’s Crew also makes it clear that Tarra Stetson is indeed John Stetson’s wife.

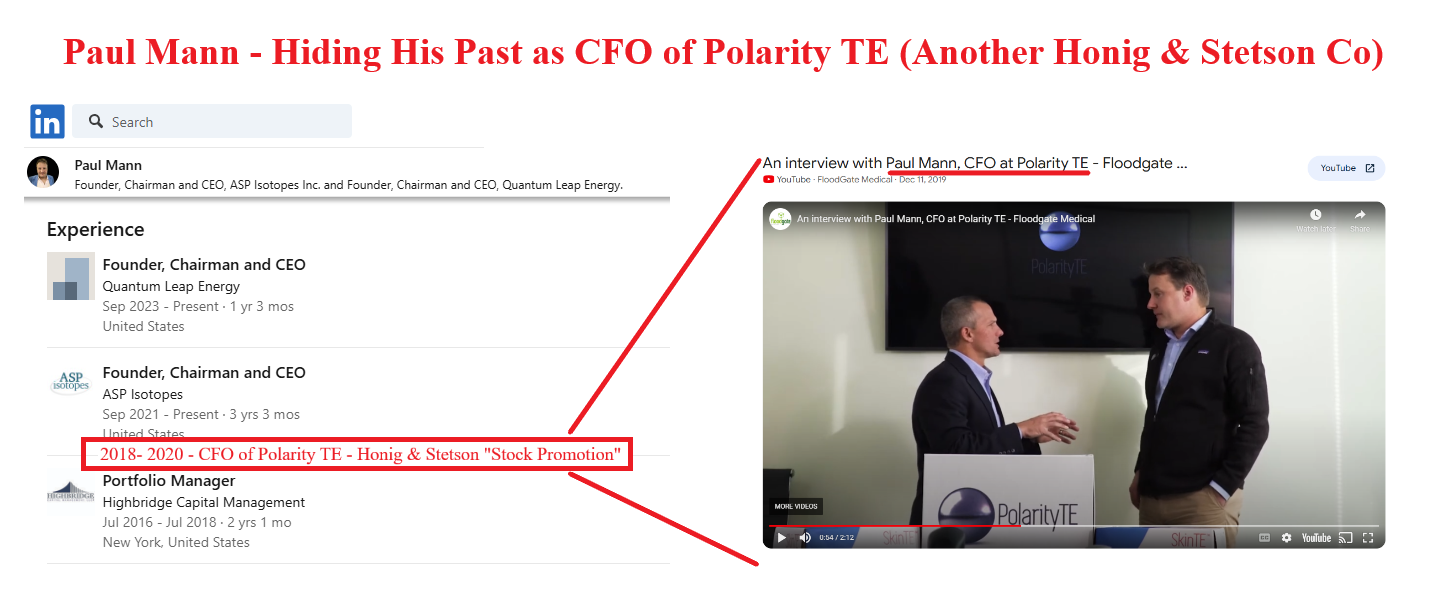

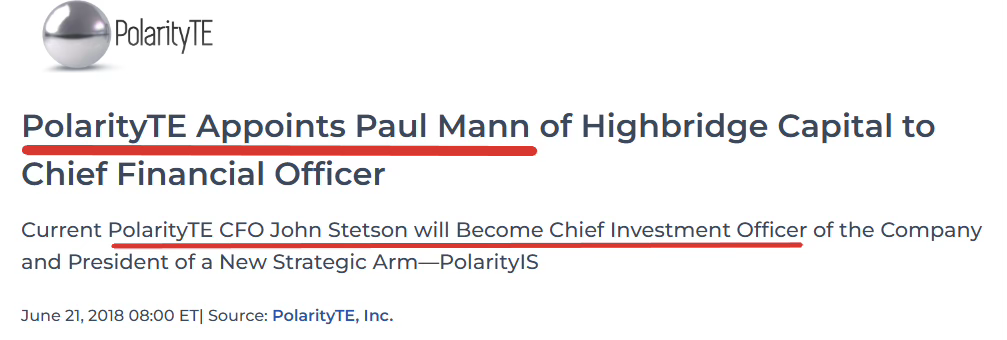

Paul Mann – Obscures Involvement in a Past Honig-Stetson Alleged Stock Promotion PolarityTE = Not COOL

ASPI’s CEO Paul Mann is more infamously known for being the CFO of Polarity Tech – PTE/COOL. Polarity Tech was another of Honig & Stetson’s reverse merger and failed stock promotions. PTE’s stock has fallen 99.9% since Paul Mann joined John Stetson at Polarity Tech.

Paul’s LinkedIn completely omits his past C-suite experience running a company that a prominent short-seller called a “Blatant Fraud.”

Part II – ASPI’s Questionable Start:

- Incorporated in Sept 2021 Funded <90 Days Later by a Shell Co That Appears to Be Controlled by the Honig Crew

- HQ was a Boca Raton Virtual Office

- Current HQ is a Co-Working Space

ASP Isotopes was incorporated in Delaware in September 2021 by Paul Mann, who has zero known expertise in nuclear energy.

The next month, ASP Isotopes bought Molybdos, a bankrupt South Africa company at a bankruptcy auction for <$750,000 and entered into a licensing agreement with its financially distressed connected party Klydon.

Less than 90 days after being incorporated, ASP Isotopes got a key investment from a pharmaceutical company. ASP sold 500k shares for $1.0m to Aikido Pharma (AIKI). We uncovered that this key investor, Aikido Pharma actually has a nefarious history of it’s own and since making the investment has done the classic shell company pivot and changed it’s name to Dominari Holdings (DOMH).

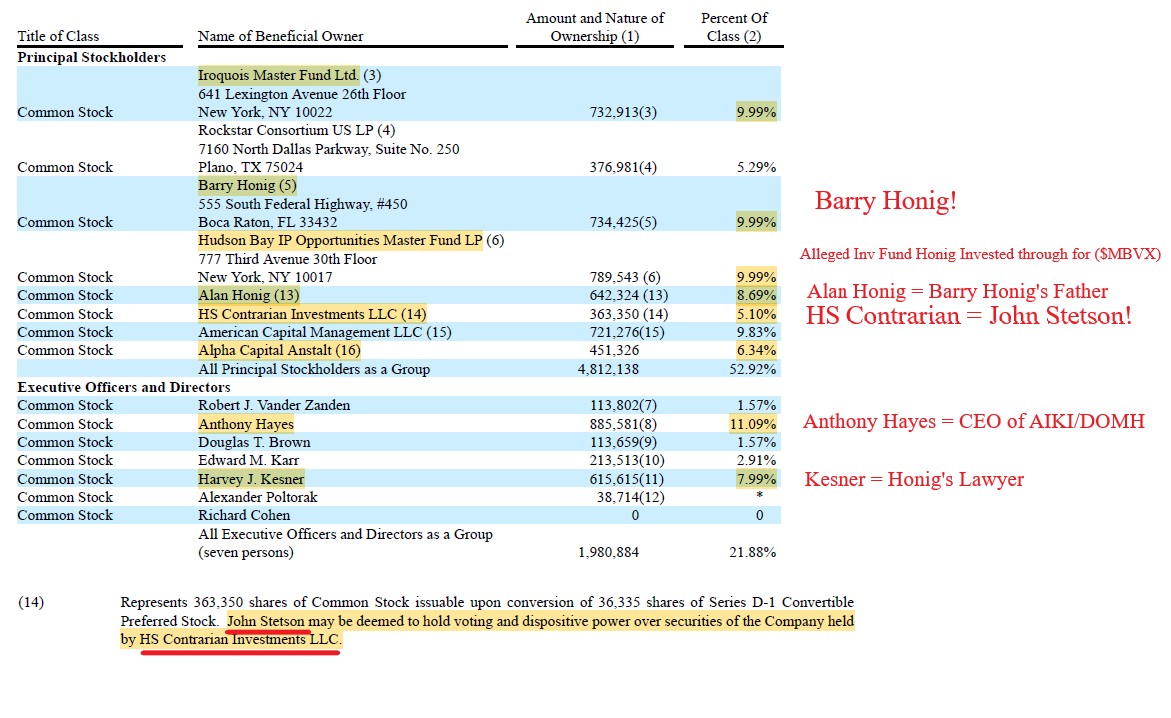

How a Secret Investment Shell Co Could Be Hiding More of Honig’s Involvement?

The publicly traded investment shell company now known as (AIKI/DOMH) was originally a different shell company known as Spherix (SPEX). We discovered that this was one of the early public shell companies of the Honig Crew.

Honig Family & Friends (John Stetson; Hudson Bay; Iroquois; Honig’s Dad, Alan; and Honig’s lawyer, Harvey Kesner, etc) appeared to have taken over this shell company in 2013/2014 and then turned it into their own personal public shell company for running patent troll lawsuits, buying IP, and making investments into unknown companies that in the future look a whole lot like stock promotions.

For fun, here is a video of Honig & lawyer Kesner after consuming too many edibles and calling an ambulance on themselves at the Roth 2014 conference.

Below are the key shareholders of Spherix (later Aikido) after the Honig Crew gained control from the 2014 proxy (pg 18). We believe they are still running the show.

Is the Honig Crew Violating Its Penny-Stock Ban?

Honig’s SEC settlement came with a $27 million fine and also FORBID him from investing in penny stock offerings. Honig consented to a life-time ban.

We believe he found a loop-hole. The lifetime ban did NOT require Honig to liquidate all his existing micro-cap investments. As a result, he would not have been forced any holdings in the shell co SPEX which is now AIKI/DOMH. Unsurprisingly, after Honig’s settlement with the SEC in 2020, the shell company (Aikido Pharma) ramped up its investing in micro-caps. This investment shell appears to have consistently been used to launch and invest in other companies that then go public and ultimately look a whole lot like pump & dumps.

Akido Pharma/Dominari Holdings recent IPOs include:

- Hoth Therapeutics (HOTH): Feb 2019 -99.5%

- Silo Pharma (SILO): Jan 2021 -94.8%

- Vicinity Motor(VEVMQ): June 2021 (uplist) -99.8%

- DatChat, Inc (DATS): August 2021 -95%

- Unusual Machines (UMAC) – Feb 2024 -32.5%

- ASP Isotopes (ASPI): November 2022 +191%

Complex Circler Fees that End Up at Former Honig Shell?

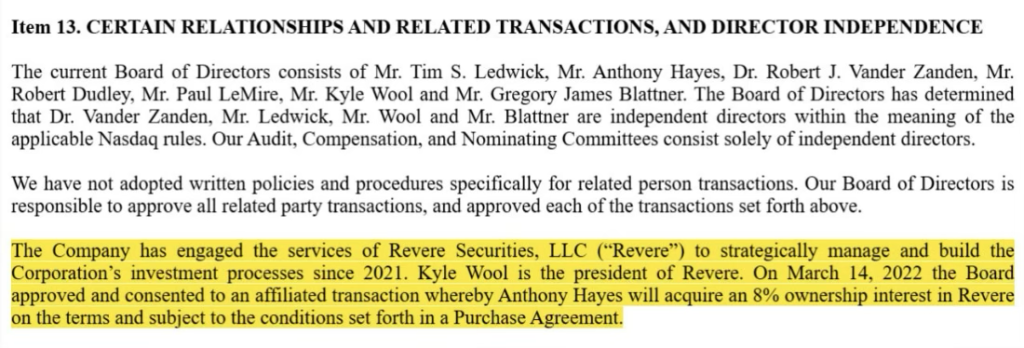

ASP Isotopes went public on Nov 10, 2022, through an IPO run by Revere Securities LLC. Revere Securities was paid 5% of total common stock in warrants and 8% of gross proceeds.

Suspiciously, 7 months prior, a disclosure from Aikido (the former Honig entity) shows the CEO of Aikido Pharma acquired 8% of Revere.

Visits to ASP Isotope’s US HQs =

- Virtual Office Space in Boca Raton

- Co-Working Regus Office Space in DC

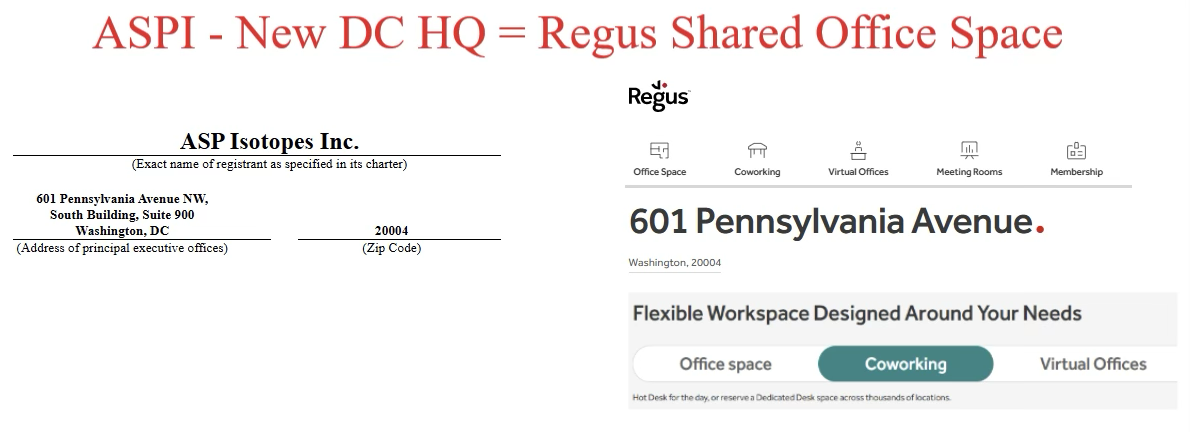

ASP Isotopes was first headquartered out of a virtual office space in Boca Raton when it IPO’ed. Now that it is a >$500 million market cap company, it’s moved up in the world, and has a in real life headquarters in Washington, D.C. But ASPI hasn’t forgotten its sketchy roots – the Washington DC HQ is a Regus operated shared Co-Working office space.

Original HQ = Virtual Office Space.

ASPI’s initial HQ was located at 433 Plaza Real, Suite 275, Boca Raton, Florida 33432. A $73/month virtual office space.

Current HQ = Co-Working Office Space

Now that ASPI has a $500+ million market cap company, they have upgraded their headquarters from a virtual office to a Regus Co-Working shared office space.

ASPI’s current address is 601 Pennsylvania Ave – South Bldg – Suite 900; Washington DC 20004. We visited both this office & their previous DC office in person and found a Regus Shared Office Space. The multiple times we visited we confirmed the location is a Regus Co-Working space, but we did NOT find any ASPI employees present during our visits.

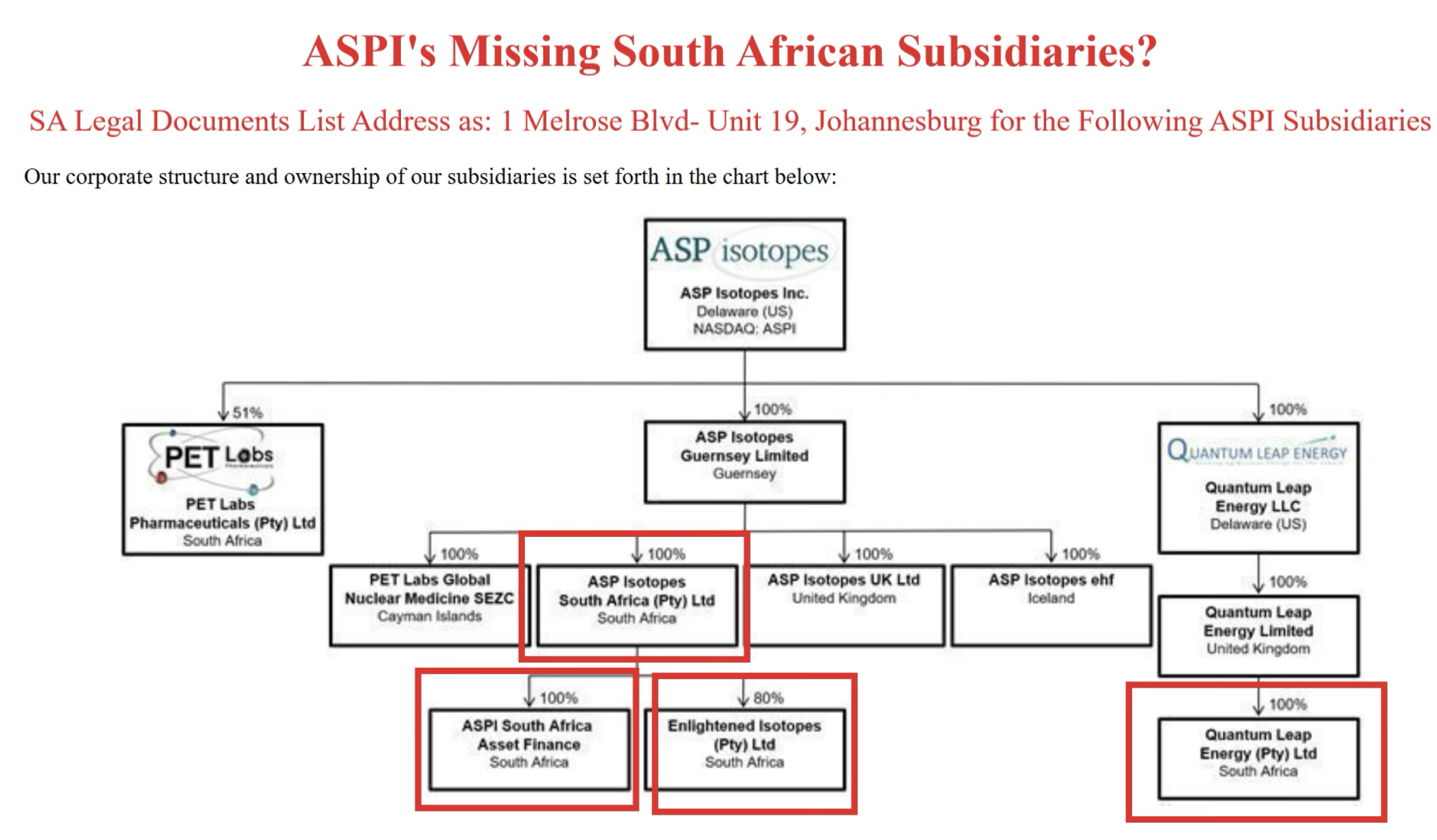

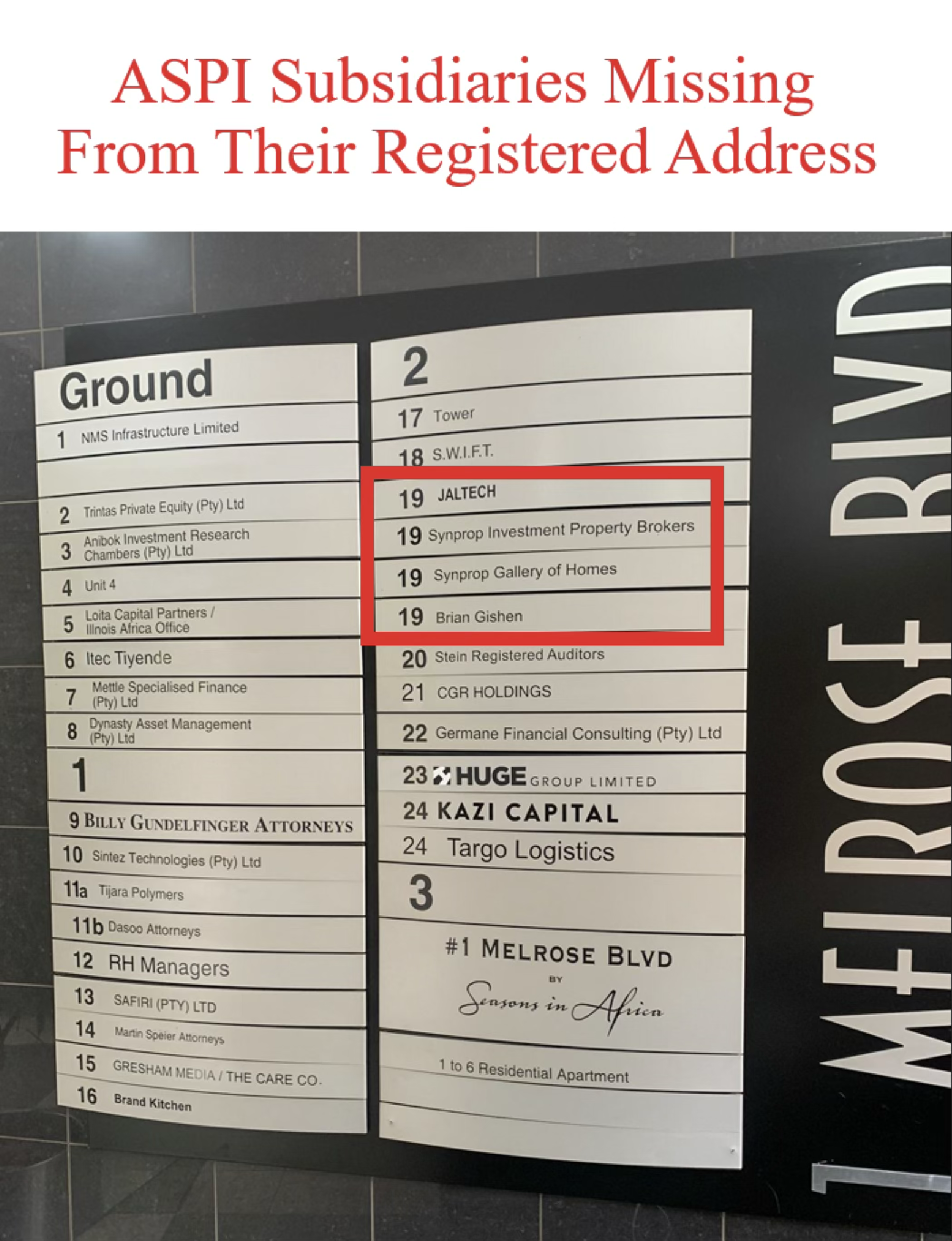

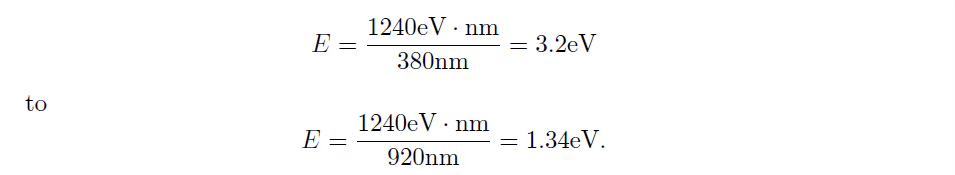

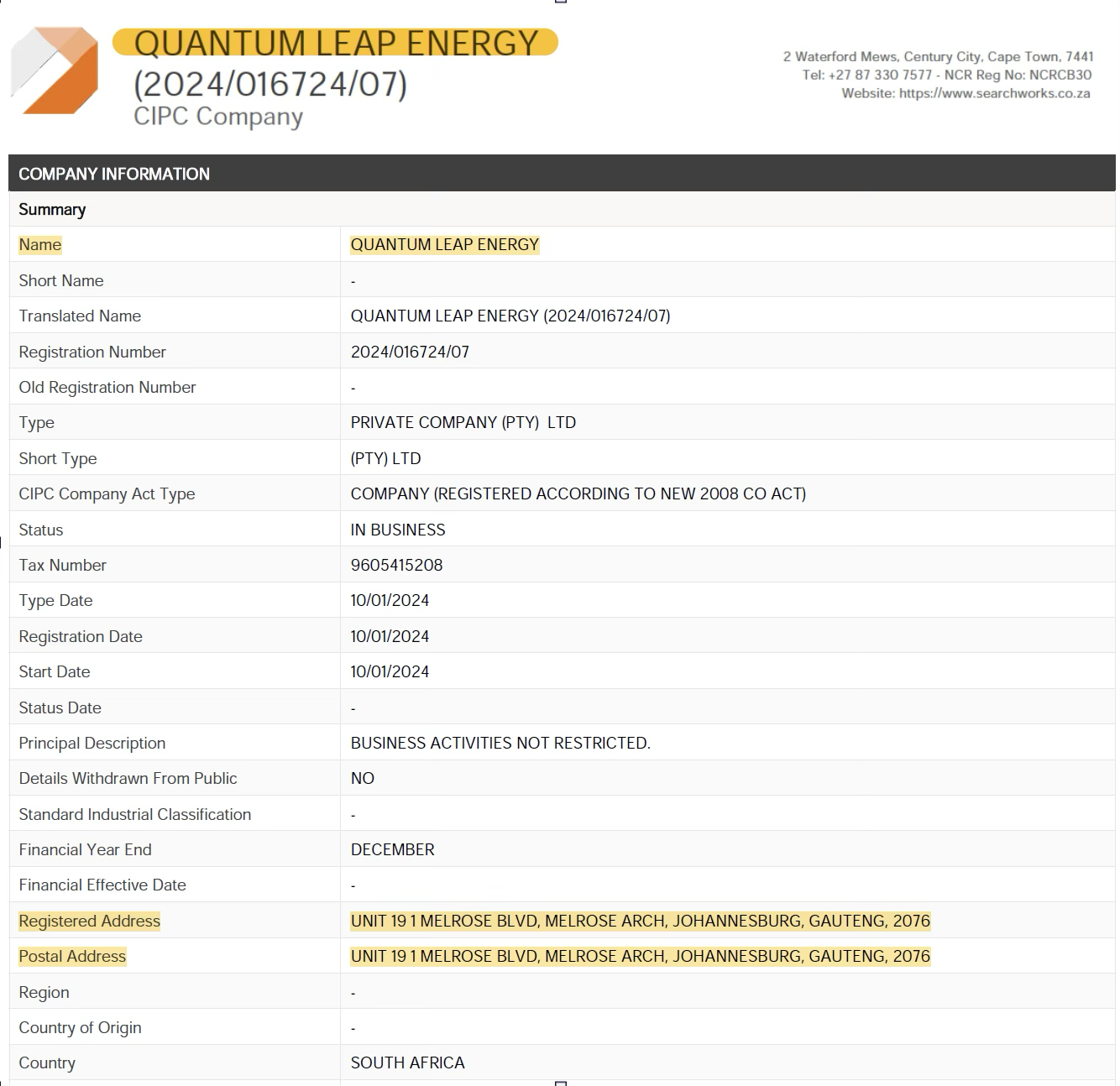

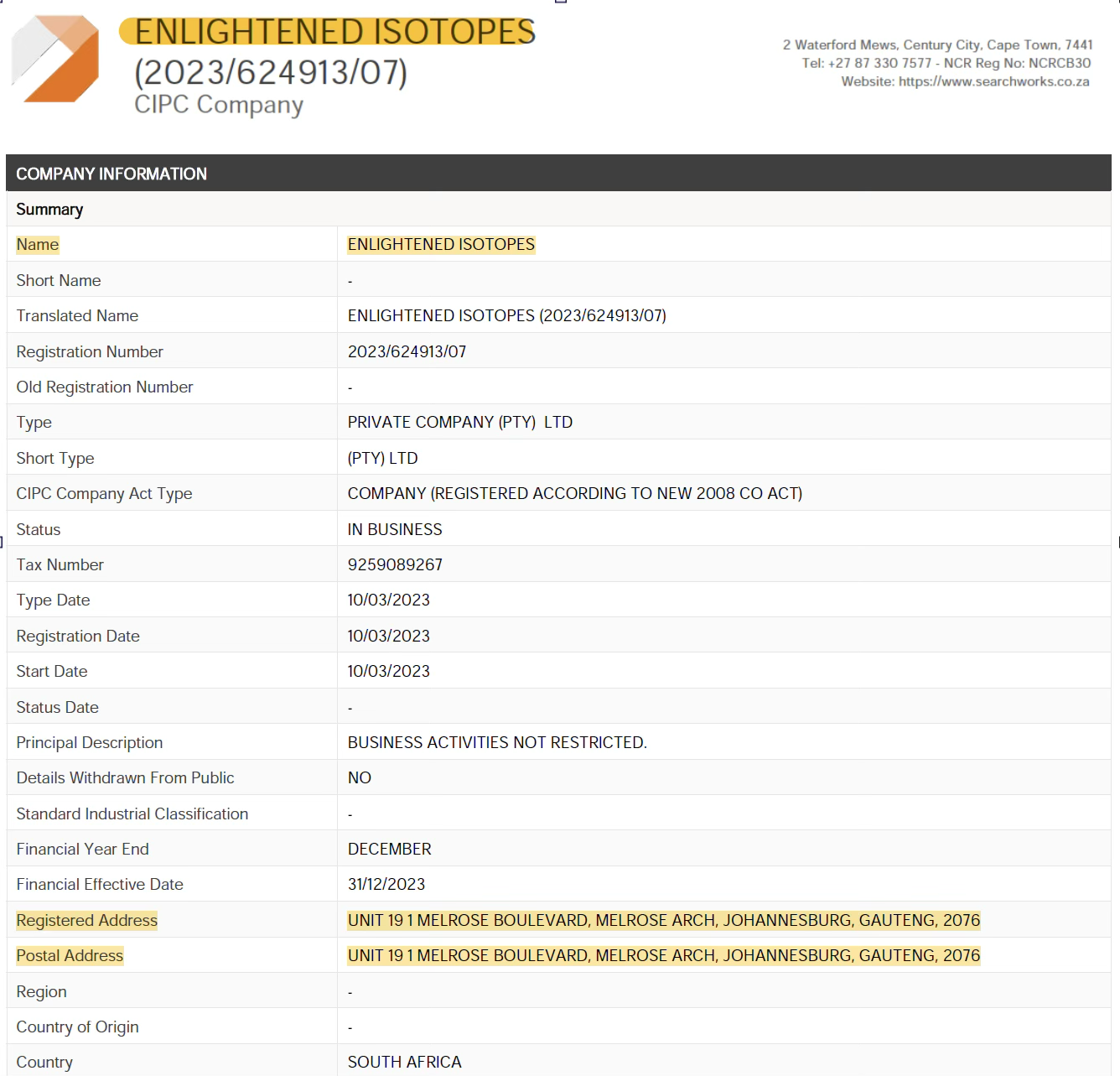

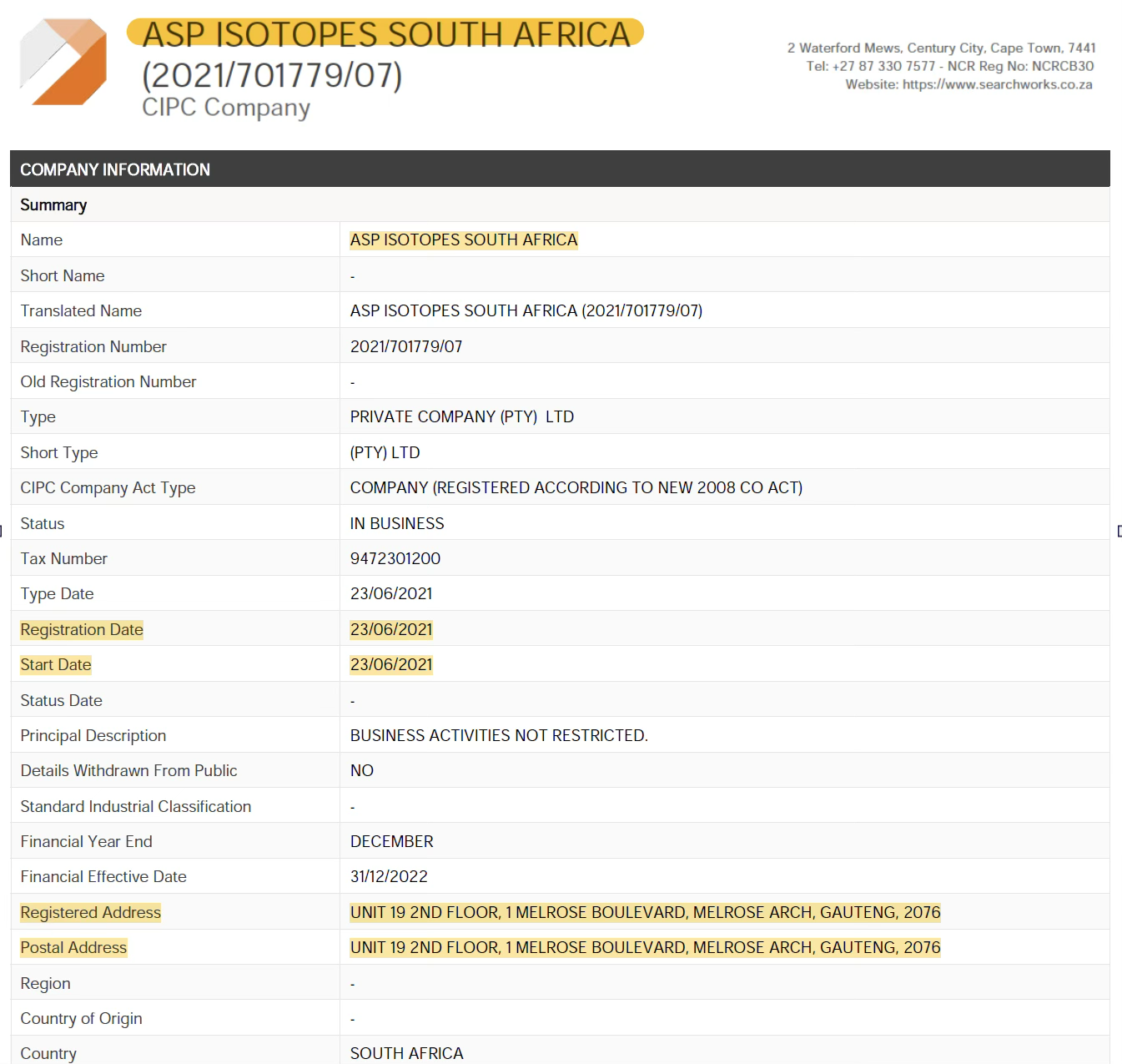

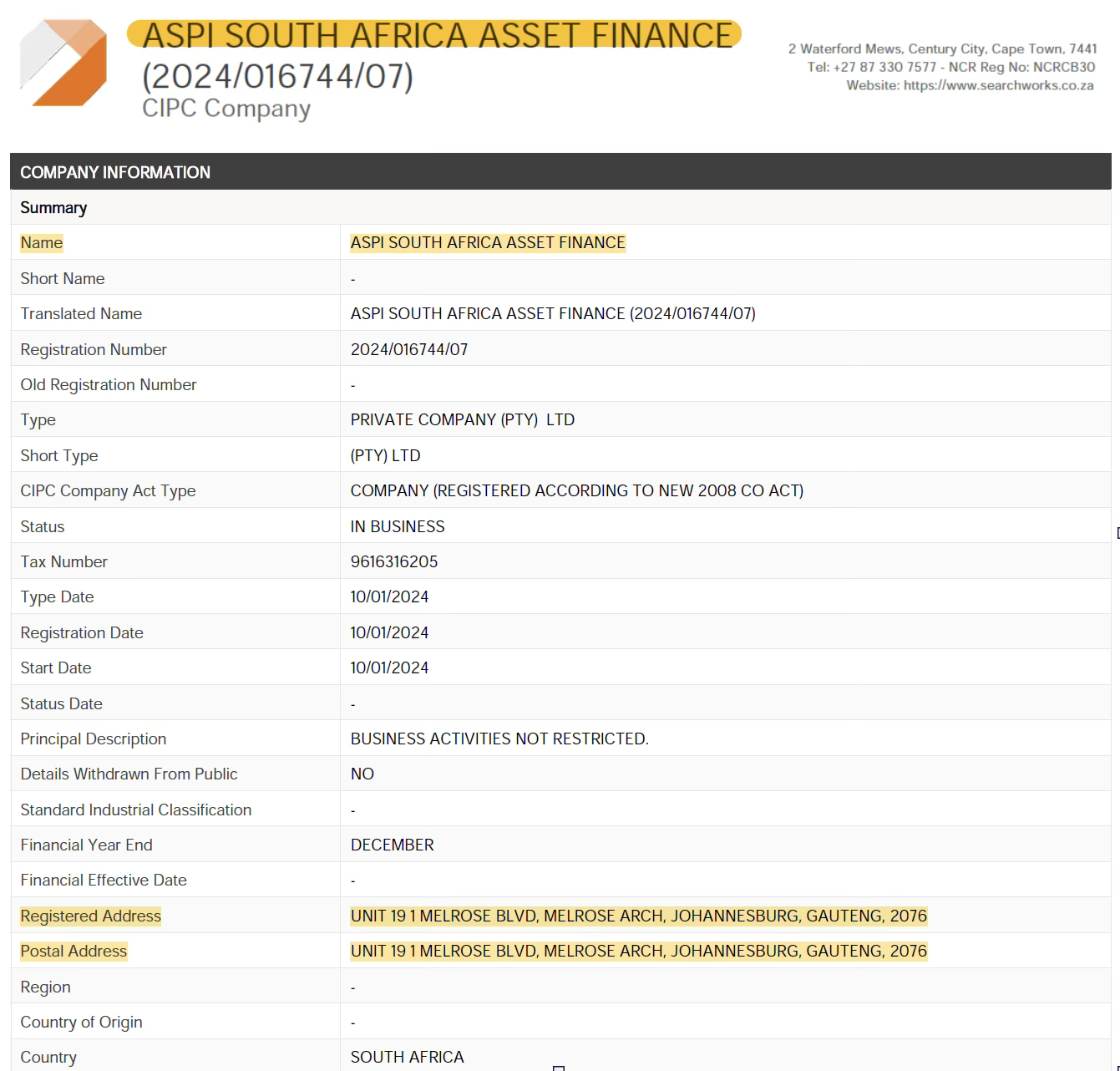

Part III – South African Subsidiaries: Many List Same Address. We Visited. They Were Not Actually There

We hired a local South African Investigator to pull ASPI’s South African subsidiaries filings (only someone with a South African ID number can do this). We then had our investigator visit the listed addresses. Shockingly, almost all the subsidiaries had the exact same address.

We visited the primary location — 1 Melrose Blvd- Unit 19, Johannesburg, South Africa — hoping to get answers. But we found that the ASP Isotopes’s SA subsidiaries were NOT actually there.

There was ZERO sign of any of the companies at their listed address ASP Isotopes South Africa, Quantum Leap Energy, Enlightened Isotopes, or ASPI South Africa Asset Finance.

When we asked security guards and neighboring business about them all told us they had never heard of the companies. The one thing we did find at that location was a South African retail investing fund, called Jaltech, that appears sketchy and shares the same address as ASPI’s key subsidiaries as well as some Board Members who are hiding on the subsidiary filings.

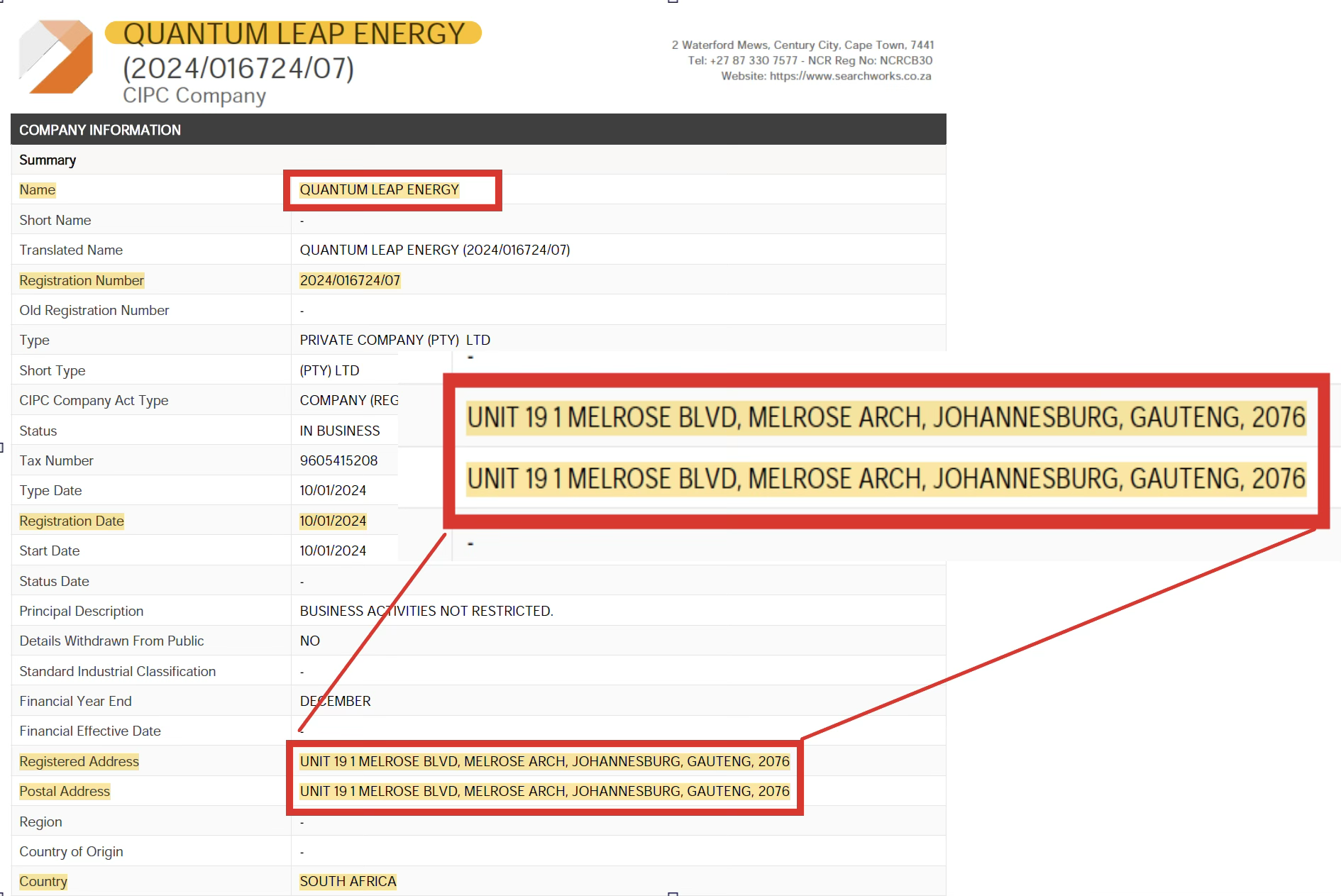

South African Registration Documents Clearly Show the current address as1 Melrose Blvd- Unit 19, Johannesburg, South Africa.

For Example – Quantum Leap Energy’s South Africa Current CIPC Statement show the registered and current postal address as 1 Melrose Blvd- Unit 19, Johannesburg, South Africa.

All ASPI Subsidiaries Were Are Missing from the Building Directory at 1 Melrose Blvd – Unit 19; Johannesburg, South Africa

Quantum Leap Energy, Enlightened Isotopes, ASPI SA Asset Finance, or ASP Isotopes SA HQ were nowhere to be found.

Part IV – Does ASP = Another Stock Promotion? – Multiple Paid Stock Promoters Found:

Do good companies with great technology ever engage in Paid Stock Promotion?

NO!

If you answered maybe or yes, then go directly to Boca Raton.

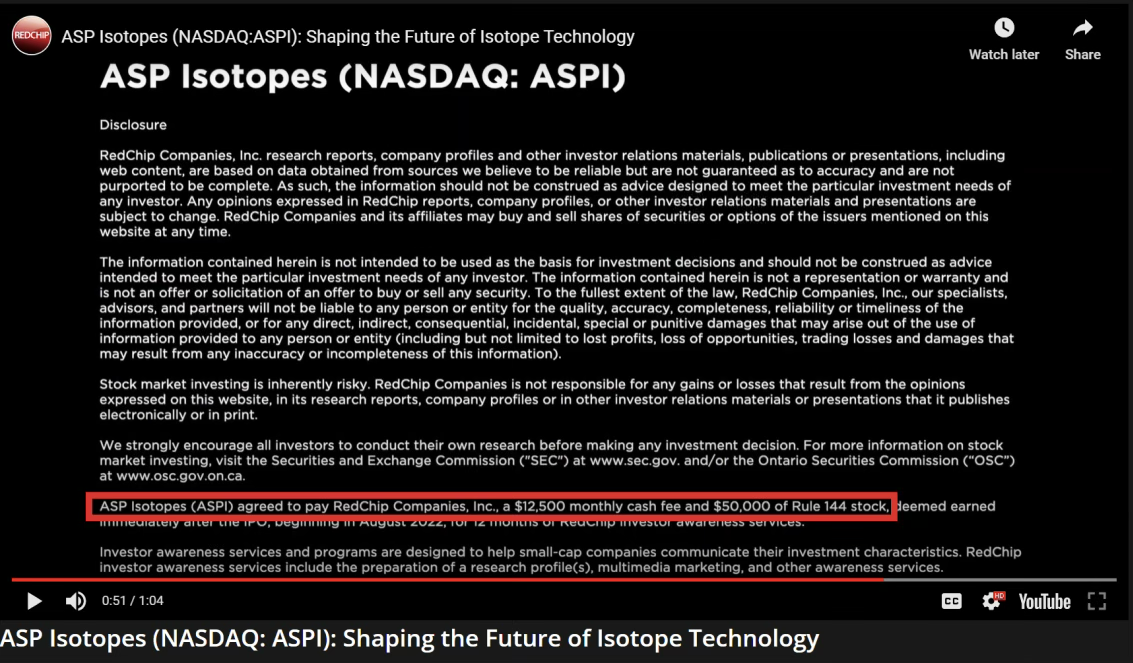

We discovered that ASPI has been using paid stock promotion services to promote the company.

RedChip Companies – Known Stock Promoters

RedChip Companies has been promoting ASPI in exchange for free shares and $12,500 monthly fee and an additional $50,000 for 14 days of ads.

Stories that Redchip have run on ASPI also claimed that the company would generate free cash flow in Mid-2024

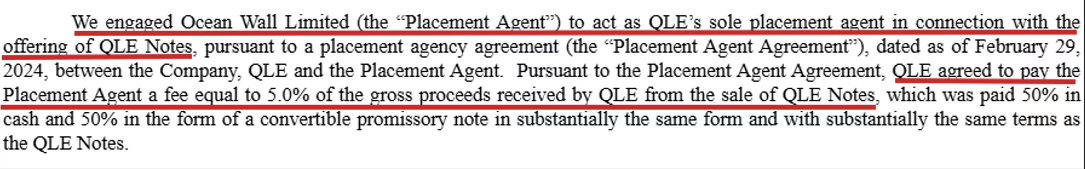

Ocean Wall – Bullish Research for High Banking Fees

Ocean Wall issues favorable investment research and articles in exchange for payment from companies. Is it surprising that this research is bullish on the company when the it’s paid for by the company?

More Paid Stock Promotion:

YouTube Stock Promotion — Emerging Growth Conference:

ASP Isotopes is using a paid stock promotion service called the Emerging Growth Conference for YouTube stock promotion. Emerging Growth.com (”EG”) has very vague disclosures, but those disclosures say that companies pay high quarterly fees for the exposure. More important, it shows that Emerging Growth is controlled by “Global Discovery Group.” According to SEC charges, “Global Discovery are paid stock promoters.”

ASPI “presented” at least 12 times at the conference (in Dec 2023, March 2024, April 2024, July 2024 in Sept 2024, Oct 2024) and is highlighted prominently on the Emerginggrowth.com website. For ASPI to join the “conference” — aka make a YouTube video — they pay $7500 a quarter and any company with a report written on them is required to pay an additional $55,000 a year. Sadly, at $7500 a quarter that means ASPI is paying more than $7.50 per Youtube impression.

The PennyQueen & Others: There are also articles by characters like the PennyQueen, whose website has since been removed (wayback version). The articles seem eerily familiar to the paid undisclosed promotions Honig’s crew has been accused of using in the past.

Part V – TerraPower Executives Ranked ASPI at the Bottom in Terms of Quality

- TerraPower Executives Said the MOU is “Non Binding” & “Required Zero Capital Commitment”

- TerraPower Executives Were “Most Skeptical” of ASPI’s Ability to Deliver

ASPI’s Stock shot up ~150% over the last month. The major reason for this share spike was … a press release.

TerraPower had publicly announced that they signed a term sheet with ASP Isotopes. To understand if this was just a press release or if this was going to be the rare Honig-Stetson company that had a technological advantage, we spoke to former TerraPower executives in charge of procurement and nuclear executives at competitors. They told us it was just a press release, a public announcement.The TerraPower-ASP Isotopes agreement is likely “Non-Binding” and required “Zero Capital Investment,” they said.

The former executives told us privately that the true purpose was to show the DOE that they had a recovery plan and to put pressure on their real suppliers. The executive said if TerraPower was actually confident in ASPI’s ability to deliver, they would’ve issued a purchase order rather than a MOU.

“This is NOT a purchase order [with ASP Isotopes]. This is just a memorandum of understanding…this term sheet MOU. It’s really just a public announcement…I would be confident if TerraPower had issued them a purchase order versus an MOU…

~TerraPower Former Executive in Procurement

So a purchase order that means there is a there’s a technical specification. A purchase request. There is a statement of work… it’s a lot more involved than an MOU. Mou is just an MOU. It’s not a binding agreement.”

The Terrapower-ASP Isotopes agreement is … non-binding and does not have a capital requirement.

~Centrus Energy Corp Executive

“Think about it from a TerraPower’s perspective, what does it hurt to, to go sign a non-binding agreement? You know? … What ASP is really selling is hope.”

~Former Centrus Energy C-Level Executive

ASPI was Ranked at the Bottom in Terms of Quality

Q) Who would you rank at the bottom?

~TerraPower Former Executive in Procurement

Probably ASP Isotopes …

[ASPI] still have to build the manufacturing facility. [ASPI] still have to qualify the process. ASPI is missing the manufacturing; They are missing the processes as well; They still have to develop the HALEU…the most important part”

Nuclear Executives Also Thought ASPI’s Timeline was Unrealistic

How would you characterize the projected timeline and forecasts?

“It’s too optimistic. And not real… That’s my view on it. And again, I have been around. I’ve worked on real projects, and I’ve seen how things work.”

~ TerraPower Former Executive

Part VI: Un-Economic Technology That Many Evaluated but No One Wants to Buy

- Centrus thought ASPI was NOT worth $2M

- Cameco Scientists Thought It Would NOT Work on Uranium

- ASPI Has Zero Patents

Centrus Executives Looked at Acquiring ASPI’s Tech in 2022 and Decided It Was NOT Even Worth $2 Million

Competitors told us they looked at buying ASP Isotopes technology. They told us they passed because their scientists concluded that ASPI’s process was uneconomic and the timeline for it to be approved by the NRC was likely 10-15 years away.

They told us they could have bought it for less than $2 Million and thought it wasn’t worth it!

“We could have bought it [ASPI] for a couple million, and we didn’t think it was worth it. So, at $500 million [market cap], you’re scratching your head.”

~Former Centrus C-Level Executive

Cameco – Another Nuclear Co Was Skeptical of ASPI Tech; Their Scientists Didn’t Think It Would Work on Uranium

We spoke with a former employee of Klydon (the company ASPI bought the tech from) and they told us that Klydon had also tried and failed at selling the tech to Cameco. The former Klydon employee told us Cameco’s scientists were “very skeptical of the technology” and Cameco “did NOT think it would work on uranium.”

Cameco has since built a 49% holding in their JV with Silex called Global Laser Enrichment, the only NRC-licensed laser enrichment technology.

ASP Isotopes has Zero Patents:

Like all Honig & Stetson past failures, ASP Isotopes is lacking something incredibly important: Patents! ASPI has Zero Patents!

ASPI management wants investors to think that their lack of patents is a positive thing. Management says their process is a trade secret. If they patented the technology or process, competitors could discover the secret sauce.

This is completely ridiculous. ASPI claims to be working on complicated cutting edge nuclear fission, not protecting the secret recipe to Coca-Cola.

In our calls with nuclear industry executives, they would consistently crack up laughing when we told them that ASPI’s management claims that they will only need to spend $10 million per plant to get a commercial enrichment plant up and running.

PART VII – ASPI Tech is Failed 1990s Tech That USA Gave Away For Free. Even IRAN and IRAQ Rejected It!

- “Tech” is a Recycled Failed US Gov’t Project from 1990s

- Japan and, yes, Iraq and Iran, Tried Developing Same Tech. All Concluded it was Commercially Useless.

- Lacks NRC License to Enrich Uranium & Didn’t Even Bid for Large DOE Award

ASPI used to admit that they have tied investor’s hopes and dreams to a process that is actually a failed DOE project from the late 1990s called AVLIS. AVLIS stands for (Atomic Vapor Laser Isotope Separation), which basically is enriching isotopes (like uranium) with lasers. This is the key technology ASPI is hyping. Unfortunately for ASPI, lots of governments have already tried AVLIS and determined it does NOT work commercially.

Even worse, all the AVLIS failures and wasted government funds are publicly documented.

USA = ~$2.0 billion & 26 Years Wasted – U.S. Abandoned AVLIS & Gave It Away For FREE

The US Government wasted 26 years and ~$2.0 billion trying to commercialize uranium AVLIS technology before giving the tech to USEC for free (United States Enrichment Corporation, now known as Centrus Energy). After only a year of owning the technology, USEC shut down the AVLIS program.

The US isn’t the only country that tried to develop an AVLIS laser-based isotope separation technique for uranium enrichment.

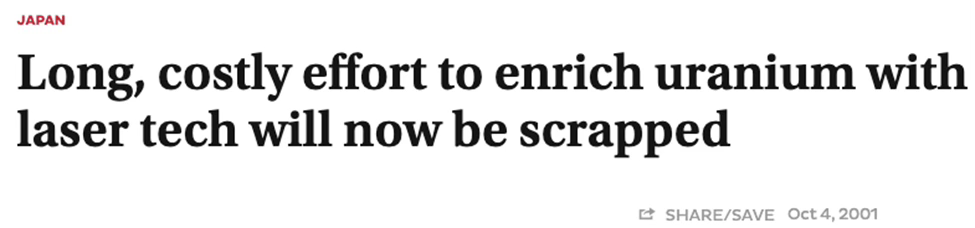

Japan Scrapped Their Program Called Laser-J in 2001

Researchers in Japan have also conducted research and development on AVLIS enrichment. This process, called Laser-J, was very similar to the U.S. AVLIS approach and was scrapped in 2001.

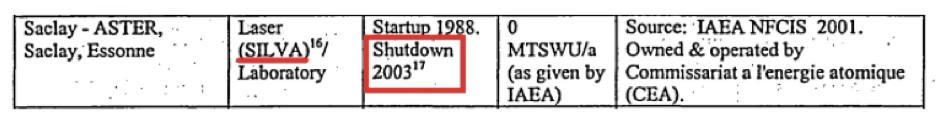

France’s Laser Program “SILVA” Shutdown in 2003

France’s SILVA program was nearly identical to the U.S.’ AVLIS technology and was also shut down due to difficulties scaling up the process.

Even Iran & Iraq Abandoned It!

In fact, twenty nations have researched laser isotope separation – Pretty much all of them abandoned it!

“In total, more than 20 other nations have researched laser isotope separation techniques. A report by Boureston and Ferguson [2005] includes Argentina, Australia, Brazil, Britain, China, France, Germany, India, Iran, Iraq, Israel, Italy, Japan, the Netherlands, Pakistan, Romania, Russia, South Africa, South Korea, Spain, Sweden, Switzerland, the United States and Yugoslavia.” (source)

Pretty much all of them decided that it was “NOT commercially viable” and “Unprofitable.”

We are not saying the technology is fake … it works, but evidently only at a small lab scale. The reality is that most nuclear companies and governments have studied AVLIS and many have wasted billions of dollars realizing that AVLIS (which ASPI’s hopes and dreams are pinned on) is inferior and unprofitable.

A 2012 Berkeley study stated: “It is unclear whether AVLIS for uranium enrichment is even feasible.”

But we think a research paper from 2005 describes it best, saying, “AVLIS has left the building”

Why AVLIS Failed? It’s Expensive! High Heat & Vapors Destroy the Equipment

Essentially AVLIS vaporizes expensive equipment the same way that we believe owning ASPI vaporizes investors’ portfolios.

Why doesn’t it work?

For the basic investor – Uranium metal must be vaporized. This causes highly corrosive vapor to be released, which destroys all of that very expensive equipment used to do the vaporizing.

For the more advanced investor – The fundamental issue with an AVLIS-based technology is that it requires uranium metal as a feedstock, as opposed to uranium hexafluoride (UF6) which is a gas and is used as the feedstock in all other current enrichment technologies. Uranium metal causes many challenges because ASPI needs to vaporize the metal at an extreme temperature of 3,400°C. Atomic vapor is extremely corrosive and has been shown to destroy the material within the separator device. When the U.S. Government set up an AVLIS pilot plant, the vapor destroyed the equipment within the separator device and required refurbishing the separator every 400 hours (22 times a year), making it costly and uneconomical.

This was a key reason why the AVLIS program was shut down. IT WAS TOO EXPENSIVE!

Same Old Tech…But With New Arrows!

- ASPI Did Not Even Bother to Change Images from Old NRC Papers. They Only Changed the Arrow Size

ASPI’s “Quantum Enrichment” technology sounds cool but the reality is they are just selling investors a 20-year-old dream that AVLIS will work.

“What ASP is really selling is hope”

~Former Centrus C-Level Executive

ASPI’s investor presentation make this even clearer as they are plagiarizing “recycling” images from NRC studies from >15 years ago.

The only innovation between a 2008 NRC research paper and ASPI’s presentation pitching “Quantum Enrichment” seems to be that ASPI is using smaller arrows & different colored isotopes in the photo.

Source: NRC 2008 Enrichment Module (link)

Source: ASPI September 2024 Investor Deck (link)

ASPI Does NOT Even Have an NRC License to Enrich Uranium

ASPI Is NOT licensed to enrich uranium or handle nuclear material with the NRC.

Experts told us it will likely take ASPI 10-15 years to get the appropriate licenses from the NRC to be able to export HALEU into the US.

“Our number one issue was time … Most of our people thought they were 10 to 15 years away before they would start actually importing HALEU… we think the CapEx is way underestimated”

~Former Centrus C-Level Executive

ASPI also Thinks It’s Unlikely They Will Get Licensed

A former Klydon executive pointed out that if the technology was as good as ASPI claims, someone surely would have by now found a way to get the necessary licenses and test it on uranium to prove its worthiness.

ASPI agrees with our research, admitting they don’t have any licenses to enrich uranium, and think it’s “highly uncertain” they will ever receive them!

ASPI Did NOT Even Bid for DOE HALEU Contract

DOE Invited Companies to Bid for HALEU Enrichment Contracts – ASPI Did NOT even bid

The DOE awarded contracts for four companies to provide HALEU enrichment. The contracts were worth up to $2.7 billion. The contracts were awarded to Urenco USA, General Matter, Centrus Energy, and Orano. We have been told that ASPI did NOT even bid

A Los Almos Applied Physicist’s Thoughts on Why ASPI’s Tech is BS

We asked an applied physicist who recently worked at Los Almos National Laboratory – you know, the place where the Allies developed the atomic bomb and saved the world! Below is their thoughts on ASPI’s solution of using AVLIS to enrich HALEU. They started doing math and equations that were very confusing but all essentially boiled down to the fact that it does not take a PhD to understand that ASPI’s management claims are BS.

But for investors inclined to math & equations, please see Appendix B for a full accounting of the BS.

We asked the applied physicist to explain the tech’s problems basic terms. They answered:

“Quantum laser enrichment requires uranium in a gas form. The temperature required to make uranium a gas will damage other sensitive parts of the experiment such as lasers, or the parts used for separating the gaseous uranium.”

Basically, ASPI’s method of using quantum laser technology to enrich HALEU sounds really cool. But in reality, it burns up the lasers and other equipment needed to do the enriching.

Silex Systems CEO Told Us That AVLIS Does NOT Work:

The Silex Systems CEO and founder told us at commercial scale that AVLIS will NOT work.

Silex Systems has been working on laser enrichment since 1988. It has been approved by the NRC to enrich uranium, and is considered the leader in laser uranium enrichment.

“I can’t see any different way to do AVLIS…AVLIS will take lots of time and money to do again…I have very low hopes for ASPI”

~ Dr Michael Goldsworthy, Silex Systems CEO

High-Cost Reality – Experts Laughed at ASPI’s Cost Projections & Estimated They Will Be At Least 10x Higher

- TerraPower Executives – Hundreds of Millions

- Centrus Executive – At Least a Billion

Management is telling investors it will only cost $10 million.The experts we spoke with told us it would cost way more than that, and that’s just to get it to the pilot phase.

TerraPower Former Executive – It will Cost ASPI “Way More” … “Hundreds of Millions”

Q) ASP has said that building out the facility for HALEU costs about $10 million. Is that accurate?

(Hahaha) “It’s not. It’s going to be way more than $10 million…hundreds of millions sounds about right…[Their estimates are] too optimistic. And not real…That’s my view on it. And again, I have been around. I’ve worked on real projects and I’ve seen how things work.

~Former Terrapower Executive

Centrus C-Level Executive – It will cost “At Least A Billion Dollars”

“At least a billion dollars. I don’t think you could mass scale an enrichment plant for under a billion dollars.”

~Former Centrus C-Suite Executive

Part VIII – Trump Card – Would You Bet Against Russian Supply Now?

Former executives from TerraPower told us if Trump restores trade relationships with Russia, then MOUs with companies like ASPI will fall apart immediately. They told us “ASPI would be dumped right away.”

The whole [TerraPower] project concept was that they’re going to be obtaining HALEU from Russia. And under the Biden and after the Ukraine war, Russia was forbidden. We were forbidden from making deals with Russia, especially when it comes to nuclear technology, nuclear fuel. So, they had to develop another source and this is a recovery plan.

If, under the Trump administration, things change with regards to Russia, ASPI will be dumped, right away…I think Trump’s going to restore relationship with Russia….”

~TerraPower Former Executive

History of Why TerraPower Would Need an Alternate Supply Due to Potential Regulations on Russia:

In May 2024, President Biden signed legislation that started prohibiting the import of Russian uranium products into the US starting in August 2024.

TerraPower reactors run on HALEU, and out of all SMR companies out there, they likely require the largest amount of HALEU. Prior to the Russia-Ukraine war, the US had access to Russian HALEU, which was a cheap steady supply of fuel. Russia was one of the only countries producing HALEU since most reactors today run on LEU. Since the war, sanctions against Russia have made it more difficult to import Russian enriched uranium and in turn have increased price estimates of HALEU from ~$7,000/kg to ~$30,000/kg. TerraPower was left in a position where they had nowhere else to procure HALEU, so TerraPower is signing contracts with all the companies they can, hoping one of one of them will actually be able to supply their fuel if uranium sanctions come to fruition.

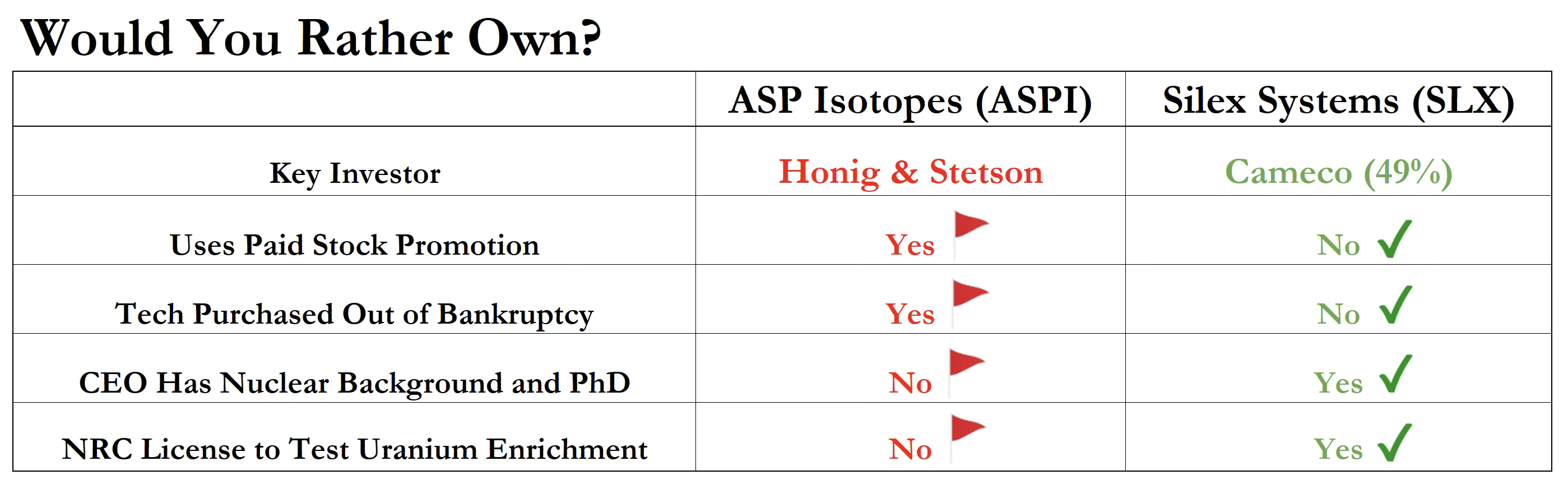

Part IX – Would You Rather–Own Cameco’s Laser Uranium Co? or Honig’s?

Silex Systems vs ASP Isotopes — Comparison is a No Brainer

We do not have a viewpoint on whether Silex Systems (SLX) is a good long-term investment. But if an investor is dead set on owning a laser-based uranium enrichment company we think Silex is the obvious choice vs. ASPI. Clearly Cameco believes so as well, rejecting an opportunity to invest in ASPI’s predecessor, Klydon.

Both Silex (SLX) and ASP Isotopes (ASPI) are both trading for < $1 billion.

Conclusion – This Honig-Stetson Paid Stock Promotion is Set to Implode

We are short ASP Isotopes.

We think ASP Isotopes is set up to implode. We believe the governments that have studied the technology for >20 years and concluded the technology is not commercially viable. We also believe Honig-Stetson’s track record is not an accident, and ASPI’s stock will end up the same way as the other Honig-Stetson Family Paid Stock Promotions, -98%. We believe that ASPI’s true purpose is NOT Uranium enrichment, but enrichment of the Honig-Stetson Crew.

If somehow you read our whole report and still disagree with our conclusion then please email us at [email protected]. We don’t actually want to hear your opinions on our report, but instead we would like to sell you a non-refundable 1 week stay at a Fyre Festival Beach Villa. Sadly, those Fyre Festival tickets likely are going to be a better investment than ASPI long-term.

We think this Paid Stock Promotion is set to Flame Out.

Fuzzy Panda Research is Short ASP Isotopes (ASPI)

Appendix BS – A Los Almos Applied Physicist’s Explanation Analysis of ASPI’s Uranium Enrichment via Lasers

Basically it Sucks

Ur Enrichment Using Lasers

~ Anonymous Applied Physicist from Los Alamos

Prepared for Fuzzy Panda Research

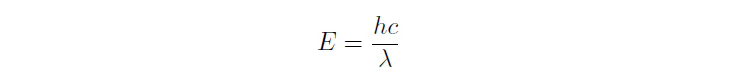

After a short reading of the National Regulatory Commission’s (NRC) Module 3: Laser Enrichment Methods (AVLIS and MLIS), the United States Government has demonstrated the ability to enrich Uranium. There are some basic requirements for this to work. I will focus on just a few.

- The ability to ionize Ur235, which requires ≈ 6.2eV of energy.

- The ability to ionize only Ur235 and not Ur238. The difference in ionization energy between the two is 4.2 × 10−5eV

- A laser, or set of lasers, that reaches 6.2eV of energy, and is accurate enough to only excite the Ur 235 and not Ur 238.

Let’s look at each one. If the company is claiming to only use one laser to ionize the Ur235, then that laser must have a photon energy of 6.2eV. To check this, the energy E of a photon is given by

where h and c are Planck’s constant and the speed of light respectively, and gives hc = 1240eV · nm. λ is the wavelength. The laser’s shared with me are Credo Dye Lasers with a wavelength range of 380nm – 920nm. Based off these values, the photon energy range is from

So, if only a single laser is used, they do not have enough energy to ionize the Ur.

Now, the NRC’s document does show a solution to this problem by exciting the election with three different wavelengths of lasers. For example, Etotal = 0.077eV + 2.1eV + 4.2eV = 6.377eV > 6.2eV. Overall, I would be a little worried if they are only using one wavelength of light (in the range I mentioned above). Based on these lasers, they would need two to three different ones to achieve ionization. Those lasers alone do not have enough energy to actually ionize the Ur.

If they are able to ionize the Ur, they have another problem of only ionizing the Ur235 and not the Ur238. This means they need a laser with a wavelength’s precision of 4.2 × 10−5nm. This number is the difference in ionization energy for 235 compared to 238 (e.g. 6.20000eV for 235 and 6.200042 eV for 238, numbers are just examples not true values). Based on the laser datasheet shared with me (linked above), the accuracy on the laser’s wavelength is 0.06cm−1. This gives an energy resolution of 7.4×10−6eV. So according to the data sheet, it does have a good enough resolution (only needing 4.2×10−5eV.

In summary, the laser energy doesn’t add up if they are only using one wavelength or one laser. If they are using more than one, it is possible they have enough energy to ionize the Ur. The laser seems to be accurate enough to only excite the Ur235 and not Ur238.

There are some other things to check. For example, is their charge capturing apparatus strong enough to pull an Ur atom with only 1 electron missing. Unclear at this point. I only looked into the laser for you.

The Lost Appendix – South Africa Other Sites

33 Eland Street – Pretoria, Johannesburg, South Africa

Our South Africa Investigator also visited ASP Istotope’s South African lab located at 33 Eland Street in Pretoria, Johannesburg, which is supposed to be the site of the lab where ASP Isotopes is doing their isotope enrichment experiments.

The 33 Eland building oddly had a lot of old tractors in front of the entrance.

We have good news and bad news for investors. The good news was that there were people at the location wearing ASP Isotope’s branded attire, so this location does exist!

The bad news is that ASP Isotopes was not listed on any of the building directories (instead the bankrupt company they bought >3 years ago, Molybdos Ltd was listed).

Even stranger we pulled the South African business filings for Molybdos Ltd and the registration filings show Molybdos Ltd as still being active, yet ASPI does not report Molybdos as an owned subsidiary. Molybdos Ltd SA registration documents show it as an enterprise “still in business rescue” which we presume means bankruptcy.

The other bad news is that the person that we spoke with from ASP Istotopes, Chantelle, told us that she “could not explain what the company does because it was technical and complicated and she did not fully understand it herself.” She also refused to give us a tour of the lab without an appointment.

After refusing to show us the lab the building security guard then tried to accost our investigator and actually detained them while threatening to call the police.

33 Eland Street – Johannesburg – Lots of Tractors in Front of Office Park – ASP Isotopes NOT Listed in Directory (Instead Molybdos was listed)

PET Labs Pharmaceuticals – Been in Business for ~20 years but only ~4m of Revenue with ~$20m of Losses.

We also decided to visit PET Labs which is located in an office park. The address is 109 Sovereign Drive, Route 21 Corporate Park, Irene, Pretoria, Johannesburg, South Africa 0184. Other tenants include Hollard, a well-known South African insurance company. Unfortuantely, we don’t have much to report from that visit as our investigator was stopped at front desk security and refused entrance.

Interestingly Pet Labs CIPC filings show that the company has been around since 2005 when it was called Pretoria Isotopes. We find it utterly unimpressive that after ~20 years in business the PET labs business generates only est ~$4 million of annual revenue with an allocated est annual LOSS of ~$19.5 million.

If everything else in our report hasn’t given you pause then the fact that ASPI was willing to pay $2 million for 51% of a business that losses ~$20 million a year and appears to be connected to a likely related party should terrify you.

South Africa CIPC Filings for ASPI’s Missing Subsidiaries:

ASPI South Africa Asset Finance:

Appendix H – Where Else Could Honig Be Hiding?

According the SEC complaint Barry Honig and his co-investors have a long history of hiding their share ownership by parking shares under the name of other family and friends and hiding their ownership with other shell companies.

We decided to play a game…it’s like “Where in the World is Carmen Sandiego?” but instead we call it “Where in the Cap Structure Could Honig Be Hiding?”

Listed in the lock-up agreements we found a large list of known stock promoters, entities that have invested with Honig & Stetson, and a colorful cast of characters sanctioned by the CFTC and connected to SEC probes.

Feel free to email us if you are interested in playing the game of “Where Could Honig Be Hiding?”

Fuzzy Panda Research Disclosures, Disclaimer and Terms of Service:

By downloading from or viewing material on this website and/or by reading this report, you agree to the following Terms of Service. You agree that any use of the research in this report or on this website is at your own risk. In no event will you hold Fuzzy Panda or any affiliated party, including officers, directors, employees, consultants, and agents of Fuzzy Panda or any companies affiliated with any of them, liable for any direct or indirect losses caused by your use of or reliance on information on this site or in this report. You further agree that you will not rely on any information in this report or on this website, to do your own research and due diligence before making any investment decision with respect to companies or securities mentioned herein, and that you will consult with your own investment professionals prior to any investment decisions. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinions in this report or on this site. You further agree that you will not communicate the contents this report or other materials on this site to any other person unless that person has agreed to be bound by these same Terms of Service. If you accessed, download, or receive this report or the contents of other materials on this site as an agent for any other person, you are binding your principal to these same Terms of Service.

As of the publication date of this report, Fuzzy Panda, and possibly any companies affiliated with it or its members, partners, employees, consultants, clients and/or investors (the “Fuzzy Panda Affiliates”), have a short position in the stock (and/or options, swaps, and other derivatives related to the stock) and bonds of the company covered in this report (the “Covered Company”). Fuzzy Panda and the Fuzzy Panda Affiliates therefore stand to realize significant gains in the event that the prices of either equity or debt securities of the Covered Company declines. There are many factors that can go into a decision to cover the short position(s) in the Covered Company’s securities and it is not possible to predict exactly when or for exactly what reasons Fuzzy Panda and the Fuzzy Panda Affiliates may cover their positions, in whole or part, or otherwise change their investment holdings. As a general matter, Fuzzy Panda and the Fuzzy Panda Affiliates intend to cover some or all of their positions at a time that the price of the Covered Company’s securities are lower than when they were sold short or otherwise invested in. Fuzzy Panda and the Fuzzy Panda Affiliates may cover some or all of their short positions immediately after the publication of this report or an indefinite period after its publication. Similarly, Fuzzy Panda and the Fuzzy Panda Affiliates may cover some or all of their short positions if the price of the Covered Company’s securities move a small amount or after moving a larger amount. Fuzzy Panda and the Fuzzy Panda Affiliates intend to continue transactions in the Covered Company’s securities for an indefinite period after the publication of this report, and they may be short, neutral, or long at any time after the publication of this report regardless of any opinions, possible stock prices or valuations, or other views stated in the report. Fuzzy Panda will not update any report or information on this website to reflect any changes in the investments of Fuzzy Panda or the Fuzzy Panda Affiliates that existed at the time of the publication of this report, or any new positions in any securities of the Covered Company.

This report and the Fuzzy Panda website is informational and describes the opinions of Fuzzy Panda. This report is not an offer to sell or a solicitation of an offer to buy any security, and Fuzzy Panda does not offer, sell or buy any security to or from any person through this report or the Fuzzy Panda website. This report is not a recommendation or advice to short or otherwise invest in or trade any security. Fuzzy Panda does not render investment advice to anyone unless it has an investment adviser-client relationship with that person evidenced by a formal written agreement. You understand and agree that Fuzzy Panda does not have any investment advisory relationship with you, or owe any fiduciary or other duties to you. Giving investment advice requires knowledge of your financial situation, investment objectives, and risk tolerance, and Fuzzy Panda has no such knowledge or information about you.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Fuzzy Panda’s research and reports express the opinions of Fuzzy Panda, which are based upon generally available information, field and online research, and inferences and deductions through due diligence and the analytical process. Fuzzy Panda believes that all information contained in this report has been obtained from accurate and reliable public sources, and no material nonpublic information was obtained from any person who had a duty to keep information confidential. However, Fuzzy Panda cannot be certain that the information it has relied upon in this report is accurate. The information and opinions in this report are therefore presented “as is,” without warranty of any kind, whether express or implied. Fuzzy Panda makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report also contains forward looking statements about what may occur in the future. The future cannot be predicted with certainty and any of the forward-looking statements about projections, beliefs, estimates, assumptions, outcomes, or any other future event may be incorrect. Among other things, any forward-looking statements may be rendered inaccurate by incorrect assumptions, incorrect methodologies, unforeseen risks and events, or other variables. Any opinions about the possible future stock price of the Covered Company or fair value of its securities is not a price target and does not mean or imply that Fuzzy Panda or the Fuzzy Panda Associates will hold any investment until such price or valuation is met. Further, all expressions of opinion, including any conclusions drawn from Fuzzy Panda’s analysis, are subject to change without notice, and Fuzzy Panda does not undertake to, and will not, update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the expressions of information in this report are copyrighted and owned by Fuzzy Panda Research, and you therefore agree not to distribute this report, any excerpts from it, or information from the Fuzzy Panda website (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link: www.fuzzypandaresearch.com. If you have obtained Fuzzy Panda’s research in any manner other than by accessing or downloading from that link, you may not read such research without going to that link and agreeing to the Terms of Service. You further agree that any dispute between you and Fuzzy Panda and/or any of the Fuzzy Panda Affiliates arising from or related to the material on their website shall be governed by the laws of the State of California, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in California and waive your right to any other jurisdiction or applicable law. The failure of Fuzzy Panda to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of such right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to this report or the material on this website must be filed within one (1) year after such claim or cause of action arose or be forever barred.